U.S. major stocks closed lower Friday after the non-farm payroll number showed more jobs created than expected. The Dow Jones Industrial Average (DJI:^DJI) gained 30.83 points, or 0.2%, ending the day at 16452.72; earlier in the session the Dow was up as much as 84 points. The S&P 500 (CME:SPH14) closed 1 point higher, or up 0.1%, to 1878.04.

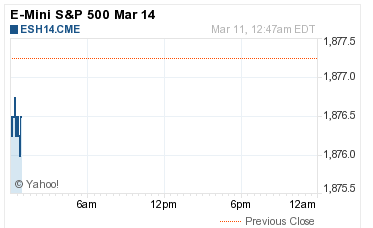

The S&P closed at another record high, but off an intraday peak of 1883.57 and off a Globex peak of 1887.50. The Nasdaq Composite Index (CME:NQH14) fell 15.90 points, or 0.4%, to 4336.22 and is now up only 14% from its 2000 tech bubble all-time high.

S&P 500 finishes up two weeks in a row

Despite Friday’s weakness the S&P futures still closed up 1.8 handles. It has closed on a Friday high two weeks in a row and is up 7.7% since making its low on Feb. 3, when the E-mini S&P 500 futures (CME:ESH14) settled down 43.8 handles.

When you look at the last two weeks of gains it’s clear that even though the futures closed higher 7 out of the last 10 trading days, the largest down day was -14.5 handles and that was followed by a Turnaround Tuesday that closed up +28.5 handles (Feb 21 -1.9, Feb 24 +11.6, Feb 25 +.40, Feb 26 -4.4, Feb 27 +3.7, Mar 3 -14.5, Mar 4 +28.5, Mar 5 +.80, Mar 6 +3.9, Mar 7 +1.8. In December the S&P was up 11 / down 9 out of 20 trading days. In January the S&P futures closed up 9 and down 11 out of the 20 trading days, in February the S&P closed up 15 out of 20 trading days and in the first week of March the S&P closed higher 4 out of 5 days. But the amazing run is since the Feb. 3 low. The S&P futures have closed higher 19 out of the last 25.

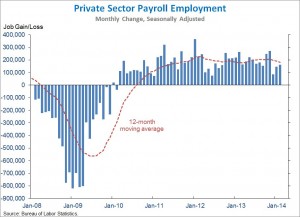

Jobs: We keep creating them, just not enough

The conventional wisdom about weather affecting job creation didn’t hold up, as the latest employment report showed. While the recovery is slow, the actual job creation came in higher than expected. The 175,000 payrolls added is good, but like previous months shows more progress is needed.

The overall numbers did support a “weakening” of the economy due to extreme cold, but it was not enough to cause any major selling. While the S&P did sell off, it was from new record highs after the number. During Friday morning’s Globex session the S&P made a high of 1887.50 and sold off all the way down to 1869.25 but still managed to settle up 1.8 handles at 1877.75, just 10 handles off its all-time contract high.

Nevertheless, the Federal Reserve and its new chair have maintained their view that the economy must create at least 260,000 new jobs a month for an extended period to constitute a true recovery.

Russia is the wild card

Speculating on what the markets might do in response to news has been notably difficult the past year. Stocks have rallied in the face of both good news and bad, which makes you think of the line from Hamlet, “Nothing is good or bad, but thinking makes it so.”

If divining what the market thinks or will think is hard enough, it is pretty much impossible to guess what a cagey and volatile character like Vladimir Putin will do next. Is he rattling his saber, like a more heavily armed Iran or Pakistan might do? Is he seriously about to take territory in Crimea, the way Saddam Hussein annexed Kuwait in 1991?

The big speculation now is whether new pipelines sending U.S. natural gas from Europe could decrease Ukraine’s dependence on Russia. Stratfor, probably the most reliable intelligence source on Russia, says clearly that it won’t. Again, there are so many variables that, while news may drive some volatility in energy futures, it will be years before Ukraine decides to wean itself off Russian gas, if it ever does.

So in the meantime we’re left with saber-rattling, ongoing unrest, and instability in energy supplies. So what else is new? Add to that the S&P’s propensity for reacting in exactly the opposite way from what everyone expects. On the day when people yell, “the sky is falling!” and the sky actually does fall, the market may well call it pennies from heaven and rally.

The Asian major markets closed sharply lower and in Europe 7 out of 11 markets are trading modestly lower. This week’s economic calendar includes only 19 economic releases, 10 T-bill or T-bond announcements or auctions and two Fed governors speaking. Today’s economic calendar has no economic numbers, but Philadelphia Federal Reserve Bank President Charles Plosser’s speech on monetary policy, banks and protectionism in Paris and Chicago Fed President Charles Evans speaks on the economy and monetary policy in Columbus, Georgia.

Our view

The S&P rallies off bad economic activity and sells off on the positive economic activity. That’s how this game is played. There was a mindset on Friday’s close that the S&P maybe finally setting up to pull back, which could coincide with the Pit Bull’s Thursday / Friday low the week before the expiration.

But according to the Trader’s Almanac the Monday before the week of the March quadruple witching has been up 19 of the last 26 occasions. Mondays are overall one of the lowest volume days of the week and have not been a good performing day. We think it’s possible to see a retest of Friday’s low. There is a lot of risk along the Ukrainian border and Crimea. That doesn’t mean the S&P can’t rally. It just feels like it may struggle a bit today.

As always, keep an eye on the 10-handle rule and please use protective stops when trading futures and options.

- In Asia, 10 of 11 markets closed lower: Shanghai Comp. -2.86%, Hang Seng-1.75%, Nikkei -1.01%

- In Europe 7 of 11 markets are trading lower: DAX -0.38%, FTSE +0.20%

- Morning headline: “S&P 500 Futures Seen Lower Ahead of Fed Speak ”

- Total volume: 1.75Mil ESH14 and 5.3K SPH14 contracts traded

- S&P Fair Value: 1877.09 (futures on par at 1877.25 as of 6:54 AM CT)

- Economic calendar: There are no scheduled economic releases today, but the Fed’s Charles Plosser and Charles Evans speak.

- E-mini S&P 5001876.50-0.75 - -0.04%

- Crude98.55-0.22 - -0.22%

- Shanghai Composite0.00N/A - N/A

- Hang Seng22305.199+40.27 - +0.18%

- Nikkei 22515142.38+22.24 - +0.15%

- DAX9265.50-85.25 - -0.91%

- FTSE 1006689.45-23.22 - -0.35%

- Euro1.3868