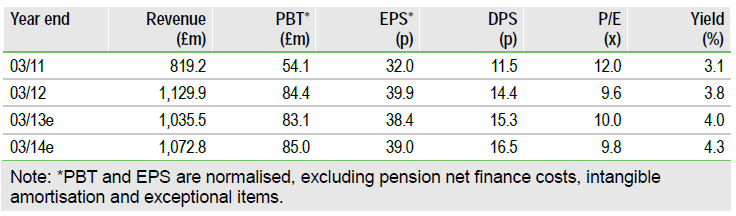

RPC Group, (RPC:LSE): Cautionary market comments at the H1 stage have been echoed in the FY IMS, leaving flat expected outturns for both closing and coming years, reducing our forecasts by 5% and 8% respectively. Returns and underlying cash flow are still enviably strong and we expect ongoing internal initiatives and potential acquisition activity to sustain this proposition. A 10x PER multiple overlooks these fundamental aspects.

Variable markets obscure underlying progress

FY13 was characterised by varied trading conditions across divisional and sub sector lines with overall demand also variable over the year. Aggregate headwinds (currency, polymer prices and subdued volumes) have restrained group operating profit to slightly below last year’s £93.5m. But, far from being a standstill year, the tail of Superfos synergies, improving mix, a small acquisition, and the start of the Fitter for the Future plant optimisation programme are all indicators of ongoing underlying qualitative group improvements. PBT guidance appears to be for flat outturns for FY13 and FY14, we have reduced our estimates by c 3% and c 7% respectively.

Proactivity in static markets

At the H1 stage, the Fitter for the Future project was unveiled with expected FY14 EBIT benefits of £4m, rising to £10m in FY15, reaching an annualised £12m in FY16. (RPC maintains a 20% average, through the cycle, group ROCE target – achieving c 18% in FY13 – and constantly reviews operations against this benchmark.) Also, more air time was given to possible acquisitions; the hiring of a new FD (Simon Kesterton) completes the previously announced FD to CEO succession in good time and brings M&A into focus again. The new FD brings experience in a manufacturing/automotive supply environment and there appears to be relevant acquisition (in Europe, Asia & US) and debt market aspects to this.

Valuation: Upside to come from active management

The “flat European outlook” has been taken to imply a repeat performance in FY14, c 10% below previous consensus earnings. While market caution is the order of the day, RPC has plenty of strings to its bow (eg net debt:EBITDA c 1.1x, interest cover approaching 10, or 15x on a cash basis – and underlying net cash flow of c £40m pa) to enhance group profit growth and shareholder returns. At 384p, revised estimates indicate historic/forward P/E ratios around 10x. This is not a standstill management team and we believe that RPC will be a corporately active business in the next year or so. The current entry point (valuation and balance sheet) suggests considerably more upside interest than downside.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

RPC Group: Estimates Lowered

Published 04/05/2013, 07:35 AM

Updated 07/09/2023, 06:31 AM

RPC Group: Estimates Lowered

Estimates lowered but model remains robust

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.