With the US dollar continuing to remain under pressure, despite last week’s positive jobs data, and with various central bank governors adding their weight to the mix, it’s a good time to take a quick look at our four major currency futures of the AUD/USD, CAD/USD, EUR/USD and the GBP/USD.

If we start with the AUD/USD, the sharp one day move higher on June 2nd duly petered out, running into the technical resistance area at 0.7800 with the pair then retracing to build a platform of support in the 0.7600 region once again which to date has held. Overnight, RBA Governor Stevens confirmed once again of a possible further cut in interest rates, but his comments were then caveated with warnings that this could lead to ‘much bigger problems for the economy’. Given this mixed message it is no surprise to see the pair creating a long legged doji candle on the daily chart at the time of writing as the market absorbs this latest statement. The currency strength indicator to the left of the chart is continuing to confirm the bearish sentiment for the Aussie dollar, but it has some way to go before it reaches the oversold region in this timeframe.

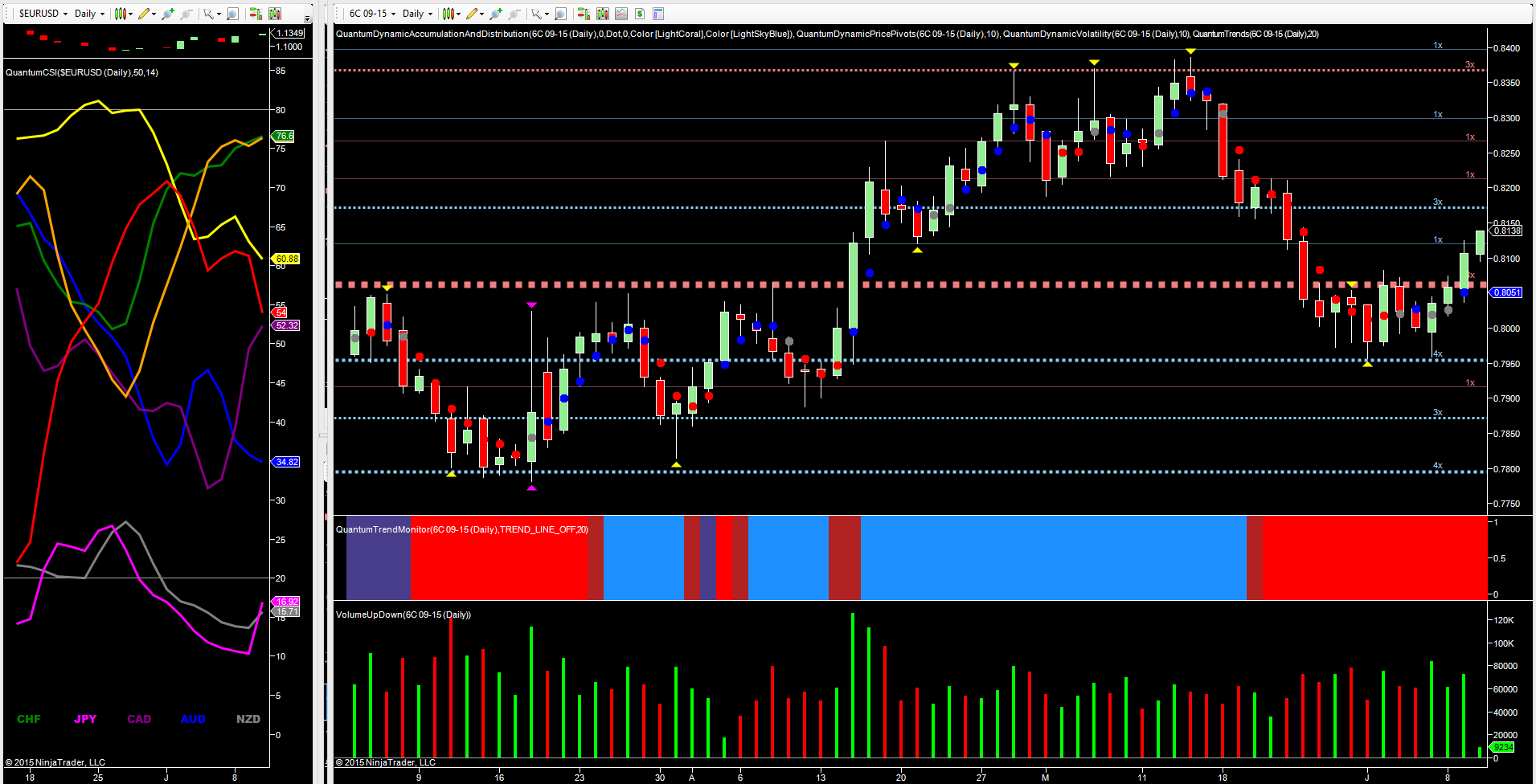

Moving to the CAD/USD, this is one pair which has seen the combined effects of a positive jobs report last week, coupled with a move lower for the US dollar this week. This has driven the pair higher, and off the platform of support in the 0.7950 which held firm through the recent congestion phase. Whilst the NFP data for the US currency was good, the Canadian data was even better with a figure of 58.9k exceeding the forecast of jobs created of 10.2K by some distance. This provided the catalyst, and with the US dollar continuing to move lower in early trading, the pair look set to test the resistance level now in place at the 0.8175 in due course. Friday’s volume on the up candle was well above average, and signalled the buying which is now helping to take the pair higher, with the last two days of price action accompanied with rising volume. The currency strength indicator to the left of the chart is confirming the current picture, with the CAD (the purple line) rising firmly whilst the US dollar (the red line) continues to fall.

