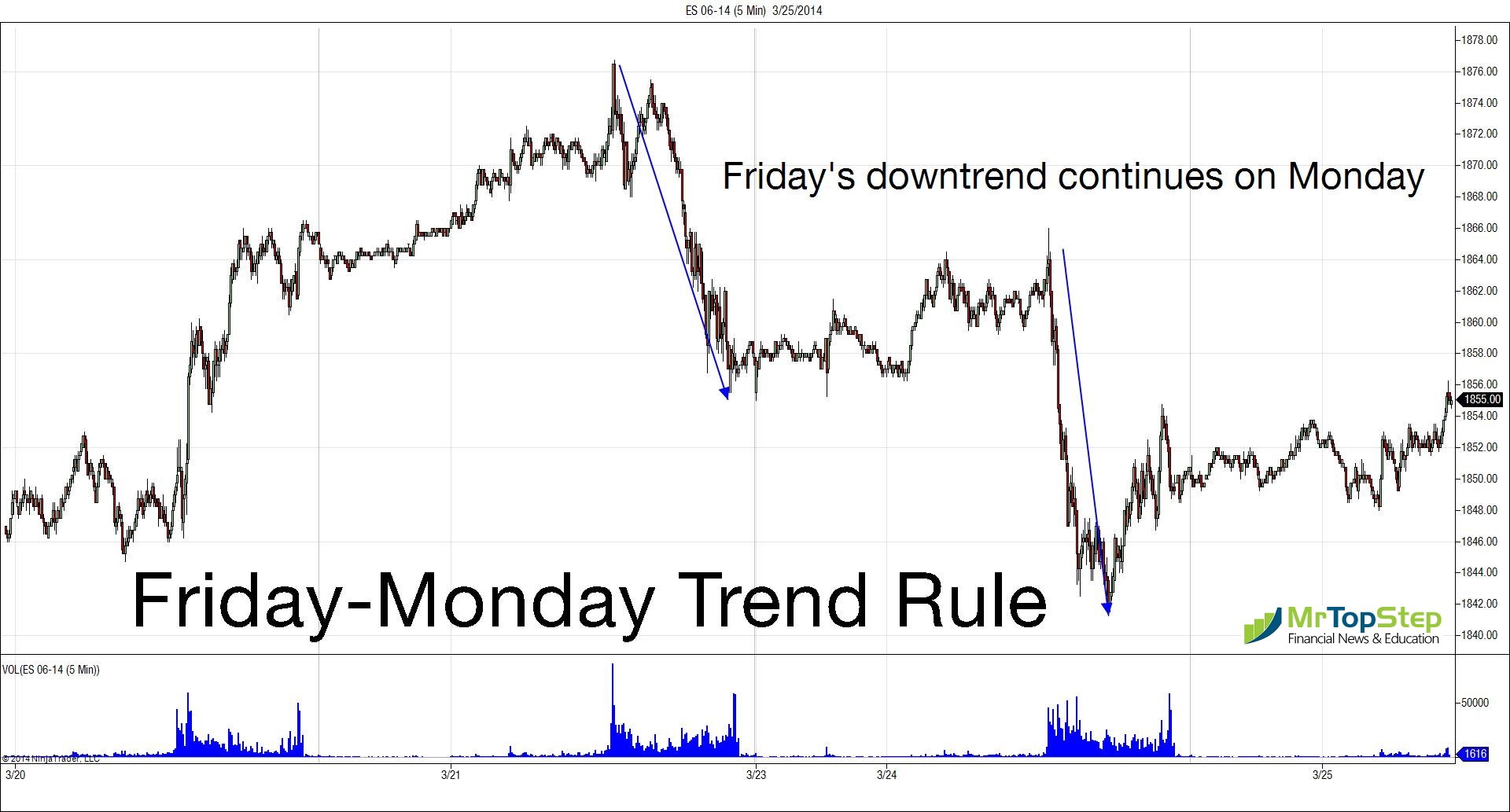

The ESM14 did what we thought it would do Monday morning; it sold off. After many years of following the Pit Bull’s trading rules I have found on those few occasions that I forget or overlook the trading rules, I end up regretting it. After seeing them work for the last 25 years, all I can say is it can be costly when we do forget.

