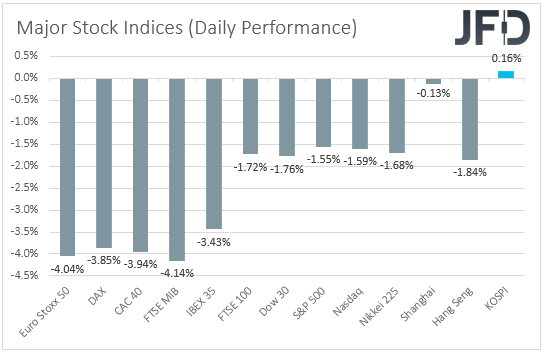

Equities around the globe tumbled yesterday and today in Asia as the crisis in Ukraine intensified, with Russia launching more rockets and the West imposing more sanctions. As for today, investors may also keep an eye on the BoC decision, as well as the testimony of Fed Chair Powell before Congress. Elsewhere, we have Eurozone’s preliminary CPIs for February.

Stocks Tumble as Russia’s Attacks Intensify

The financial world was spooked once again on Tuesday and during the Asian session Wednesday, with equities around the world seeing another day of losses. All the major indices under our radar except one were a sea of red, and apparently the driver was once again the escalating crisis in Ukraine.

After ceasefire talks failed to reach a breakthrough, Russia lunched rockets on several Ukrainian cities, including Kharkiv, while global sanctions against Russia tightened.

This is in line with our view. Remember that for the last few days, we’ve been highlighting that it is too early to assume that the sanctions will force Russia to back down or that the talks will bear fruit so early. It is also too early to say that no other nation will intervene with its army.

Therefore, we stick to our guns that the path of least resistance for equities, the euro, and the pound, is to the downside. As we noted yesterday, we don’t expect the traditional risk-linked currencies Aussie, Kiwi, and Loonie to suffer much, as they seem to be drawing support from the rising commodity prices. Oil prices surged further yesterday, with WTI nearing the 110.00 zone, which was last tested back in September 2013.

Will the BoC Hike Interest Rates This Time?

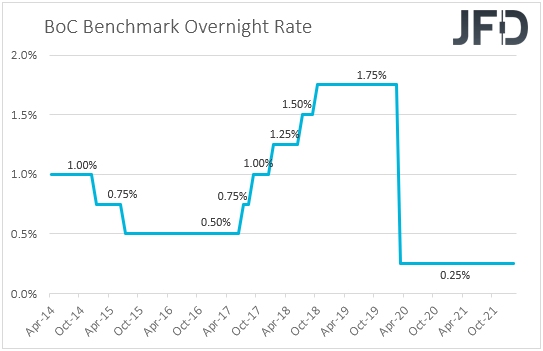

As for today, besides the developments surrounding the crisis in Ukraine, Loonie traders may also keep an eye on the BoC decision. At its latest gathering, the BoC decided to keep interest rates untouched at 0.25%, at a time when the financial community was expecting a hike.

In the statement accompanying the decision, it was noted that the Council expects rates to increase and that the overall economic slack is now absorbed, which means that they are more likely to hit the hike button today.

Yesterday, the MoM rate of the Canadian GDP for December slid to 0.0% from +0.6%, but the QoQ annualized one surprised to the upside. Therefore, with that in mind and taking into account the upside surprise in the CPI numbers for January, we doubt that a slowdown in economic activity for December will be enough to prevent officials from pushing the hike button. After all, for the quarter as a whole, the economy improved.

However, a quarter-point hike is the market consensus as well, and thus, we don’t expect it by itself to move much the Loonie. If indeed, the hike is delivered, CAD-traders may quickly turn their attention to the accompanying statement for clues and hints as to how fast officials are willing to proceed with subsequent rate hikes. The Loonie is likely to gain if they appear willing to proceed with a relatively steep rate path to curb accelerating inflation.

Besides the BoC decision, traders of the Canadian dollar may also pay attention to the OPEC+ decision. Despite the ongoing conflict between Russia and Ukraine pushing oil prices above $100 per barrel, the cartel and its allies are not expected to accelerate their plan of gradually scaling back their supply cuts.

This may allow oil prices to continue trending north, a factor that could also prove supportive for the Canadian dollar. Let’s not forget that Canada is the fifth-largest oil-producing nation globally, while it holds the sixth place in terms of exports.

