The situation in the Crimea and the wider Ukraine is dragging risky assets lower this morning as we open up in Europe. USD, JPY and CHF are the notable outperformers with oil and gold also up on the day as investors nudge into havens following a weekend of troop movements and increased sabre rattling from parties on both sides of the divide.

The Russian Central Bank has intervened this morning in an effort to stop the recent ruble weakness after the open saw RUB fall to another record low. Interest rates in Russia have been increased by 1.5% to 7% in an effort to bring about some financial stability although the Russian economy is not really in a position to be swallowing such sudden tightness in policy. The Russian stock exchange is down around 9% as I write this.

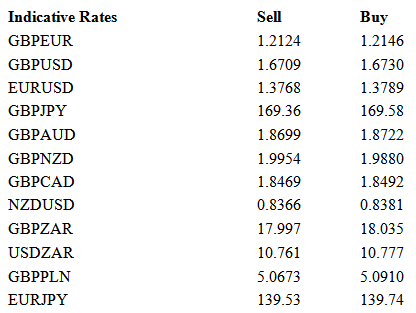

Regional currencies are also on the slip with Polish zloty weakening following reports that it is moving troops in order to solidify its border with Ukraine. Needless to say, other emerging market currencies that are more than a couple of tanks of petrol away from the situation are also lower with weakness seen in South African rand, Mexican peso and Indian rupee.

As we said on Friday, the story around the US economy, the data that we glean as to its performance and the subsequent effect on the US dollar depends on whether you believe that it is the weather that is slowing the recovery or the recovery is slowing on its own and the weather is simply helping matters. We are in the former camp and believe that we will see the data resume some poise the closer we get to April as March’s warmth starts to thaw things out. That being said, another poor jobs number this Friday will not only worry the market but the Fed as well, despite it not being a clean figure. US GDP was revised lower on Friday afternoon to 2.4% from 3.2% as lower personal consumption and durable goods orders weighed.

In spite of the likelihood of a war in Eastern Europe, the economic calendar remains busy and as today is the first trading day of the new month we are in for a session of PMI manufacturing surveys from across the world. China’s flash number fell to a 7yr low earlier in the month with the official number doing little better overnight, rising to 48.5 from 48.3. The juggling act in China of reining in credit and protecting against bubbles whilst promoting consumer spending and the emergence of a middle class in an economy that must not fall below 7% growth is getting more and more precarious by the month it seems.

Measures from the Eurozone are due throughout the morning with Italy at 08.45 GMT, France at 08.50, Germany at 08.55 and the Eurozone-wide measure at 09.00. The UK number is due at 09.30 with strong growth expected following January’s slight slip. The US ISM is due at 15.00.

This week, away from Ukraine, will be dominated by central bank movements. The Bank of Canada, European Central Bank, Reserve Bank of Australia and the Bank of England all have meetings this week and there are 7 separate speeches by Fed members. We expect no moves in policy by the Bank of Canada, Reserve Bank of Australia or Bank of England and last week’s Eurozone inflation numbers have limited the possibility of an ECB policy alteration. For more on this readers can sign up to our monthly webinar this Thursday – please register here.