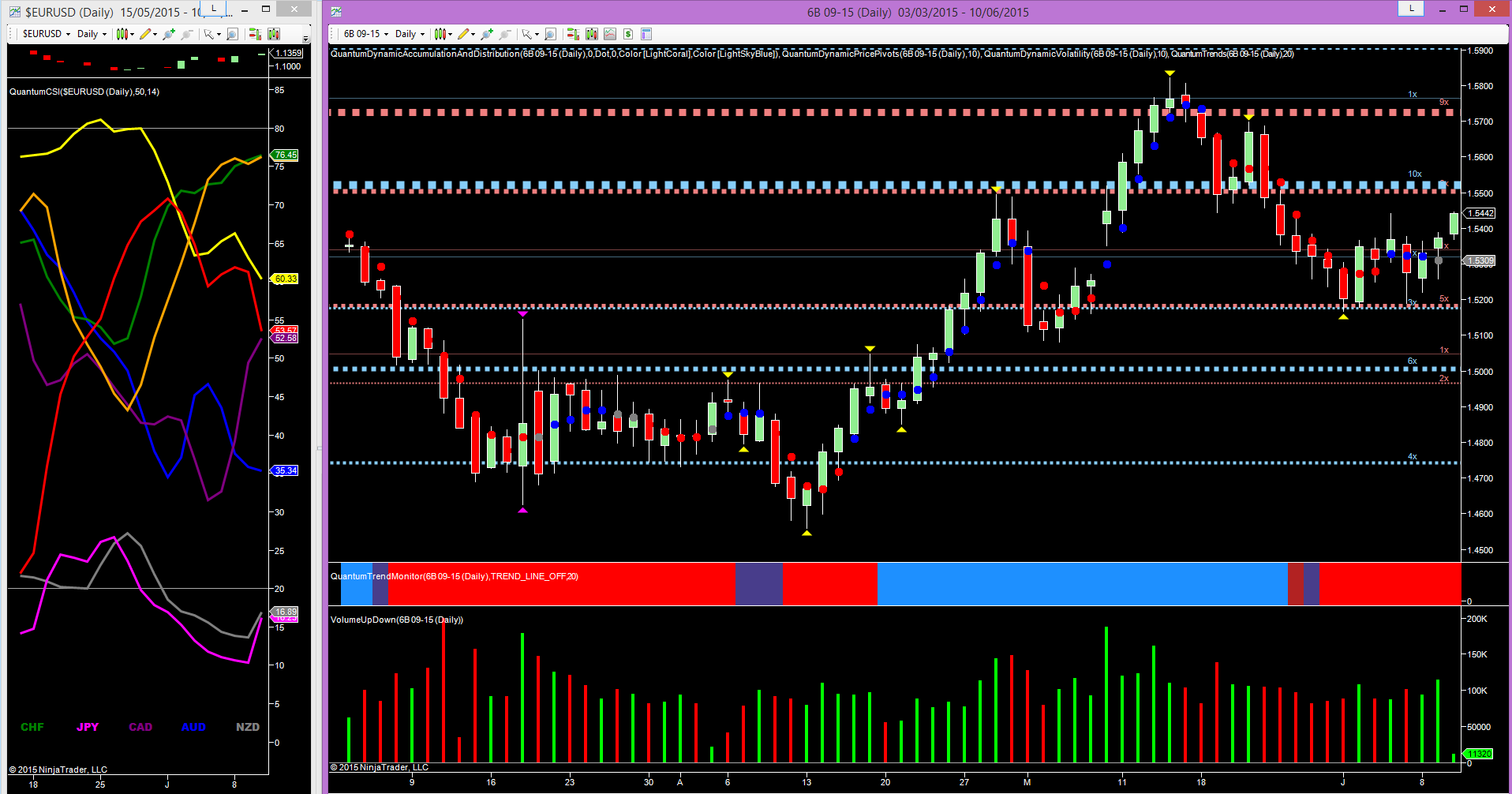

For the GBP/USD, the recent bullish sentiment for the pair is no great surprise, given the weakness in the US dollar, and despite some poor economic numbers for the British economy over the last few days, Friday’s candle was significant. The deep wick to the body of the candle signaled strong buying, which has duly been delivered in trading this week. Yesterday’s candle was also significant, with another deep wick to the lower body, confirming the bullish sentiment on rising volume. With this strong platform of support now in place, we can expect to see the pair continue to move higher in the short term and on to test the 1.5500 region where a deep area of resistance now awaits. Over the longer term the pair remain bearish, and much will depend on sentiment towards the US dollar, which despite a better than expected jobs report on Friday, continues to remain under pressure in the short term.

