Asian markets were lifted by a report by the Financial Times that European leaders were trying to strengthen the region’s bailout fund. The Nikkei jumped 1.7% to 8722, the Kospi gained .9%, and the ASX 200 rose .7%. The Hang Seng rallied 1.6% while China’s Shanghai Composite rose .3%, snapping a 3-day losing streak.

Meanwhile, European markets posted moderate losses, surrendering earlier gains. The DAX fell .6%, the FTSE slipped .4%, and the CAC40 eased .1%. S&P has threatened to cut the credit rating on the ESFS bailout fund, and the threat may help force European leaders to agree to a deal at Friday’s summit.

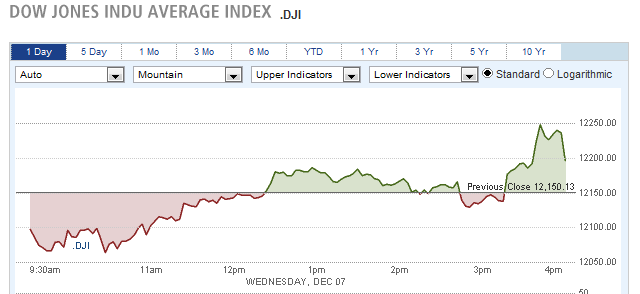

US stocks closed mostly higher. The Dow gained 46 points to 12196, the S&P 500 rose .2%, while the Nasdaq ended flat.

Stocks Rally on IMF Loan Rumor

Rumors circulated that the G20 is considering a $600 billion loan to the IMF to help Europe, but the IMF denied the claim.

Currencies

The Dollar traded mixed as the market prepared for the upcoming EU summit. The Pound rallied .7% to 1.5707, and the Australian Dollar gained .4% to 1.0286. The Euro, Canadian Dollar and Yen all closed little changed. The Swiss Franc slipped .2% to 1.0827.

Economic Outlook

Consumer credit increased to $2.457 trillion, slightly more than expected. Weekly mortgage applications also increased, thanks to a recovering economy and low interest rates.

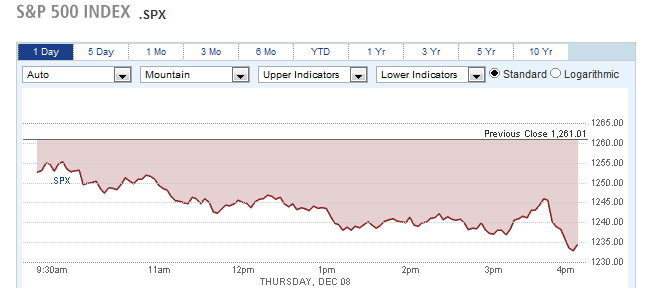

Stocks Tumble on ECB Disappointment

Equities

Asian markets slid on Thursday as anxiety grew ahead of Friday’s European Summit. The Nikkei dropped .7% to 8645, pulling back from a 1-month high. The Kospi slipped .4% after the Bank of Korea held interest rates at 3.25%, and Australia’s ASX 200 declined .3%. China’s Shanghai Composite largely recovered from an earlier drop, closing down .1%, and the Hang Seng shed .7%.

European markets tumbled after ECB President Mario Draghi said the region’s economy faced significant risks, while offering no new bond purchase plan. The central bank cut interest rates to 1% from 1.25%. The CAC40 dropped 2.5%, the DAX lost 2%, and the FTSE fell 1.1%, with financials leading the declines. The European Banking Index closed down 3.1%.

US stocks posted similar losses. The Dow fell 199 points to 11998, the S&P 500 skidded 2.1%, and the Nasdaq lost 2%. Selling accelerated in the last few minutes of the day after Germany rejected a draft proposal for the EU summit, casting doubts on the outcome of Friday’s meeting. The ongoing debate over whether to introduce stiffer budgetary requirements, or strengthen the bailout mechanisms, does not appear close to resolution.

S&P 500 Falls 2.1%

Despite earnings reports which exceeded estimates, Costco fell 2% and Smithfield Foods dropped 3.7%.

Currencies

The currency markets shunned risk on Thursday, pressuring the Australian and Canadian Dollar. The Australian Dollar fell 1.2% to 1.0168, and the Canadian Dollar dropped 1.3% to 1.0218. The Pound and Euro both lost .5% to 1.3348 and 1.5638 respectively, while the Yen closed flat at 77.67.

Economic Outlook

Weekly jobless claims were far better than expected, dropping by 23K to 381K. Wholesale inventories rose by 1.6%, more than forecast, posting their biggest gain in 5 months.

