Forex News and Events

Russia: Heading towards another rate cut in September

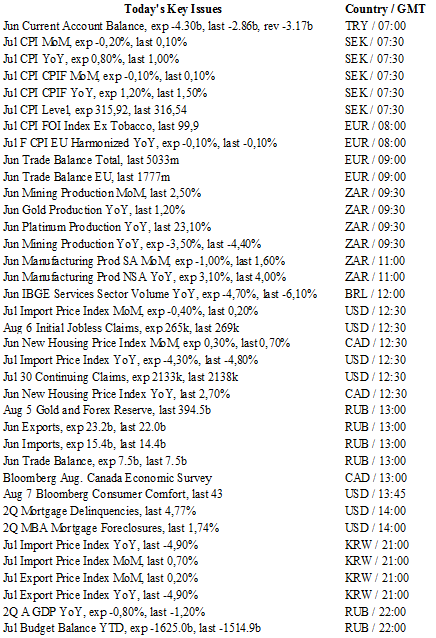

The ruble is following its upside momentum, currently trading below 65 ruble for a single dollar note. Things are looking up for the country as its economic prospects show definite signs of improvement. July's inflation data plunged to its lowest level in 2 years - to 7.2% y/y for July. It would appear that Elvira Nabiullina's monetary policy strategy is paying off. Moreover, the head of the Russian Central Bank has made clear that one of her primary objectives is to increase gold and FX reserves up to $500 billion in an effort to back its currency in gold as much as possible. This would appear to be a smart move considering the current context of global uncertainty and the strategy is definitely helping Russia to attract investors. Today, Russian gold and FX Reserves will be released which should show a continued increase towards the central bank’s target.

For the time being, the ruble is appreciating and this overall increase needs to be monitored. For this reason we believe that it is likely that the Russian central bank will ease again at its September monetary policy meeting. The last rate cut happened in June when rates were lowered to 10.50% from 11%. We now expect a cut towards 10%.

Mexico’s central bank, cautious but on hold

At today’s monetary policy meeting, Banxico is widely expected to keep its policy rate unchanged at 4.50% following the 50bp hike in June and 125bp total in the current tightening cycle. Despite a slight deceleration in inflation, as annual CPI rose to 2.64% below 2.73% expected, the divergence between inflation and growth dynamics remains an issue for the central bank. However, Banxico remains vigilant as MXN steady deprecation risks breaching the bank’s inflation target and triggering financial instability. On the growth side, industrial product, released today should remain restrained, at 0.5% from 0.4% y/y highlighting growth uncertainties emulating from the US. However, Banxico is primarily focused on the Fed and defending the MXN from excessive depreciation. The central bank indicated a reactive strategy, shadowing the FOMC policy decision. Should the Fed raise rates by 25bp in September we anticipate Banxico will respond-in-kind (FOMC 21st & Banxico 29th Sept). Yet with a preemptive 100bp tightening head-start, Mexico is currently ahead of the curve so we do not anticipate any intra-meeting action (so long as MXN weakness remains measured). That said, our current base scenario is for no Fed hike in the fall, keeping Mexico on the sidelines.

Reaffirmation that global central banks will remain dovish for the foreseeable future, with the obvious exception of the Fed, has supported broad-based risk and yield seeking. Investors have piled into EM FX with MXN the clear outperformer in recent days, despite the peso generally lagging in the indiscriminate risk rally.

In EM FX, MXN has been one of the worst performing currencies of the year-to-date, due to its high correlation to oil, uncertainty over US growth and the political backdrop (decline of Republican presidential candidate Trump in the polls has been viewed as a positive for Mexico) and the general preference of investors to demonstrate a negative EM strategy through the peso (low cost of carry). In the current risk-taking environment we should see MXN gain marginally against the USD, but lag behind LATAM peers.

USD/JPY - Trading In Range.

The Risk Today

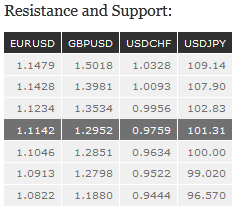

EUR/USD has failed to break above 1.1200. A break of hourly resistance lies at 1.1234 (02/08/2016 low) is needed to confirm deeper buying pressures. The road remains nonetheless wide-open towards hourly support that can be found at 1.1046 (05/08/2016 low). Expected to further decline. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD still lies within a downtrend channel. The pair is trading around 1.3000 but fails to head lower but the bearish momentum remains lively. Hourly resistance can be located at 1.3097 (08/08/2016 high). Expected to head towards support implied by the lower bound of the downtrend channel around 1.2900/20. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment,

USD/JPY's short-term buying pressures have faded around hourly resistance given at 102.83 (02/08/2016 high). A failure to go above 102.83 indicates a continued medium-term bearish momentum. Hourly support is given at 100.68 (02/08/2016 low). We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF continues to trade between hourly support at 0.9634 (02/08/2016 low) and strong resistance given at 9956 (30/05/2016 high). Buying pressures seem weak and should indicate that a reversal towards 0.9634 is likely. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.