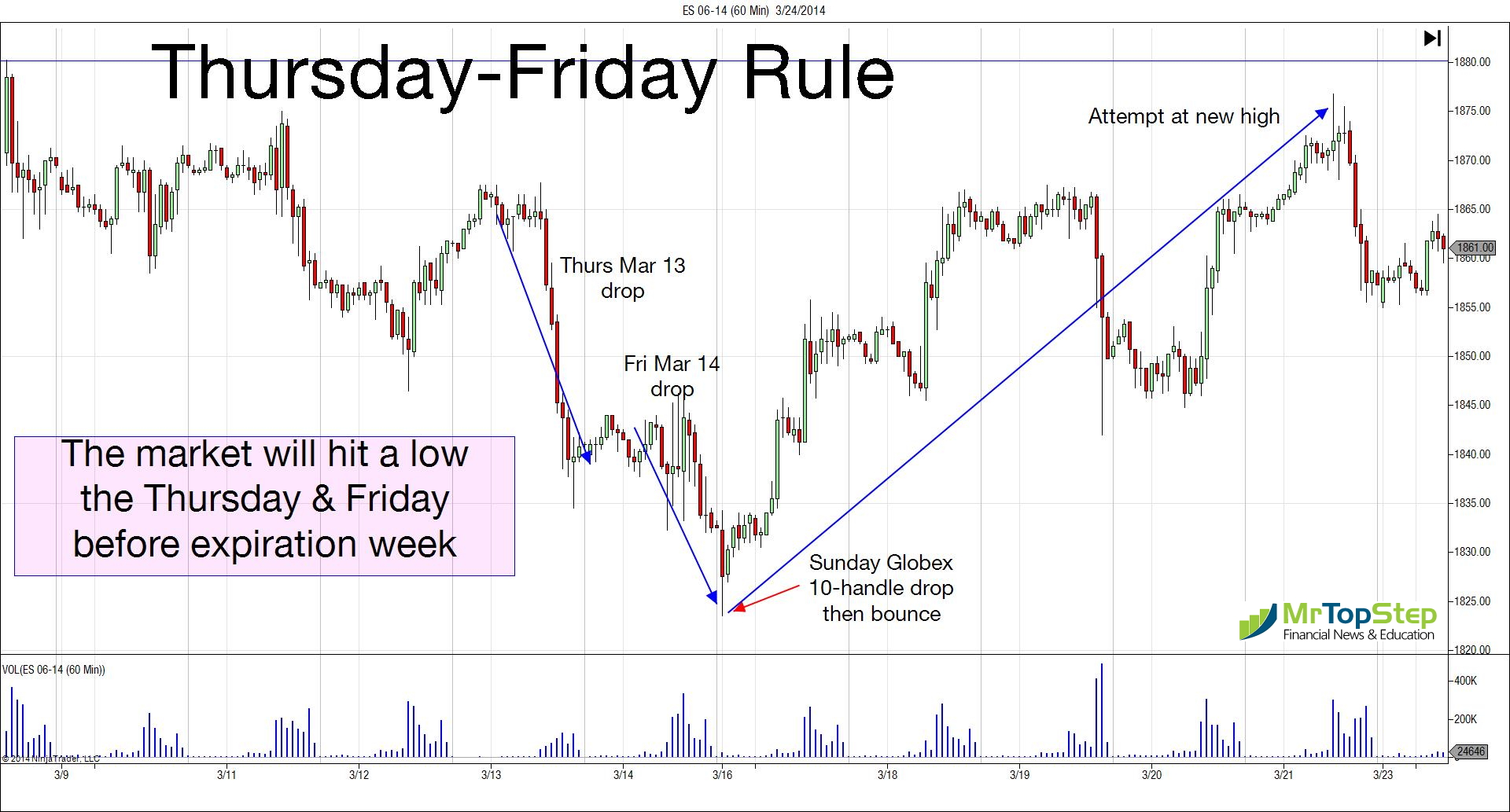

Thursday / Friday low

S&P 500 futures down 3 out of the last 4

Another of the Pit Bull’s rules is that if the expiration is weak, then the Monday after it should be weak. If it goes well, Monday should be firm. If the weakness actually shows up like it did yesterday, there is usually a bounce.

