The S&P 500 ended Thursday nearly unchanged as investors awaited the full release of job creation numbers Friday. The Nasdaq received a slight lift from a rally in Internet stocks.

Early data show that the Labor Dept. will report that jobless claims are unexpectedly up by the largest amount in nine weeks. At the same time, the report is expected to show that the US economy added 215,000 new jobs in April, the highest in five months.

The Dow Jones industrial average (^DJI) fell 21.97 points or 0.13 percent, to 16,558.87, the S&P 500 (SNP:^GSPC) lost 0.27 points or 0.01 percent, to 1,883.68 and the Nasdaq Composite (^IXIC) added 12.896 points or 0.31 percent, to 4,127.451.

The two-day FOMC meeting ended with a statement of firm, but modest optimism about the economy, with a particular focus on job creation, which new chair Janet Yellen has said is her priority.

In a statement released after the meeting, Fed policymakers said economic activity has picked up across the board, including consumer spending, following the winter slowdown, and said, “Labor market indicators were mixed but on balance showed further improvement.”

It’s likely that the on-balance optimism is already priced in and the market is set to rally tomorrow. While the jump in jobless claims may be a surprise, there is reason to believe some of that may be due to more people entering the job market as they see more Help Wanted signs.

For traders, it mainly means low volume and hesitant price action the last two days, and orders getting executed today. We expect increased volume and, as we’ve been saying all week, a test of 1900.

The Asian markets closed mostly higher and in Europe 7 out of 12 markers are modestly higher. Today’s economic calendar includes the US Jobs Report, Factory Orders and earnings from Chevron Corporation (NYSE: CVZ), CVS Corporation (NYSE: CVS), Estee Lauder Companies, Inc. (NYSE: EL), and Marsh & McLennan Companies, Inc. (NYSE: MMC).

Our view

Russian separatists have shot down two military helicopters this morning and the S&P is up 3 handles. Additionally, the S&P has closed higher 10 out of the last 13 sessions but look at the down days: Apr 23 -1.0, Apr 25 -13.0, May 1 -.20.

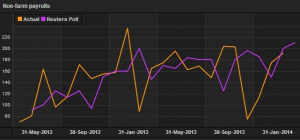

It’s been an amazing run that I still think is targeting 1890 and 1910. Today jobs report will be a test of that idea. According to Bloomberg, non-farm payroll consensus is for 215,000 new jobs with a range of 190,000 to 279,000. Unlike last last months 192,000 we believe today’s number will come in above consensus.

While we will be indeed looking for a “Counter-trend Friday” and selling any sharply higher open we just don’t know if the volume part of the rule will fall into line. Yesterday’s total volume was only 936,000 including pre-market Globex volumes. Clearly as the S&P (CME:SPM14) goes higher the volume is disappearing. We have set our targets and we are sticking with them.

As always please keep an eye on the 10-handle rule and please use stops when trading futures and options.

- In Asia, 6 of 11 markets closed higher: Shanghai Comp. +0.30% , Hang Seng +0.57%, Nikkei -0.19%.

- In Europe, 7 of 12 markets are trading higher: DAX -0.11%, FTSE +0.21%

- Morning headline:“ S&P Futures seen higher ahead of US jobs Report”

- S&P Fair Value: S&P -5.86 , Nasdaq -8.65 , Dow -68.87

- Total volume:LOW 936k ESM and 5.1K SPM traded

- Economic calendar: US Jobs Report and Factory Orders. Earnings from Chevron Corporation (NYSE: CVZ), CVS Corporation (NYSE: CVS), Estee Lauder Companies, Inc. (NYSE: EL), and Marsh & McLennan Companies, Inc. (NYSE: MMC).

- E-mini S&P 5001873.75-4.00 - -0.21%

- Crude102.15+0.02 - +0.02%

- Shanghai Composite0.00N/A - N/A

- Hang Seng22260.67+126.699 - +0.57%

- Nikkei 22514457.51-27.62 - -0.19%

- DAX9556.02-47.211 - -0.49%

- FTSE 1006822.42+13.55 - +0.20%

- Euro1.3871