This is the question and in more ways than one as in how will Fed Chairman Ben Bernanke convince investors to reverse the prevailing opinion that QE3 is likely to be a 2012 move by shifting the focus toward a substitute policy move that will be deemed acceptable, but let’s keep it simple and away from Fed policy and on the equity indices.

Starting out with the intriguing, the Russell 2000 3-month uptrend is intact despite the recent reversal of its 1-month uptrend as shown by the preservation of the dashed trendline and the breaching of the bottom trendline of a small Rising Wedge in solid trendlines, respectively.

What makes this chart so interesting beyond the Ascending Triangle that may never follow the Dow Jones Industrial Average and the S&P to fulfill up having coddled its more than year-long trend of lower highs as that aspect took those other indices up is the near-Death Cross that was averted briefly but perhaps not for long when considering the month-long and confirmed Rising Wedge with its target of 765.

Should this minor Rising Wedge succeed in taking the Russell 2000 to its target, this small cap index’s 3-month uptrend will start to reverse down and something that will cause it to drop toward the bottom of this year’s range near 730 if not closer to the target of the Double Top at 703.

Relative to the reversal level at hand to watch in the Russell 2000 for September, then, above about 785 rising toward 805 by the end of the month and its near-term uptrend is intact but below that rising range and there will be a sideways swipe to the downside – at least – at hand.

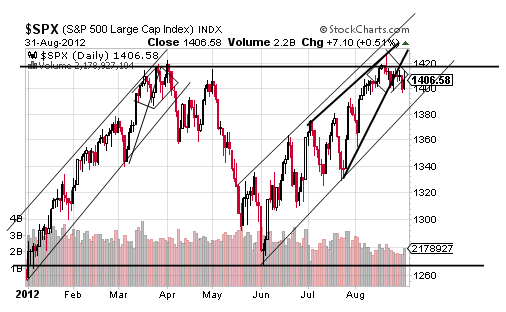

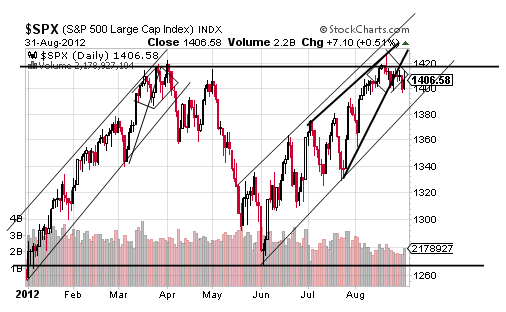

For better or worse or actually neutral as the case is with a sideways trend, a look at the S&P suggests that the Russell 2000 is probably going to continue to lean down toward reversing its 3-month uptrend in looking at the daily chart of the index on the following page.

As will be seen, the S&P is showing a nice piece of pattern repetition to the combination of the bearish aspects that caused it to move down into the sideways trend this spring and something that is likely to be replicated to some degree in the weeks ahead.

Specifically, the S&P appears to have confirmed a small Diamond Top for a target of about 1372 and a level that will confirm its three-month Rising Wedge for its target of 1267 by breaching the bottom trendline of the Ascending Trend Channel that is “hiding” it.

When applied to the Russell 2000, this aspect of the S&P implies that the small cap index will reverse its near-term uptrend and fall to the full target of its Rising Wedge at 730, and thus it seems watching the S&P’s reversal range for September that starts near 1380 and will finish the month above 1420.

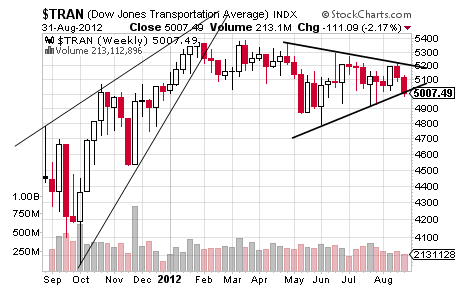

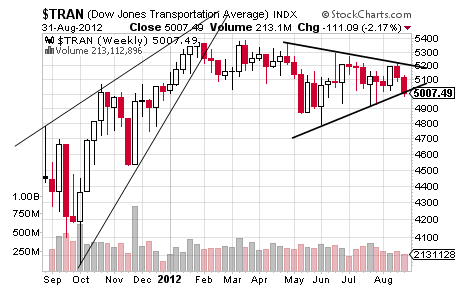

But the real reason to think that these reversal ranges are likely to be breached to the downside soon on both the Russell 2000 and the S&P is shown by the weekly chart of the Dow Transports.

