The Royal Bank of Scotland Group (LON:RBS) plc (NYSE:RBS) is planning to lay off as many as 880 employees in London by 2020 to combat rising expenses and increase profitability, according to Unite — a U.K. labor union. Out of the total, 650 would be permanent jobs and 230 would be contractor positions.

In 2016, Royal Bank had employed 2200 workers in its IT department, but the company is planning to reduce the number to 950 in the next three years, as per the union.

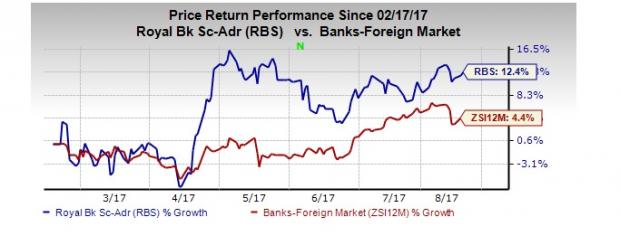

Royal Bank’s shares have gained 12.4% in the last six months, outperforming the 4.4% growth for the industry it belongs to.

We have observed that the bank is trying to reduce expenses in all possible ways. In March, Royal Bank announced the closure of 158 branches due to the change in the customers’ preference from traditional to digital banking. This led to termination of 362 employees. Around a month ago, the bank also announced plans to shift jobs from U.K. to India in order to reduce its compensation expenses.

Royal Bank is in the midst of a major restructuring with the aim to get back to profit after decade-long losses.

However, the restructuring plan has disappointed the union. Unite’s national officer Rob MacGregor said, “By 2020 just a fraction of the RBS IT function will remain, leaving this organization operating a skeleton service with the customers and remaining staff paying the price.”

Currently, Royal Bank carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are KB Financial Group Inc. (NYSE:KB) , Bank of N.T. Butterfield & Son LTD (NYSE:NTB) and Banco Bilbao Vizcaya Argentaria, S.A. (NYSE:BBVA) .

KB Financial Group Inc. has witnessed an 18.9% upward earnings estimate revision for the current year, in the past 30 days. Moreover, its shares have gained 22.9% over the past six months. It sports a Zacks #1 Rank (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bank of N.T. Butterfield & Son’s earnings estimates were revised upward by 1.4% for the current year, in the past 30 days. Also, its shares have jumped 2.2%, over the past six months. It carries a Zacks Rank #2 (Buy).

Banco Bilbao Vizcaya Argentaria, S.A.’s earnings estimates have been revised upward by 7.4% for the current year, in the past 30 days. Also, the stock has gained 32.6% over the past six months. It sports a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Royal Bank Scotland PLC (The) (RBS): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

Banco Bilbao Viscaya Argentaria S.A. (BBVA (MC:BBVA)): Free Stock Analysis Report

Bank of N.T. Butterfield & Son Limited (The) (NTB): Free Stock Analysis Report

Original post

Zacks Investment Research