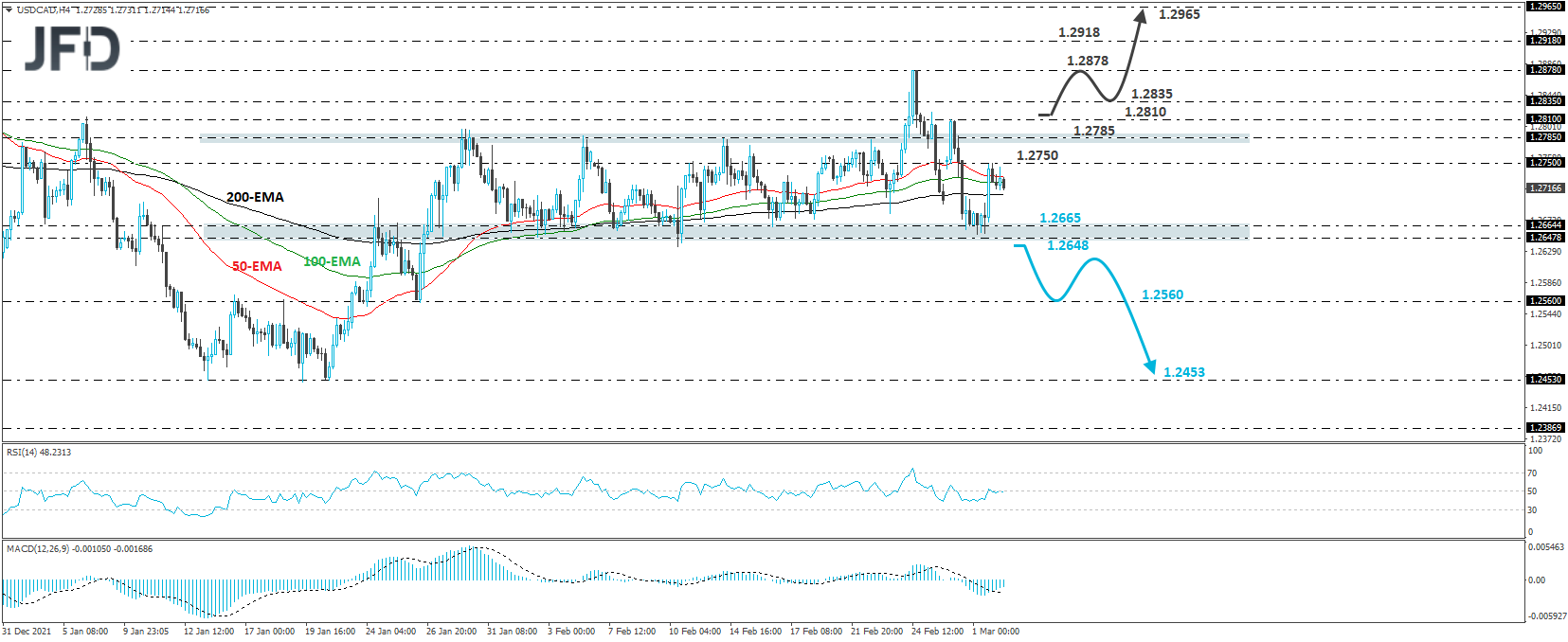

USD/CAD – Technical Outlook

USD/CAD traded higher yesterday but hit resistance at 1.2750 and pulled back again. Overall, the pair is back within the sideways range that’s been in place since Jan. 27, and thus, we will consider the short-term picture to be neutral.

To start examining the bearish case, we would like to see an apparent dip below the lower end of the range, at 1.2648, a move that would confirm a forthcoming lower low on the 4-hour and daily charts, and perhaps see scope for declines towards the low of Jan. 26, at 1.2560. If the bears are unwilling to stop there, then a lower break could set the stage for extensions towards the 1.2453 zone, which acted as a floor between Jan. 13 and 20.

Now, in order to say that the bulls have gained the upper hand, we would like to see a strong recovery above the 1.2810 barrier, marked by the peak of Monday. The rate will be above the upper end of the aforementioned range, and the first target may be the high of last Thursday, at 1.2878.

If that barrier doesn’t hold, we could see advances towards the 1.2918 level, marked by an intraday swing high formed on Dec. 22, or towards the peak of Dec. 20, at 1.2965.

Fed Chair Powell Testifies Before Congress

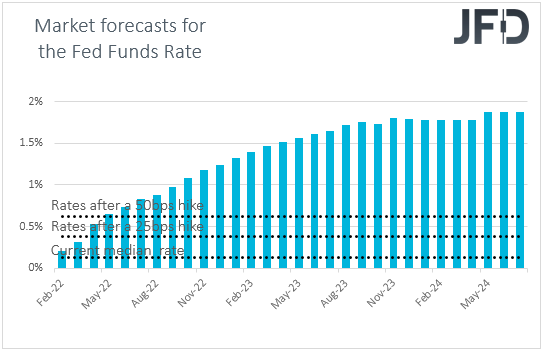

In the US, Fed Chair Jerome Powell will testify on monetary policy before the House Financial Services Committee and again before the Senate Banking Committee tomorrow. At the latest FOMC gathering, Powell sounded more hawkish than expected, cementing expectations over a rate hike in March and encouraging participants to price in around six quarter-point increases by the end of this year.

Remember that the December “dot plot” pointed to only three.

That said, some may have been scratching their heads about whether the crisis in Eastern Europe will weigh against an aggressive attempt to curb inflation. According to the Fed funds futures, bets are being scaled back. Investors are now pricing in five quarter-point increases by the end of the year. However, our view is different.

The crisis is pushing oil prices higher, which could result in a further acceleration in inflation around the globe. Something like that could force policymakers to act more aggressively than previously thought. So, with that logic in mind, we expect Powell to maintain the view that a March hike is on the table and that more are in the works for the months to come. This is likely to prove positive for the US dollar.

