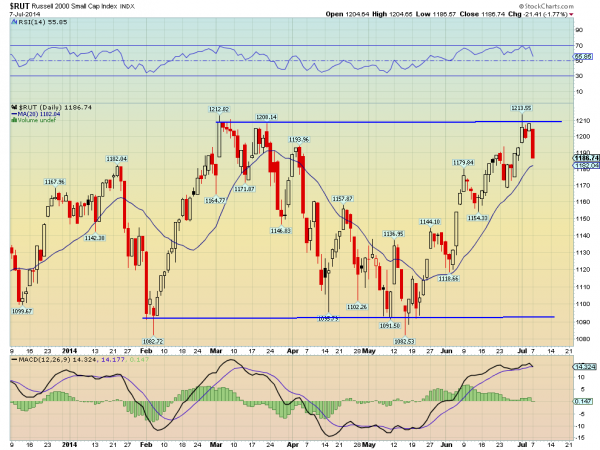

The Russell 2000 (iShares Russell 2000 Index (ARCA:IWM) has everyone’s attention. Many follow it as the ‘leader’ of the market, pulling the other indexes along with it. Some look at the mid and small cap names and see the health of the market and the economy. As a technical trader though, when I look at it I see an index at a crossroads. Take a look at the chart below:

The bottoms in February and May, along with the tops in March and July, set a roughly 120 point range for the index. To be fair, it has been in this range since November, but the last five months have really established the range.

With the long red candle, a Marubozu, on Monday it appears to be pulling back for another trip to the bottom. And guess what? Pundits miraculously are calling for a 10% correction. Seems they walked out in the middle of their Technical Analysis 101 class. They may be right in the end, but the trend remains higher today. Monday’s price action closed a price gap from last week, and it remained above the 20 day Simple Moving Average (SMA, rising blue line). As you can see, since the beginning of the year using the 20 day SMA as a guide, being either long or short would have served you well.

If it crosses down through that line, then the trend has reversed again and pundits will surely tell you they were right. They have other factors on their side as well. The momentum indicators shown (RSI and MACD) are both moving lower. Technically speaking, if the MACD crosses down, that is bearish, so the RSI moving through the mid line at 50 would be bearish. But both momentum indicators are actually still in bullish ground. In fact, if the RSI were to reverse higher from here along with price, it would create a very bullish situation, a Positive RSI Reversal. This is where the RSI bottoms below the prior low but the Price bottoms at a higher low, and it would target a 43 point move higher on the Russell.

Today may be a very interesting day. Will long holders end up stuck in the Russell 2000 as it heads to the bottom of the channel? Or will they be excited as the index gets ready to soar? Can't wait to find out.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.