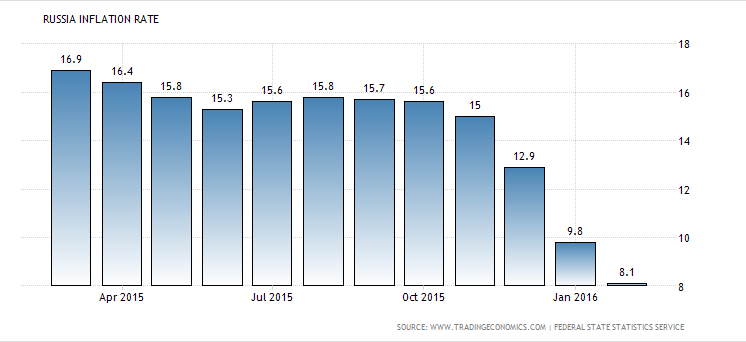

For a long time, we have been stating that the Sell-off in both the ruble and the Russian stock market provided the astute investors with a great long-term buying opportunity. Well, this chart proves that things are getting better and that the sanctions that the West imposed on Russia at the behest of America was a stupid idea, but more importantly, it has made Russia even stronger. The chart below is proof of this; inflation is down over 50% year over year. Translation: things must be getting better.

Game Plan

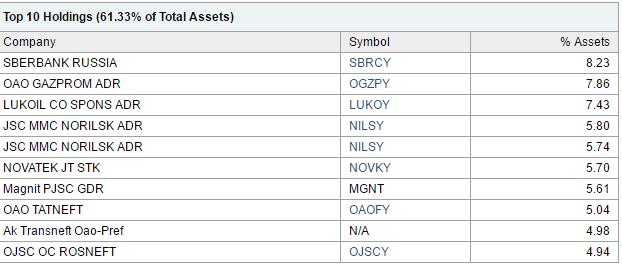

Prudent investors should start looking for gems in the Russian market; one good way to play the Russian bounce would be to open positions in the ETF Market Vectors Russia (NYSE:RSX).

Top 10 Holdings of RSX

Technical outlook

Game plan

It will face resistance in the 16.00-16.50 ranges, so it would make sense to wait for a pullback to the 13.50-14.00 ranges before committing new funds. Alternatively, you can look to sell puts at specific target price; if the stock trades below the strike price, the shares will be put to your account. Selling puts allows you to place a limit order and get filled at a better price than the limit set because your premium further reduces the cost of opening a position. Another stock you can look at is MBT.