The Russell 2000 has been lagging the rest of the market since the August downturn. it even made a lower low in September where the other indexes did not. But there are indications now that it may play catch up. In fact it has room to vault higher.

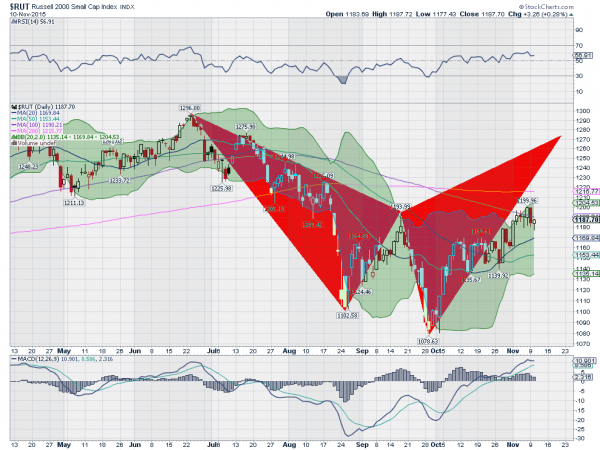

The chart below shows a harmonic pattern that has played out since the June top. The fall to the August low and retrace to the September high and then a lower low. Now the move higher and over the September high. This targets a move to the first Potential Reversal Zone (PRZ) of a harmonic Shark at 1274. Should it continue higher the second PRZ is at 1321.

There is support for this from other indicators. Momentum indicators are bullish with the RSI rising and in the bull zone while the MACD is level, but positive. The MACD may start to diverge and that is something to watch for. The Bollinger Bands® are opening higher as it consolidates the latest leg higher. And the Measured Move from the September bottom to the mid October plateau projected higher would give a target of 1240.

The point is that there are many ways to see more upside and one slight caution at this time. This is not the time to be selling unless there is more evidence of downside. Until then the evidence points higher.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.