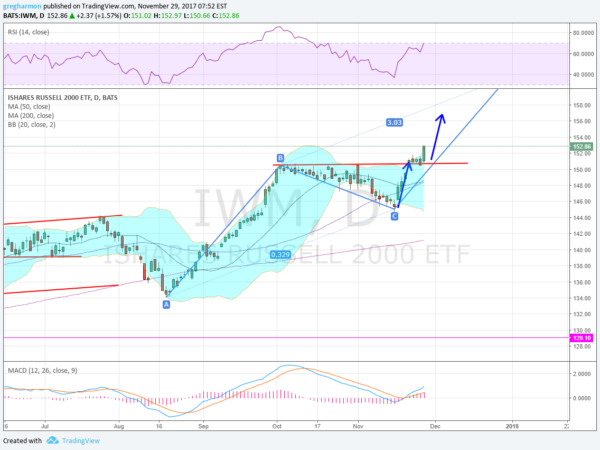

Last week I raised the question, How Strong is the Russell 2000 in this space. It had been the laggard index and looked as if it might be waking up. Since then it flexed its muscles and started a drive higher. It has acted this way in the past, with a strong 6 week run from mid-August to the early October high and plateau. Another 6 week run could easily get to the target mentioned over 161. It has broken out to a new all-time high twice on its way higher already. Today it is worth a look at potential short term resistance points along the way.

The move last week out of the expanding wedge gives a target to near 157. This is also the target looking at the run from the November low into consolidation added to the breakout, like a smaller bull flag. There is plenty of support for this and further upside to continue. The Bollinger Bands® have opened to the upside. The RSI is bullish and rising. It is now on the edge of being overbought but it only takes a look left to the October peak in RSI to see it can go a lot further still. And the MACD is crossed up, positive and rising. It also has a lot of room before it reaches the prior high.

Identifying a mosaic of price patterns and indicators all pointing in the same direction can help immensely in finding the strongest trends and gauging when they will end. Keep looking for several reasons in the actual price action to back up your trading capital, not ethereal quantifiers like P/E ratios or the like. Price tells the truth.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.