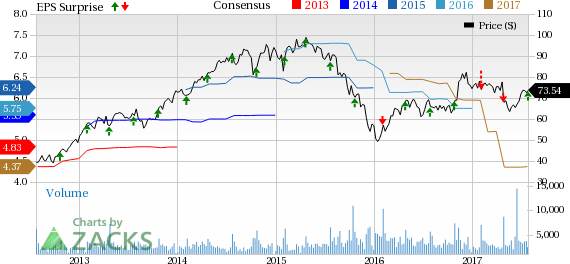

Ryder System (NYSE:R) performed well in the second quarter of 2017 reporting better-than-expected earnings per share and revenues.

The transportation company’s adjusted earnings of $1 per share beat the Zacks Consensus Estimate of 93 cents. Earnings, however, declined 36% on a year-over-year basis.

Ryder System reported total revenue of $1,793.2 million, which surpassed the Zacks Consensus Estimate of $1,769.2 million. Revenues increased 5% on a year-over-year basis with growth being witnessed in all segments.

Segment Results

Fleet Management Solutions: Total revenue was $1.16 billion, up 1% year over year. Operating revenues (revenues excluding fuel) came in at $1 billion, flat year over year. Segmental results were aided by an increase in lease revenues on the back of a larger average fleet size.

Dedicated Transportation Solutions: Total revenue came in at $273 million, up 6% from the year-ago quarter. Operating revenues (excluding fuel and subcontracted transportation) grew 3% year over year to $200 million.

Supply Chain Solutions: Total revenue in the quarter under review was $471 million, up 17% year over year. Operating revenues (revenues excluding fuel and subcontracted transportation) increased 8% year over year to $359 million.

Liquidity

Ryder System, which carries a Zacks Rank #2 (Buy), exited the second quarter with cash and cash equivalents of $55.4 million compared with $58.8 million at the end of 2016. The company had total debt of $5,384.8 million compared with $5,391.3 million at the end of 2016. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Guidance

The company now expects 2017 adjusted earnings in the band of $4.38 to $4.58 per share compared with the previous range of $4.25 to $4.55. The Zacks Consensus Estimate for 2017 is pegged at $4.37 per share. It expects third-quarter 2017 adjusted earnings per share in the band of $1.25 to $1.35. The Zacks Consensus Estimate for the third quarter is pegged at $1.36 per share.

Other Important Releases Coming Up

Investors interested in the broader Transportation space keenly await the second-quarter earnings reports of SkyWest, Inc. (NASDAQ:SKYW) , Spirit Airlines (NASDAQ:SAVE) and American Airlines Group (NASDAQ:AAL) . While SkyWest and Spirit Airlines are scheduled to report results on Jul 27, American Airlines will unveil its earnings report on Jul 28.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Ryder System, Inc. (R): Free Stock Analysis Report

Original post

Zacks Investment Research