Notice that I’m not talking about why this happens, only that decades of experience have shown it to happen more often than not. Not having an economist’s explanation of these phenomena is no reason to ignore these simple trading rules.

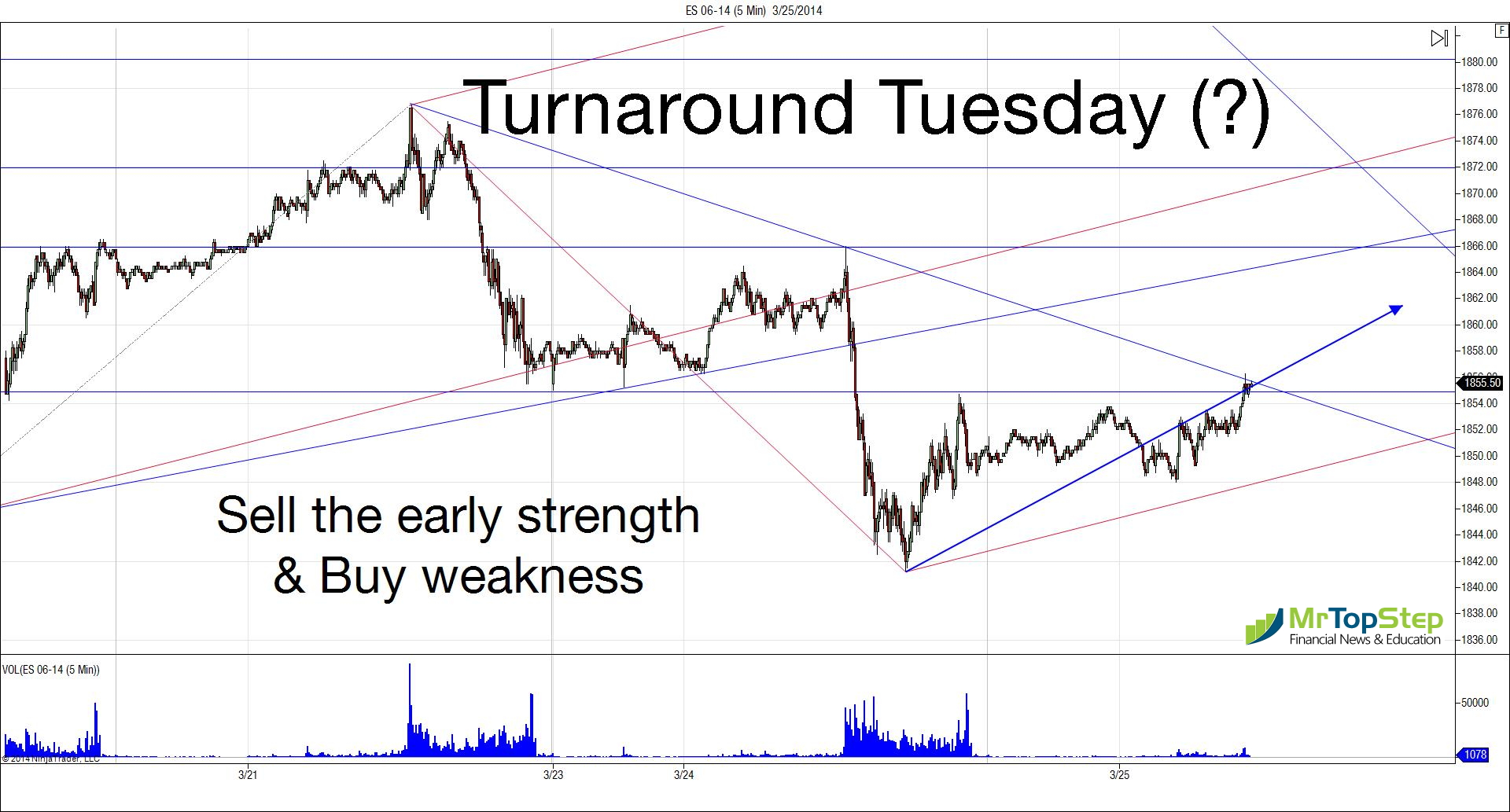

Sell the early rally and buy weakness

Our call to sell the early strength was right on as was the other half of the call, to buy weakness. After the early rally and selloff the ESM14 sold off 14 handles, making a new low, then started moving back up late in the day when the MiM started showing buy imbalances. Essentially the S&P ran sell stops in the first part of the day and buy stops late in the day.

The Asian majors closed modestly lower and in Europe 11 of 13 markets are trading higher. On today’s economic calendar: Redbook, FHFA House price index, S&P Case Shiller HPI, new home sales, consumer confidence, Richmond Fed Manufacturing Index, State Street Investor Consumer Confidence, 2-Yr Note Auction, Atlanta Fed President Dennis Lockhart’s fireside chat on the economic outlook at 4:00 ET in Atlanta and Philadelphia Fed President Charles Plosser speech on economic outlook and monetary policy in New York at 7:00 PM ET. The markets are moving and with all the data and Fed speak this week we do not expect that to change.

If you follow fair value premium—and you should, since many algos do—as of 7AM CT, futures are trading nearly 7 points above fair value, a bullish sign for the open.

Our view