Western Markets Rally on Euro Summit Deal

Equities

Asian markets slumped on Friday as investors grew increasingly nervous over the European Summit. Hong Kong’s Hang Seng led the declines, tumbling 2.7% to 18586. Japan’s Nikkei sank 1.5% to 8536, the ASX 200 lost 1.8%, and the Kospi fell 2%. In China, stocks fell .6%, despite a report which showed a inflation dropped to 4.2%.

European leaders agreed to work towards leaner budgets, but failed to announce any new aid measures. Nonetheless, stocks rallied, led by the banks, which rose 2.6%. The CAC40 climbed 2.5%, the DAX jumped 1.9%, and the FTSE rose .8%.

DAX Rallies 1.9% on Treaty Deal

US markets followed their European counterparts higher. The Dow advanced 187 points to 12184, the Nasdaq rallied 1.9%, and the S&P 500 gained 1.7% to 1255. The VIX tumbled 13.3% to 26.53.

Currencies

The US Dollar traded mostly lower after the European Summit. The Euro rose 30 pips to 1.3370, the Pound rose 20 pips to 1.5662, and the Swiss Franc edged up 30 pips to 1.0821. The Australian Dollar gained .5% to 1.0221, and the Canadian Dollar ticked up .3% to 1.0193.

Economic Outlook

Consumer sentiment rose more than expected, climbing to 67.7, from last month’s 64.1 reading. The trade deficit fell to $43.5 billion, in line with forecasts.

Western Markets Tumble as Reality Sets In

Equities

Friday’s Western relief rally lifted Asian markets on Monday, following an agreement for stricter budgets amongst euro zone countries. The Nikkei advanced 1.4% to 8654, the Kospi climbed 1.3%, and the ASX 200 rose 1.2%. China’s Shanghai Composite bucked the uptrend, sliding 1%, and the Hang Seng closed down fractionally.

Friday’s gains were short-lived for European stocks, as a steep selloff hit the continent. Germany’s DAX tumbled 3.4% to 5785, the CAC40 dropped 2.6%, and the FTSE fell 1.8%. Despite Friday’s summit treaty, little progress has been made in improving the European debt crisis.

Germany's DAX Slumps 3.4%

US markets dropped as well, but ended well off their lows. The Dow dropped 163 points to 12021, the Nasdaq declined 1.3%, and the S&P 500 dropped 1.5%. Banking shares were hit hardest, as Citigroup plunged 5.4% and Bank of America dropped 4.7%.

Currencies

The Dollar surged as investors flocked to safety. The Euro and Swiss Franc both tumbled 1.5% to 1.3186 and 1.0672 respectively. The Australian Dollar shed 1.4% to 1.0078, and the Canadian Dollar lost 1% to 1.0258. The Yen fared better than its pears, easing .3% to 77.90.

Economic Outlook

The Fed will issue its rate statement on Tuesday, and is not expected to lift rates from .25%. Also due are retail sales, business inventories, and the TIPP economic optimism report.

Retail Stocks Drop on Weak Data

Equities

Asian markets traded lower as disappointment over Friday’s European Summit set in. The Nukkei dropped 1.2% to 8553, the Kospi slumped 1.9%, and the ASX 200 declined by 1.6%. The Shanghai Composite fell 1.9% to 2249, its lowest level since March 2009, and the Hang Seng eased .7%.

European markets closed mixed following Monday’s slide. The CAC40 fell .4%, and the DAX slipped .2%, while the FTSE rallied 1.2%, lifted by the energy sector. Investors digested news that German chancellor, Angela Merkel, opposes an increase in Europe’s bailout fund.

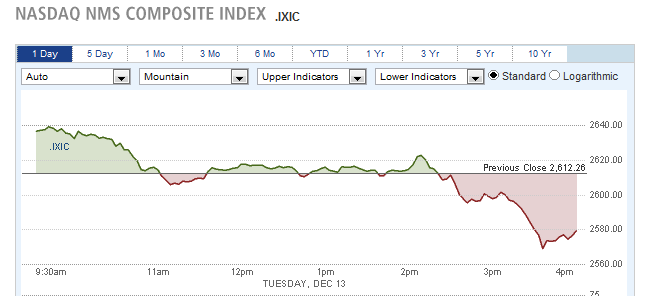

US stocks dropped in the late afternoon, following the Fed’s statement, which failed to entice investors. The Dow closed down 66 points to 11955, the S&P 500 dropped .9%, and the Nasdaq fell 1.3%

Nasdaq Loses 1.3% in Afternoon Selloff

Currencies

The Euro extended its losses from Monday, dropping 1.1% to 1.3031. The Pound and Canadian Dollar both lost .7%, and the Australian Dollar fell .5% to 1.0005. The Yen settled at 77.99, down fractionally, and the Swiss Franc slumped .8% to 1.0571.

Economic Outlook

Tuesday’s economic data was disappointing. Retails sales rose by.2% in November, significantly less than the .6% forecast. Business inventories rose by .8%, slightly more than expected.