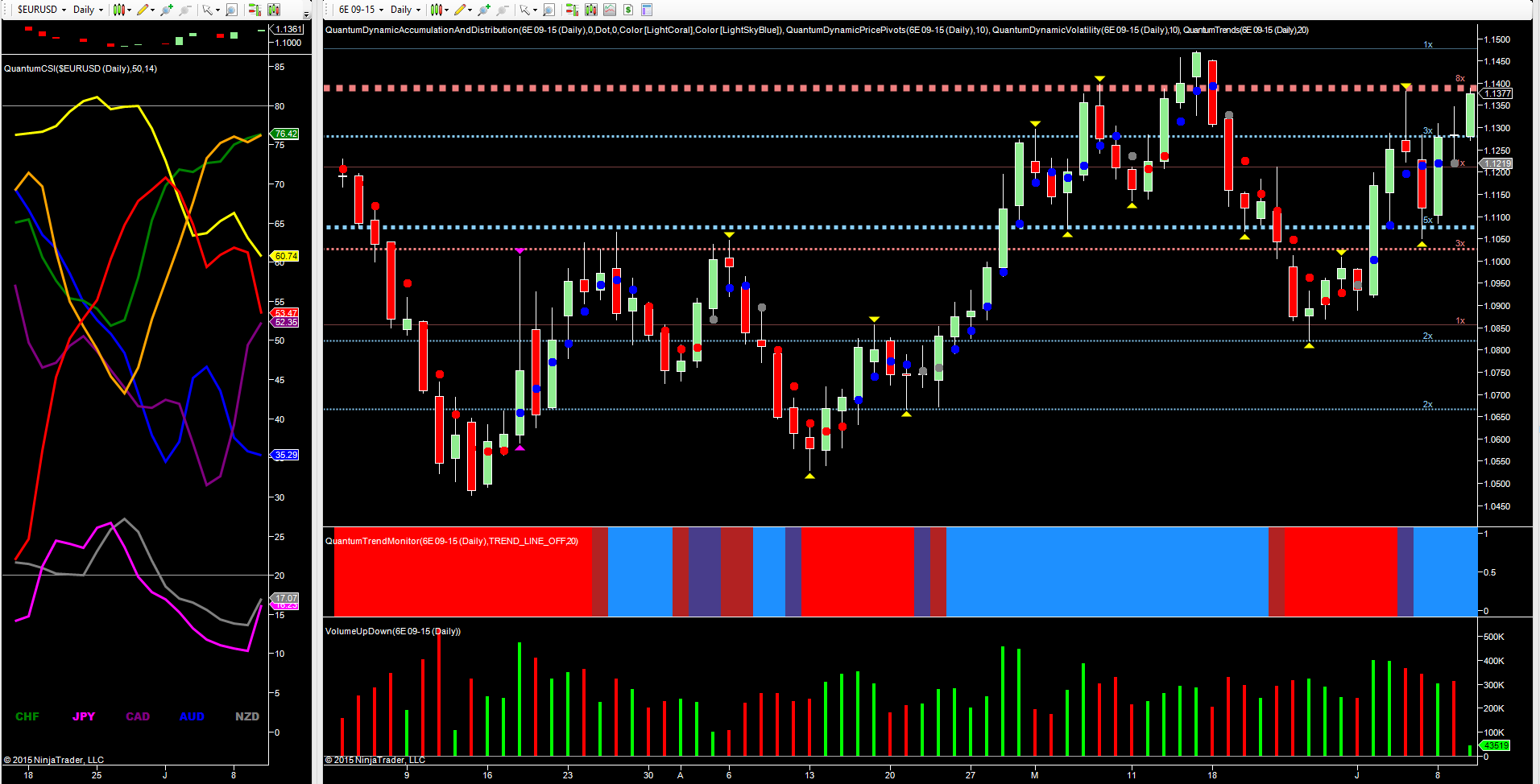

Finally to the EUR/USD, which continues to squeeze the euro shorts ever harder with a strong move developing once again this morning as the pair moves to test the deep resistance overhead in the 1.1400 region, and trading at 1.1387 at time of writing. If this level is breached today, then we can expect to see a further move higher with a possible move to test the 1.1470 region in the short term. This bullish sentiment is further confirmed by the trend monitor indicator, which has transitioned to blue, and with the orange line (the euro) on the currency strength indicator to the left of the chart rising strongly towards the overbought region, there is some way yet to go for the currency pair.