About a month has gone by since the last earnings report for Royal Caribbean Cruises Ltd. (NYSE:RCL) . Shares have added about 6.5% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Royal Caribbean Beats on Q2 Earnings, Lifts ’17 View

Royal Caribbean posted solid second-quarter 2017 results with both earnings and revenues topping the Zacks Consensus Estimate. Strong close-in demand for cruise bolstered the quarterly performance.

In fact, solid demand trends and continued cost discipline, resulted in the highest second-quarter earnings in the company’s history. Royal Caribbean thus remains positioned to witness another record year and achieve its targets under the Double-Double program.

Adjusted earnings of $1.71 per share were 2.4% ahead of the Zacks Consensus Estimate of $1.67 as well as above the management’s guided range of $1.60 to $1.65. Further, earnings jumped a significant 56.9% from the year-ago tally of $1.09, owing to higher revenues and lower expenses.

Total revenue increased 4.3% year over year to $2.195 billion, driven by higher passenger ticket revenues as well as better onboard spending. However, revenues slightly missed the Zacks Consensus Estimate of $2.191 billion.

Quarter Highlights

On a constant currency basis, net yields increased 11.5% year over year, better than the guided range of 10-10.5%. The outperformance came on the back of strong close-in demand, which in turn, drove higher pricing and occupancy.

Both passenger ticket revenues as well as onboard and other revenues increased 4.3% to $1.58 billion and $613.9 million, respectively.

Net cruise costs (NCC), excluding fuel, decreased 0.9% on a constant currency basis, lower than management’s guidance of a decline of about 2%.

Also, total cruise operating expenses decreased 4.1% year over year to nearly $1.26 billion, mainly due to a decline in onboard and other expenses, lower food, fuel, payroll and related as well as other operating costs. The decrease was partly offset by higher commissions, transportation and other costs.

3Q17 Guidance

For the third quarter, Royal Caribbean expects adjusted earnings per share to come in at $3.45.

Constant-currency net yields are projected to increase in the range of 4-4.5%. Notably, solid demand trends for Europe and North America products are driving improvement over an already strong previous year.

NCC, excluding fuel, are likely to be up about 4% at constant currency.

2017 Guidance Updated

For full-year 2017, the company now anticipates earnings in the band of $7.35 to $7.45 per share, up from the earlier guided range of $7–$7.20. Better-than-expected performance in the quarter along with favorable booking trends led to the improvement.

The company expects net yields to increase in the range of 5.5% to 6%, on a constant currency basis, up slightly from the prior guidance of an increase in the range of 4.5-6%, given better results in the second quarter as well as stronger trends for the rest of the year.

NCC, excluding fuel, on a constant currency basis, are expected to be up roughly 1%. Previously, the company expected the same to be flat to up slightly.

The company stated that bookings continue to be very robust. In fact, its booked position for the rest of 2017 continues to set new records. Moreover, Royal Caribbean booked position for the next 12 months is also strong, and ahead of the same time last year, in both rate and volume.

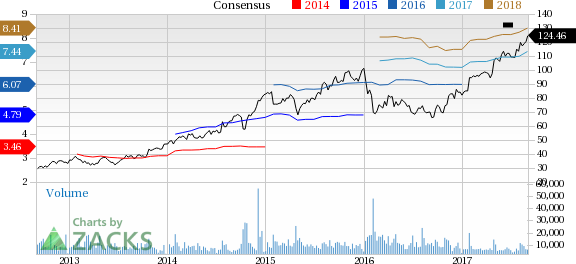

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended upward during the past month. There have been five revisions higher for the current quarter, while looking back an additional 30 days, we can see even more upward momentum.

VGM Scores

Currently, the stock has a strong Growth Score of B, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for growth and value investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #2 (Buy). We are expecting an above average return from the stock in the next few months.

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

Original post

Zacks Investment Research