The Royal Bank of Scotland Group (LON:RBS) plc (NYSE:RBS) is scheduled to report second-quarter 2017 results on Aug 4.

The company reported improved earnings in the first quarter. Results were driven by higher revenues, partially offset by elevated expenses.

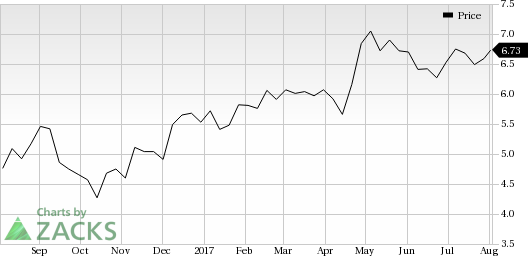

With the impressive results, RBS’ shares jumped nearly 7.6% on the NYSE for the three-month period ended Jun 30, 2017. This increase was largely driven by gradual improvement in the macroeconomic backdrop and a positive implication of the bank’s restructuring activities.

RBS, which was bailed out with £45 billion by the British government in 2008, has been striving for growth with several restructuring initiatives. These include cost-reduction measures, reducing geographic footprint and capital build-up efforts, while remaining focused on its strategy to become a smaller and simpler bank.

The bank’s ability to cope with the broader industry challenges amid its overhauling moves remains a key area to watch this earning season. So, will the upcoming earnings release lead to further improvement in RBS’ share price? Let’s check out the factors that are likely to affect the results.

Factors to Impact Q2 Results

The Edinburgh-based banking giant experienced decline in net fees and commissions in the recent quarters and we do not expect this quarter to display substantial strength. The company has downsized its investment banking division, which is likely to witness a decline. Further, its revenues from advisory might fall, as per the Thomson Reuters data, the total deal value of announced M&As across the world fell during the quarter.

As the bank remains focused on expediting its ongoing overhaul, the quarterly results will likely be marred by further significant restructuring charges. Also, given RBS’ exposure to numerous lawsuits and investigations, the company might have kept additional reserves for litigation expenses, which could dampen the bottom line to some extent.

However, expense base may get some respite owing to RBS’ continued cost-control efforts. In addition, the company might have benefited from the ongoing economic recovery (albeit at a slow pace) in the UK and Ireland – the major domestic markets.

Notably, the bank plans to move majority of jobs to India in order to bring down compensation costs. This restructuring move is aimed at boosting the bank’s profitability.

Moreover, net interest margin is anticipated to increase partially, reflecting the consistent benefit from reductions in the low yielding non-core assets.

Currently, RBS currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider

Shinhan Financial Group Co., Ltd. (NYSE:SHG) has been witnessing upward estimate revisions for the last 30 days. Also, the company’s shares have risen nearly 16.9% over the past six months. It currently sports a Zacks Rank #1 (Strong Buy).

KB Financial Group Inc. (NYSE:KB) has been witnessing upward estimate revisions for the last 30 days. Further, the stock gained over 25% over the last six months. It currently flaunts a Zacks Rank #1.

Banco Bilbao Viscaya Argentaria S.A. (NYSE:BBVA) has been witnessing upward estimate revisions for the last 30 days. Also, the company’s shares have risen nearly 40.3% over the past six months. It currently carries a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Royal Bank Scotland PLC (The) (RBS): Free Stock Analysis Report

Shinhan Financial Group Co Ltd (SHG): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

Banco Bilbao Viscaya Argentaria S.A. (BBVA (MC:BBVA)): Free Stock Analysis Report

Original post