Royal Caribbean Cruises Ltd (NYSE:RCL) was downgraded by analysts at Vetr from a "strong-buy" rating to a "buy" rating in a report released on Wednesday, MarketBeat.com reports. They currently have a $95.16 price objective on the stock. Vetr's price objective points to a potential upside of 10.74% from the stock's previous close.

A number of other equities analysts also recently weighed in on the company. Deutsche Bank AG began coverage on Royal Caribbean Cruises in a research report on Thursday, September 29th. They set a "hold" rating and a $81.00 price target on the stock. Zacks Investment Research downgraded Royal Caribbean Cruises from a "hold" rating to a "sell" rating in a research report on Monday, October 17th.

SunTrust Banks Inc. set a $92.00 price target on Royal Caribbean Cruises and gave the stock a "buy" rating in a research report on Wednesday, October 19th. J P Morgan Chase & Co downgraded Royal Caribbean Cruises from an "overweight" rating to a "neutral" rating and lowered their price target for the stock from $96.00 to $73.00 in a research report on Thursday, October 27th.

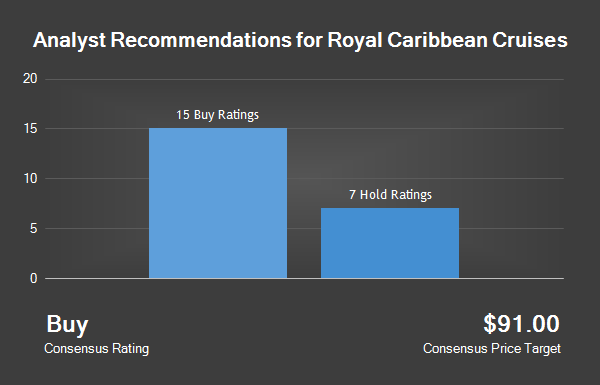

Finally, Macquarie began coverage on Royal Caribbean Cruises in a research report on Tuesday, October 4th. They set an "outperform" rating and a $88.00 price target on the stock. Eight equities research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the stock. The stock has an average rating of "Buy" and an average price target of $90.86.

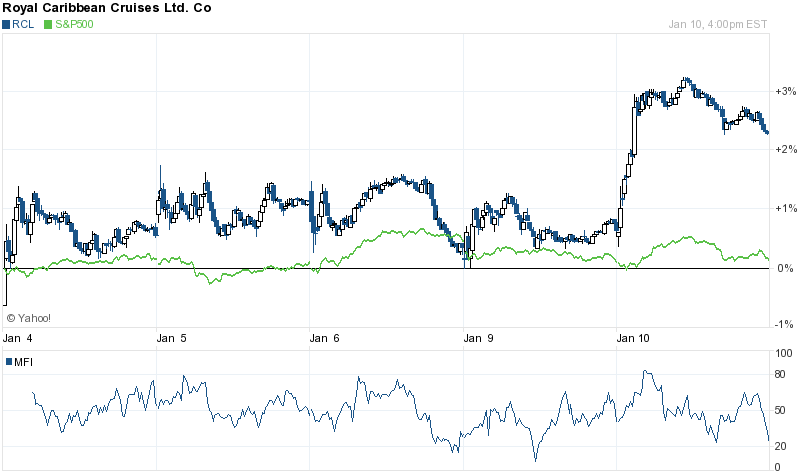

Royal Caribbean Cruises opened at 85.93 on Wednesday, MarketBeat.com reports. Royal Caribbean Cruises has a 52-week low of $64.21 and a 52-week high of $94.56. The company's 50 day moving average price is $83.57 and its 200 day moving average price is $74.75. The company has a market cap of $18.44 billion, a P/E ratio of 15.20 and a beta of 1.24.

Royal Caribbean Cruises last released its earnings results on Friday, October 28th. The company reported $3.20 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.10 by $0.10. Royal Caribbean Cruises had a return on equity of 15.29% and a net margin of 14.48%. The business had revenue of $2.56 billion for the quarter, compared to analyst estimates of $2.58 billion. During the same quarter in the prior year, the company posted $2.84 earnings per share. Royal Caribbean Cruises's revenue was up 1.6% on a year-over-year basis. Equities research analysts anticipate that Royal Caribbean Cruises will post $6.06 EPS for the current fiscal year.

The company also recently declared a quarterly dividend, which was paid on Thursday, January 5th. Stockholders of record on Wednesday, December 21st were paid a $0.48 dividend. This represents a $1.92 dividend on an annualized basis and a dividend yield of 2.23%. The ex-dividend date was Monday, December 19th. Royal Caribbean Cruises's payout ratio is 33.86%.

In other news, SVP Henry L. Pujol sold 7,600 shares of the stock in a transaction on Wednesday, November 2nd. The stock was sold at an average price of $75.93, for a total value of $577,068.00. Following the completion of the transaction, the senior vice president now directly owns 46,959 shares in the company, valued at approximately $3,565,596.87. The sale was disclosed in a filing with the Securities & Exchange Commission.

Also, major shareholder Wilhelmsen A. S. A sold 3,600,000 shares of the stock in a transaction on Wednesday, December 14th. The shares were sold at an average price of $84.02, for a total value of $302,472,000.00. Following the completion of the transaction, the insider now owns 24,899,253 shares of the company's stock, valued at $2,092,035,237.06. The disclosure for this sale can be found here. 16.80% of the stock is owned by insiders.

Several hedge funds and other institutional investors have recently made changes to their positions in the stock. Primecap Management Co. CA raised its position in shares of Royal Caribbean Cruises by 31.6% in the second quarter. Primecap Management Co. CA now owns 7,721,989 shares of the company's stock valued at $518,532,000 after buying an additional 1,852,117 shares in the last quarter. MD Sass Investors Services Inc. raised its position in shares of Royal Caribbean Cruises by 1,406.8% in the second quarter. MD Sass Investors Services Inc. now owns 883,334 shares of the company's stock valued at $59,312,000 after buying an additional 824,709 shares in the last quarter.

HG Vora Capital Management LLC bought a new position in shares of Royal Caribbean Cruises during the third quarter valued at about $59,960,000. Ameriprise Financial Inc raised its position in shares of Royal Caribbean Cruises by 96.7% in the third quarter. Ameriprise Financial Inc now owns 1,223,046 shares of the company's stock valued at $91,676,000 after buying an additional 601,344 shares in the last quarter.

Finally, Bank of New York Mellon Corp raised its position in shares of Royal Caribbean Cruises by 36.9% in the third quarter. Bank of New York Mellon Corp now owns 1,992,417 shares of the company's stock valued at $149,331,000 after buying an additional 536,612 shares in the last quarter. Institutional investors own 75.46% of the company's stock.

About Royal Caribbean Cruises

Royal Caribbean Cruises Ltd. is a cruise company. The Company owns various brands, such as Royal Caribbean International, Celebrity Cruises, Pullmantur, Azamara Club Cruises, CDF Croisieres de France and joint venture interest in TUI Cruises. It operates approximately 23 ships with an aggregate capacity of approximately 68,600 berths under its Royal Caribbean International brand, offering cruise itineraries that range from 2 to 24 nights.