EUR/USD – Technical Outlook

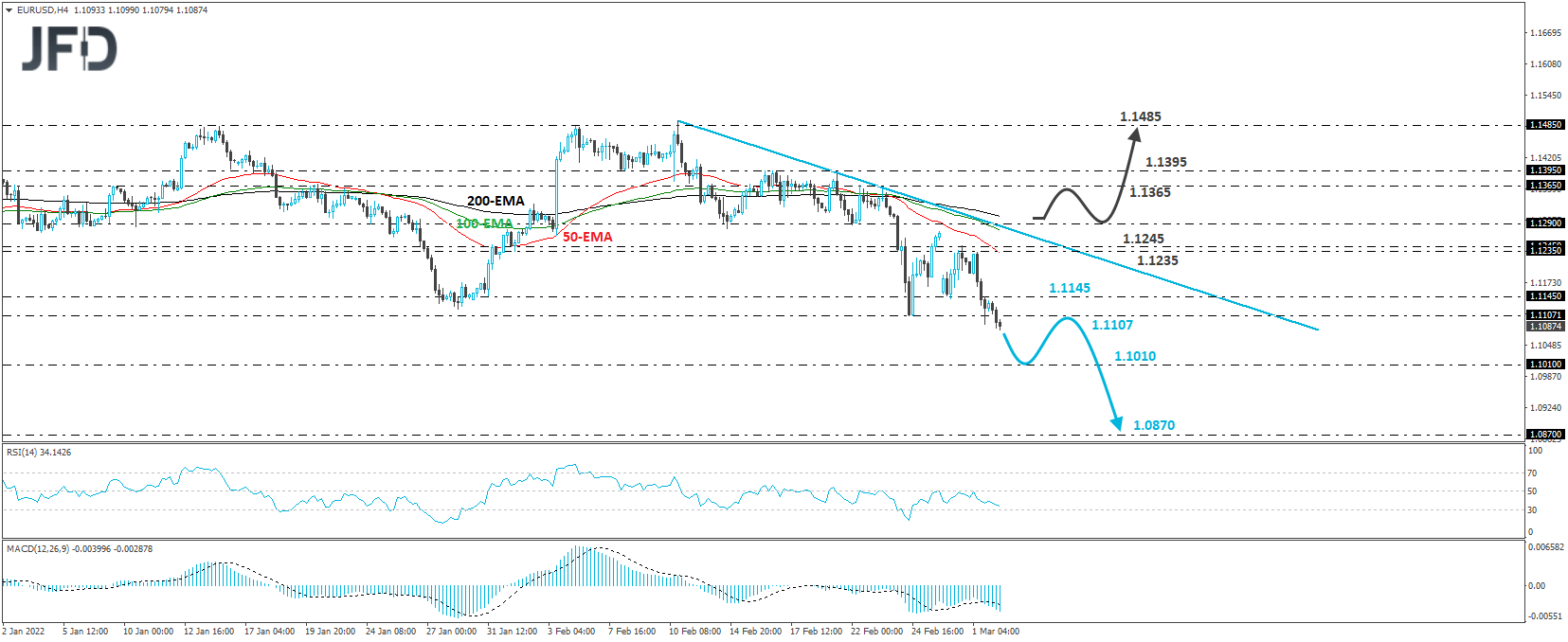

EUR/USD fell sharply yesterday after hitting resistance at 1.1235. The slide brought the rate below the 1.1107 barrier, marked by the low of Feb. 24, thereby confirming a forthcoming lower low on both the 4-hour and daily charts. This, combined with the fact that the rate is also trading below the downside resistance line drawn from the peak of Feb. 10, suggests that the outlook is still bearish.

We believe that the dip below 1.1107 may invite more bears into the action, who could push towards the 1.1010 barrier, marked by the inside swing high of May 21, 2020. If they are unwilling to stop there, then a lower break could carry more bearish implications, perhaps opening the way towards the low of May 25, 2020, at 1.0870.

On the upside, we would like to see a clear rebound back above 1.1290 before we start examining the case of a bullish reversal. The rate will be above the aforementioned downside line and the bulls may initially climb towards the 1.1365 or 1.1395 zones, marked by the highs of February 23rd and 21st, respectively. Another break, above 1.1395, could see the scope for extensions towards the 1.1485 zone, which has been acting as a ceiling since Jan. 13.

As for the Rest of Today’s Events

During the EU session, Eurozone’s preliminary CPIs for February are out, with the headline rate rising to +5.8% YoY from +5.1%, and the core one jumping to +2.7% YoY from +2.4%.

Remember that at the press conference following the latest ECB decision, President Lagarde said that inflation remained elevated for longer than previously thought and that the economy was hurt less than anticipated by the pandemic. She also added that the March and June meetings would be essential for evaluating their guidance, which means that they could, after all, decide to lift rates this year.

Although she pushed against expectations over a summer rate increase in the aftermath of that gathering, accelerating inflation could encourage some participants to add back to such bets, which could prove supportive for the euro. However, we don’t expect any positive reaction in the common currency to last for long as the Russia-Ukraine crisis weighs on the currency.