I’m staggered by the amount of confusion about Gold purchases by Russia’s central bank. For example, a headline I saw last Friday clearly calls for scrutiny.

The headline on a well-known news website couldn’t have been clearer: Russians have started dumping their gold in response to their deepening financial woes. The article claimed that $4.3 billion worth of gold reserves—3.5 million ounces of gold at today’s price—was sold by the Central Bank of Russia.

It took me just two clicks to find out that the reality was not nearly as sensational as the headline would have us believe. It turns out that the article was based on the text of a Russian language website someone was, it would seem, just too lazy to translate. The original report in Russian didn’t say anything about selling gold, stating clearly that it was international currency reserves that decreased to $416.2 billion from $420.5 billion. I suspect that a picture of gold bars on the page was all it took for the author(s) to jump to a mistaken conclusion.

The offending article has been edited since, but the story, or rather its original headline (see the above image), has been left lingering in the second-top position of Google search results. In fact, it’s still there as I write this.

Now, my reason for telling you this story has little to do with bemoaning poor reporting standards as employed by today’s mainstream media and everything to do with keeping one’s critical thinking cap on. The importance of checking your facts and not being overly reliant on a single outlet for your daily dose of news cannot be stressed enough. Remember, in this day and age, false facts and interpretations have the ability to travel at the speed of light.

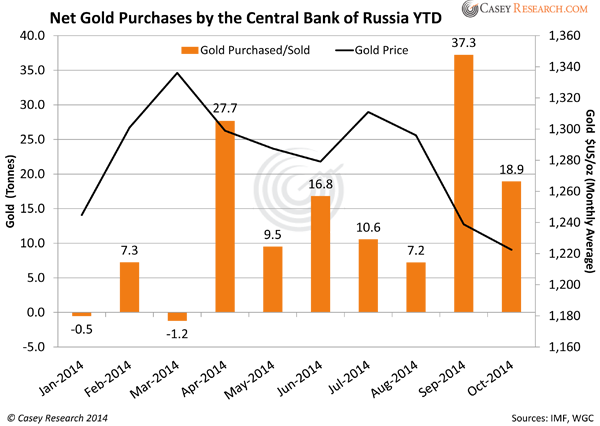

With that in mind, here’s a look at the year-to-date net purchases of gold by Russia’s central bank, according to the International Monetary Fund (IMF). Russia has added a total of 133.5 tonnes to its reserves so far this year.

Going straight to the source, the mighty Russian bear, indicates that this number is too low. Governor Elvira Nabiullina announced that Russia’s central bank bought about 150 tonnes of gold this year, which falls comfortably within the range of our own estimate of 156.6 tonnes. That’s almost double 77.4 tonnes of gold purchased in 2013. The Russian bear looks like a gold bull to us.

To put things in perspective, Russia’s “close” second contender in the race to load up on cheap gold, Kazakhstan, has reportedly purchased 42.2 tonnes, while Azerbaijan checked in third at 10 tonnes, with the rest of the gold-buying countries trailing below the 6-tonne mark.

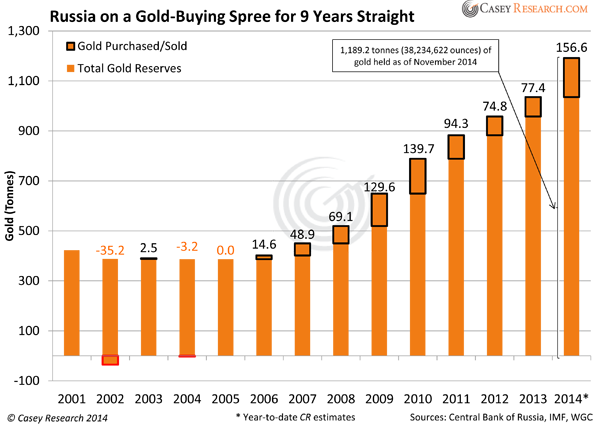

The story only gets better; the fact is that Russia has been buying gold for years, as shown in the chart below.

What we’re seeing here is not some haphazard pattern of purchases. Quite the contrary, this is a trend that has been in motion for quite a while, right under the noses of indebted Western governments and against the backdrop of unprecedented rounds of money printing by the world’s major central banks. This trend has taken Russia’s gold holdings from around 400 tonnes 13 years ago to what is fast approaching 1,200 tonnes at the end of 2014. Russian reserves currently represent the world’s sixth-largest hoard of the yellow metal.

What should also jump out of the chart above is that the 150 tonnes bought year to date is above any amounts of gold acquired in previous years—significantly so.

In the end, Russia has been well ahead of other countries in the gold-buying department for quite some time, so it’s hardly a surprise that it’s become a heavyweight gold champion among central banks worldwide this year. Gold now makes up 10.8% of Russia’s total reserves, and a whopping 18.4% of its M1 monetary supply—both unparalleled in the Western world.

The message is clear: Russia prefers to hold gold more than the US dollar.

In fact, the US dollar’s status as reserve currency of the world is being pushed ever closer to the brink by Russia and China as they continue making agreements between themselves and other countries on deals that bypass the US dollar.

At the same time, however, it’s true that Western sanctions and the collapse of oil prices are taking their toll on Russia’s economy; the ruble is down by more than 40% this year.

This leads many to ask if Russia will start selling its gold in a bid to stave off further slides in its currency. It’s hard to see how selling gold would prop up confidence in the ruble, but that’s par for the course among mainstream analysts who still don’t grasp that gold is money.

Many such analysts thought Russia was selling gold when it plunged between August and November this year. It turns out, however, that Russia was actually backing up the truck to take advantage of the bargain prices.

Now, with each new mega deal tying Russia closer to China (the world’s second-hungriest gold consumer), Russia is making a clear bet against the US dollar. This makes it unlikely that Russia will do anything that might benefit the USD—and what better way to boost the greenback than to sell gold (in dollars)?

So no, we don’t see Russia selling its gold any time soon—not to any significant extent anyway. If anything, given its track record as a (very) consistent shopper, it will probably be buying more soon.