Just this past week, it was the recent Bear Wedge in the Dow Transports that started to fulfill down in earnest toward its target of 4931 and something that caused the Dow Transports to start reversing the uptrend aspect of its sideways trend by breaching the bottom trendline of the Symmetrical Triangle shown above toward the downside on a closing basis.

Should this early bearish trading find follow-up this week and this month, it means the Symmetrical Triangle will probably ignore the upside target of 4985 and move it toward the downside target of 4200 and a level that finds support through the 3951 target of the only real Rising Wedge at work in the Dow Transports considering it has settled into true sideways trend this year that has allowed only for shorter Bear Wedges.

Interesting, though, is the fact that the major Rising Wedge in the Dow Transports is very much confirmed on a reversal of its intermediate-term uptrend and something that suggests that the real question ahead is less about to reverse or not to reverse and more about when the reversal will occur.

Starting out with the intriguing, the Russell 2000 3-month uptrend is intact despite the recent reversal of its 1-month uptrend as shown by the preservation of the dashed trendline and the breaching of the bottom trendline of a small Rising Wedge in solid trendlines, respectively.

What makes this chart so interesting beyond the Ascending Triangle that may never follow the Dow Jones Industrial Average and the S&P to fulfill up having coddled its more than year-long trend of lower highs as that aspect took those other indices up is the near-Death Cross that was averted briefly but perhaps not for long when considering the month-long and confirmed Rising Wedge with its target of 765.

Should this minor Rising Wedge succeed in taking the Russell 2000 to its target, this small cap index’s 3-month uptrend will start to reverse down and something that will cause it to drop toward the bottom of this year’s range near 730 if not closer to the target of the Double Top at 703.

Relative to the reversal level at hand to watch in the Russell 2000 for September, then, above about 785 rising toward 805 by the end of the month and its near-term uptrend is intact but below that rising range and there will be a sideways swipe to the downside – at least – at hand.

For better or worse or actually neutral as the case is with a sideways trend, a look at the S&P suggests that the Russell 2000 is probably going to continue to lean down toward reversing its 3-month uptrend in looking at the daily chart of the index on the following page.

As will be seen, the S&P is showing a nice piece of pattern repetition to the combination of the bearish aspects that caused it to move down into the sideways trend this spring and something that is likely to be replicated to some degree in the weeks ahead.

Specifically, the S&P appears to have confirmed a small Diamond Top for a target of about 1372 and a level that will confirm its three-month Rising Wedge for its target of 1267 by breaching the bottom trendline of the Ascending Trend Channel that is “hiding” it.

When applied to the Russell 2000, this aspect of the S&P implies that the small cap index will reverse its near-term uptrend and fall to the full target of its Rising Wedge at 730, and thus it seems watching the S&P’s reversal range for September that starts near 1380 and will finish the month above 1420.

But the real reason to think that these reversal ranges are likely to be breached to the downside soon on both the Russell 2000 and the S&P is shown by the weekly chart of the Dow Transports.

Just this past week, it was the recent Bear Wedge in the Dow Transports that started to fulfill down in earnest toward its target of 4931 and something that caused the Dow Transports to start reversing the uptrend aspect of its sideways trend by breaching the bottom trendline of the Symmetrical Triangle shown above toward the downside on a closing basis.

Should this early bearish trading find follow-up this week and this month, it means the Symmetrical Triangle will probably ignore the upside target of 4985 and move it toward the downside target of 4200 and a level that finds support through the 3951 target of the only real Rising Wedge at work in the Dow Transports considering it has settled into true sideways trend this year that has allowed only for shorter Bear Wedges.

Interesting, though, is the fact that the major Rising Wedge in the Dow Transports is very much confirmed on a reversal of its intermediate-term uptrend and something that suggests that the real question ahead is less about to reverse or not to reverse and more about when the reversal will occur.