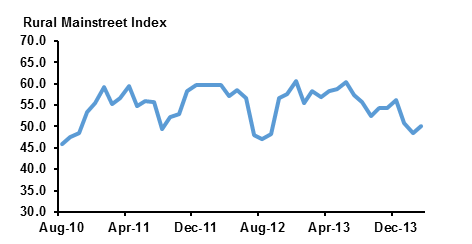

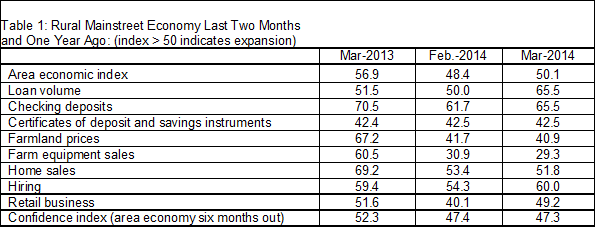

The Rural Mainstreet Index (RMI) increased to above growth neutral after falling below growth neutral last month for the first time in over one year. Uncertainty over when the Federal Reserve will increase interest rates has attributed to the decline of the farmland price and equipment sales indexes, which declined to their lowest levels since 2009.

The Rural Mainstreet Index, ranging between 0 and 100 with 50.0 representing growth neutral, increased to 50.1 from a 48.4 in February. Ernie Goss PhD., economist at Creighton University, suggests that crop prices need to continue the rise they have seen over the past couple months to produce positive results for the rural economy.

Goss stated, “Slight upturns in agriculture commodity prices over the past several months have yet to boost the Rural Mainstreet Economy. We will need to see additional increases in farm commodity prices to push the agriculture based economy back into healthy growth territory such as was experienced in 2012 and early 2013.” The extremely cold weather experienced across much of the Midwest resulting in increased heating costs was also cited as reasons for the decrease.

Source: Rural Mainstreet Index Creighton University

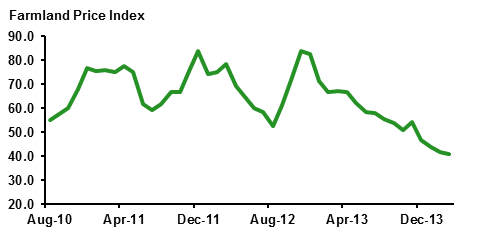

The farmland price index decreased to 40.9 from 41.7. “This is the fourth straight month that the farmland and ranchland-price index has moved below growth neutral,” said Goss. This month Federal Reserve Chairwoman Janet Yellen said that interest rates would not be adjusted until six months after the tapering of the Federal bond buying program had ended. Most speculate the window for the increase in interest rates to be between late 2015 to early 2016.

Source: Rural Mainstreet Index Creighton University

Farm equipment sales sank to 29.3 from 30.9. Goss explained "Agriculture equipment and implement dealers in the agriculture based areas of the region are experiencing very weak sales to farmers even as farm equipment manufacturers are experiencing positive growth due to healthy sales abroad.”

Bankers were asked the current value of annual cash rents for farmland in their area and how much they expected values to change over the next 12 months. Over 60% of bankers surveyed expected cash rents to increase between 0% and 9% over the next 12 months. When asked average cash rent per acre of cropland, over 75% of bankers answered within the range of $200 to $400.

Source: Rural Mainstreet Index Creighton University

Survey

This survey represents an early snapshot of the economy of rural, agricultural and energy-dependent portions of the nation. The RMI is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.