Tuesdays are days of the week that have been up 12 out of the last 13. I have a “funny feeling” about the markets right now. As we head into the end of the first quarter and the “end” of the best six months for stocks, the old adage about selling in May and walking away keeps flashing.

Historically stocks tend to “soften” around this time of the year and it may be time to start thinking about some downside protection and buy some cheap S&P puts. We think 2014 is going to continue to have some big twists and turns.

Our view is we can’t sell the S&P down 9 or 10 handles; we lean to buying the early weakness and selling the rallies.

As always, keep an eye on the 10 handle rule and please use stops when trading futures and options.

- In Asia, 7 of 11 markets closed lower: Shanghai Comp. +0.05%, Hang Seng -0.52%, Nikkei -0.36%

- In Europe, 11 of 13 markets are trading higher: DAX +1.13%, FTSE +1.04%

- Morning headline: “S&P 500 Futures seen lower ahead of key housing data”

- S&P Fair Value: 1849.34 (futures 6.91 higher at 1856.25 as of 7:04AM CT)

- Total volume: 1.82mil ESM and 5.6K SPM traded

- Economic calendar: Redbook, FHFA House price Index, S&P Case Shiller HPI, New Home sales, Consumer Confidence, Richmond Fed Manufacturing Index, State Street Investor Consumer Confidence, 2-Yr Note Auction, and Dennis Lockhart and Charles Plosser speak,

- E-mini S&P 5001881.75+8.00 - +0.43%

- Crude98.55-0.22 - -0.22%

- Shanghai Composite0.00N/A - N/A

- Hang Seng21924.539+192.219 - +0.88%

- Nikkei 22514477.16+53.97 - +0.37%

- DAX9338.40+149.631 - +1.63%

- FTSE 1006604.89+84.50 - +1.30%

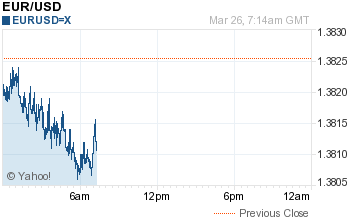

- Euro1.3813