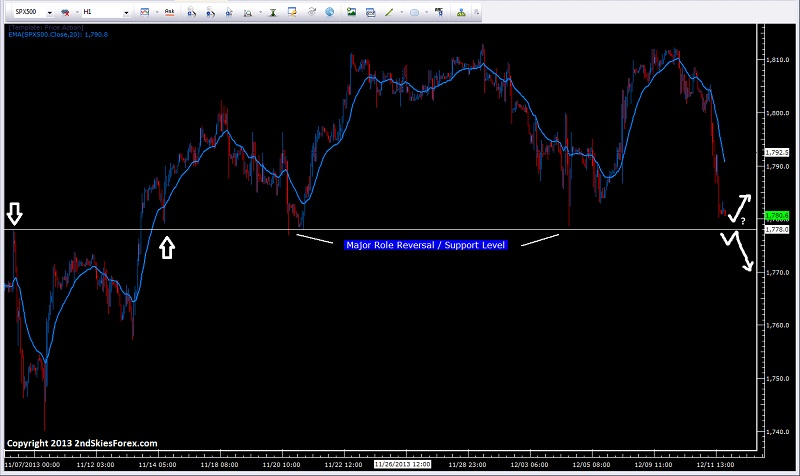

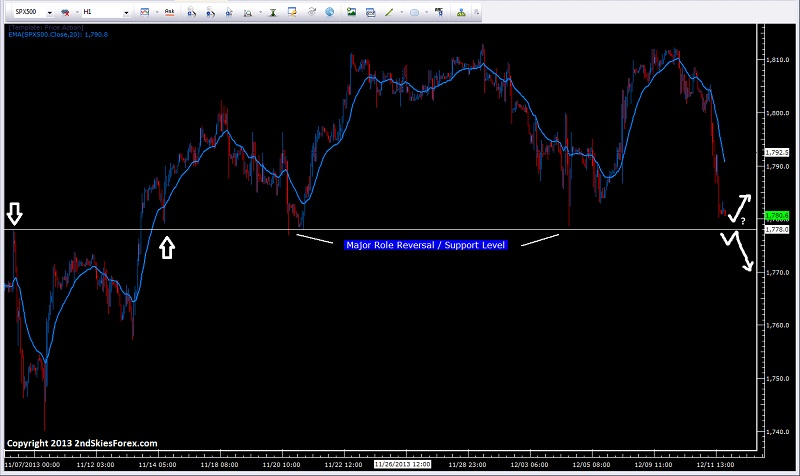

S&P 500 – Just Above Critical Support

For almost a month now, the S&P 500 has been in a re-distribution phase holding above the key 1778 level. It had prior tested this level twice before breaking above it. Once it broke above it, it treated it as a role reversal level 3x, with each time bouncing past 1800, and 2x making it to 1810. For bulls, this will be a major ‘line in the sand‘ for them and critical support level. I’m guessing some bears already short will cover ahead of this level.

Bulls can look for longs off this level with tight stops below. Upside targets would be 1800 and 1810 offering a good risk-reward play here. Bears meanwhile will want to wait for a 1hr close below it, then look for a breakout pullback setup at the level, with downside targets of 1757 and 1742 as I suspect stops will be parked just below this key 1778 level.

Original post

For almost a month now, the S&P 500 has been in a re-distribution phase holding above the key 1778 level. It had prior tested this level twice before breaking above it. Once it broke above it, it treated it as a role reversal level 3x, with each time bouncing past 1800, and 2x making it to 1810. For bulls, this will be a major ‘line in the sand‘ for them and critical support level. I’m guessing some bears already short will cover ahead of this level.

Bulls can look for longs off this level with tight stops below. Upside targets would be 1800 and 1810 offering a good risk-reward play here. Bears meanwhile will want to wait for a 1hr close below it, then look for a breakout pullback setup at the level, with downside targets of 1757 and 1742 as I suspect stops will be parked just below this key 1778 level.

Original post