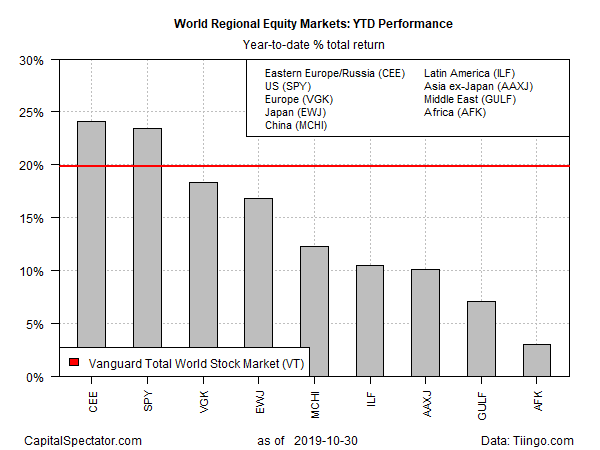

All the world’s major equity regions continue to post year-to-date gains, but stocks in Eastern Europe/Russia, followed closely by US shares, are in the lead by a healthy margin, based on a set of exchanged-listed funds.

Edging into the lead in recent days is Central and Eastern Europe (CEE), a closed-end fund that offers the only US-exchange-listed product that targets this region. CEE’s 24.1% return so far in 2019 (through Oct. 30) is slightly ahead of the US performance via SPDR S&P 500 (SPY (NYSE:SPY)), which is up 23.4%.

The US-Russian relationship is strained from a geopolitical perspective, but Americans don’t appear deterred in terms of deploying capital. Forbes last week reported that “North American investors, led fully by Wall Street, account for over half of the foreign capital flowing into Russian stocks, according to the Moscow Exchange.”

Whatever’s driving demand, CEE is certainly benefiting lately. The fund has climbed sharply in recent week, closing at its highest price in over three months through yesterday’s trading.

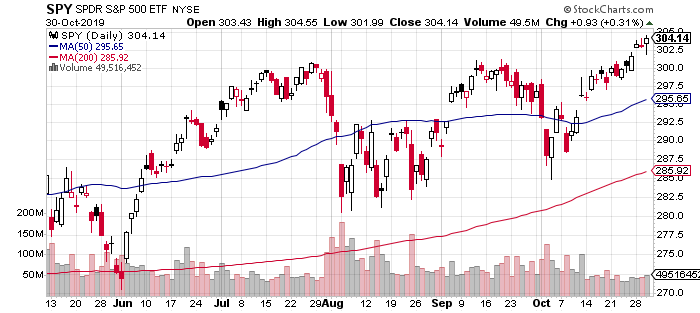

US shares are doing nearly as well on a year-to-date basis, although over a longer span it’s tough to beat American shares. Indeed, SPY (NYSE:SPY) on Wednesday edged up to a record high.

“The [US] market is finally breaking out of this trading range, and it is headed higher,” Andrew Slimmon, managing director at Morgan Stanley (NYSE:MS) Investment Management, predicted on Monday.

Looking at global shares in the aggregate also paints a bullish profile at the moment. Vanguard Total World Stock (NYSE:VT) is currently enjoying a strong 19.9% year-to-date gain – exceeded only by Eastern Europe/Russia and US stocks, based on our set of regional fund proxies.

Although all the major equity regions of the world are posting gains in 2019, there’s a wide range of results. The weakest year-to-date performer: VanEck Vectors Africa (NYSE:AFK), which is ahead by a tepid 3.0% so far this year.

The biggest country weight in AFK – South Africa – has been a major headwind for the fund, courtesy of various economic challenges. Earlier this month Bloomberg reported that “foreigners offloaded South African stocks at the fastest pace in two years last week, as worries about the state of the global economy helped spur an exit from riskier assets.”

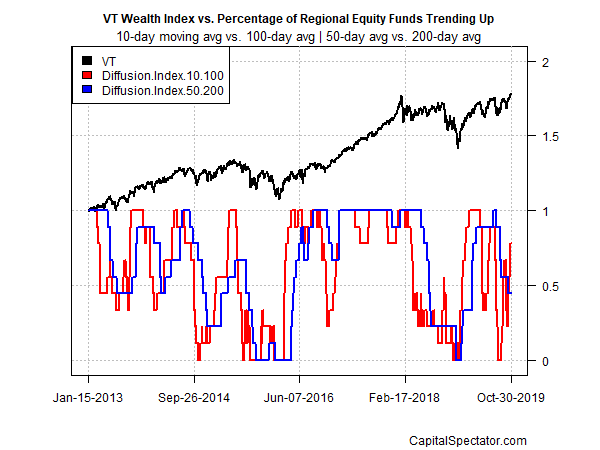

Reviewing all the regional and country funds listed above through a momentum lens reminds that the general upswing in global markets (based on VT) is increasingly dependent on a smaller slice of shares. Two sets of moving averages continue to paint a mixed picture overall for trending behavior. The first measure compares the 10-day average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). Based on these metrics, the near-term momentum outlook appears challenged compared with recent history.