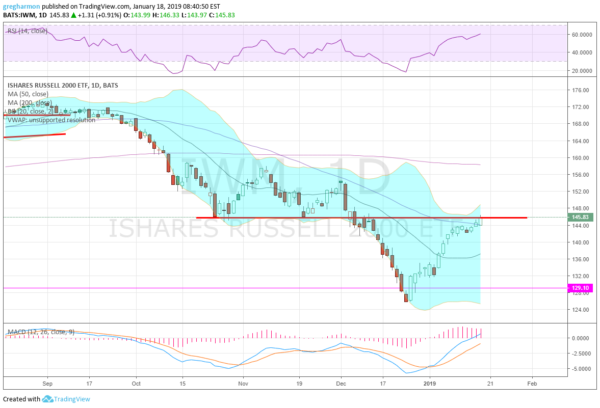

When equity markets started moving lower in September, the Russell 2000 was leading the way down. Not waiting until the end of the month to start the drop, the Russell continued to a bottom in late October. It bounced there. A minor digestion of the long run higher.

It consolidated there until early December, bouncing off of support again in November. Then in December the crime occurred. The Russell 2000 broke down through that support and continued lower. It finally stopped when it had retraced back to the June 2015 high, where it started the correction to the early 2016 low.

The low on Christmas Eve cast shadow over the holiday. But it has been nothing but up since then. Of the 16 trading sessions since, 14 have been up days. This has brought the Russell 2000 ETF, (NYSE:IWM), back to the sight of the December breakdown.

Markets often retest a key price point before resuming lower, and I am sure those in the bearish camp will be looking to reload short positions here. But there are significant reasons for them to watch for a shift to the bullish camp. The first is as always, the price action. It is going up.

Momentum is growing as well. And looking at the details the RSI has just moved into the bullish zone with a lot of overhead space left before it is overbought. The MACD has also just turned positive so it has a lot of upside room as well. The Bollinger Bands® are opening higher as the price rises.

I have said it many times and will repeat it again. The equity markets have done a lot to dig out of the December crime scene, but there is still work to be done to prove a reversal has occurred. A move over the 200-day SMA for the Russell 2000 would be a good start.