Russell Investments has issued a white paper, the 2013 Global Market Outlook, which foresees moderate growth in the U.S. and China along with episodes of European-generated volatility. A report for the UK outlook by Wouter Sturkenboom sees Great Britain treading water but doing better in the second half of the year. Sturkenboom says that since the Great Financial Crisis (GFC) the UK "has been paying the price for its pre-2008 private and public sector debt buildup." Although Sturkenboom does not see the UK policy mix changing materially in the coming year, he does foresee the uptick in the second half of 2013 producing growth of 1-1.5% for the entire twelve months.

Sturkenboom summarizes:

The economy in the UK has been treading water for two years now, and is expected to do so for at least another year. Especially in the first half of 2013, continued weakness in the private sector and the ongoing Eurocrisis will keep the risk of renewed recession high, despite austerity tapering off a bit. On the back of an expected uptick in global growth, the second half of 2013 should be slightly better, ending the recession.

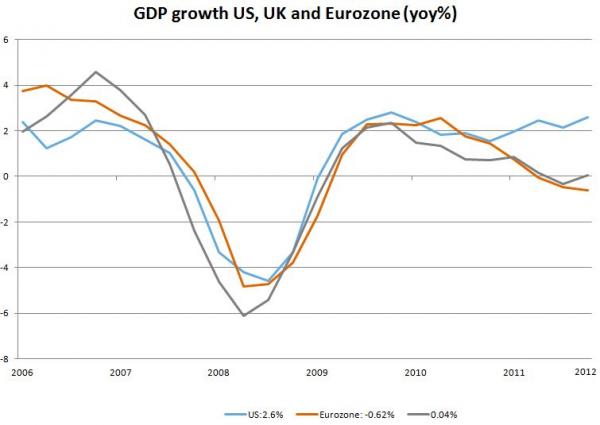

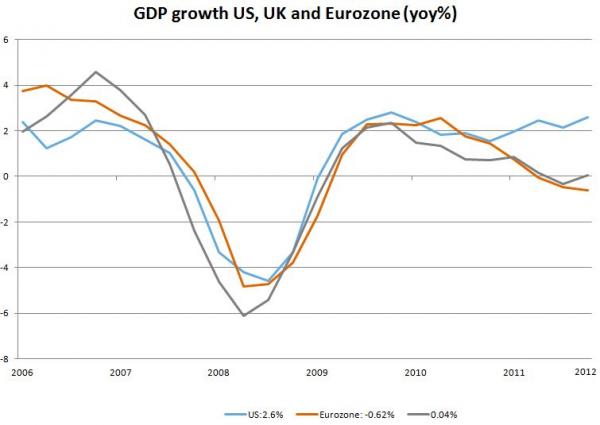

The following graph contrasts the US, UK and Eurozone economic performance since before the GFC.

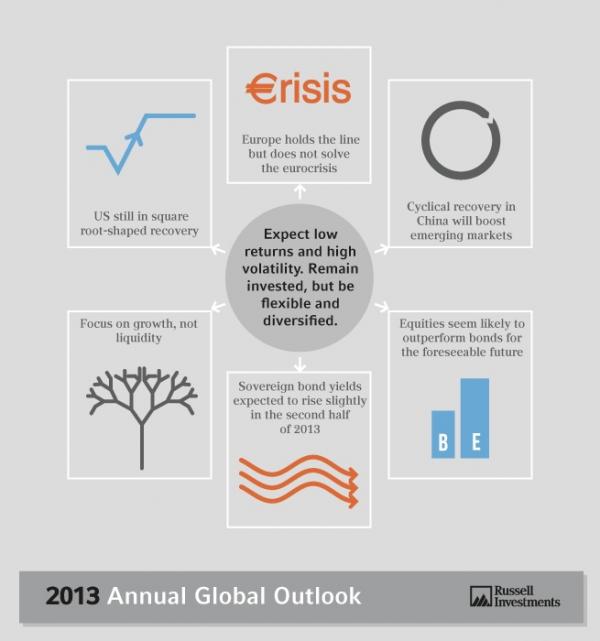

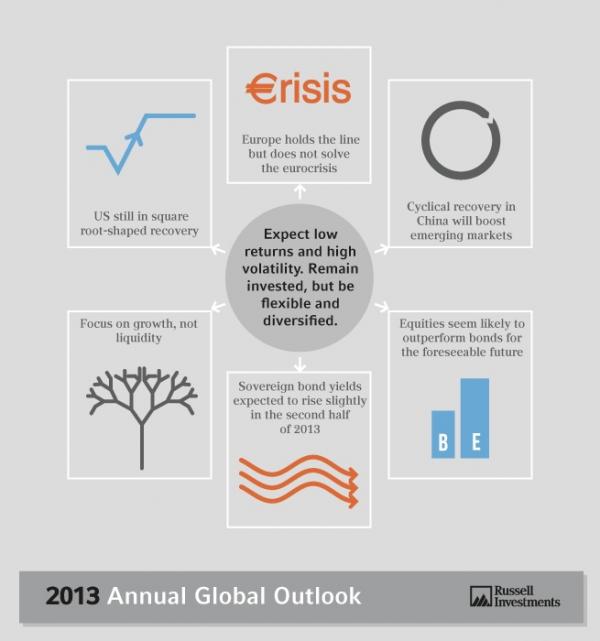

The following info graphic appears in the Sturkenboom report:

Sturkenboom offers the following overview for 2013 projections for the UK:

Sturkenboom summarizes:

The economy in the UK has been treading water for two years now, and is expected to do so for at least another year. Especially in the first half of 2013, continued weakness in the private sector and the ongoing Eurocrisis will keep the risk of renewed recession high, despite austerity tapering off a bit. On the back of an expected uptick in global growth, the second half of 2013 should be slightly better, ending the recession.

The following graph contrasts the US, UK and Eurozone economic performance since before the GFC.

The following info graphic appears in the Sturkenboom report:

Sturkenboom offers the following overview for 2013 projections for the UK:

- Economic growth: The UK policy mix is not expected to change materially in 2013. That means the combination of monetary stimulus and austerity will stay in place, allowing the economy to tread water, but not much else. Both the Eurocrisis and global growth will play an important role in ending the recession and entering a cyclical upturn in the second half of 2013. For now, that means we expect growth over 2013 to be around 1-1.5%.

- Inflation and interest rates: In a weak economic environment where the monetary transmission mechanism is not functioning properly because of a weak financial sector keeping credit supply down and a weak private sector keeping credit demand down there is little endogenous upward pressure on inflation. Exogenous pressure can come from a weakening of the pound, increases in global commodity prices and tax policy. Currently, we only expect some upward pressure on inflation from food prices, but because there is very little inflationary pressure other than that we do not think inflation will go much above 3% and remains firmly range-bound. By extension we expect interest rates to remain range bound as well with a slight increase in rates expected in the second half of 2013 as growth picks up.