Titan Pharma Inc (OBB:TTNP) is a biomedical pharmaceutical company most known for its flagship drug, Probuphine, used to treat opioid addiction. Probuphine has proved to be effective in two clinical studies and one safety study. Titan is in the process of completing one more clinical study before receiving FDA approval, which is expected to be completed by mid-2015.

On January 20th, Roth Capital’s Scott Henry released a note launching coverage on Titan Pharmaceuticals with a Buy rating and a $1.25 price target. The analyst gave four driving reasons for the rating:

- Probuphine is superior to other treatments. Opioid addiction is a “large and growing” problem in the United States. Scott Henry estimates that the market for opioid addiction generates $1.5 billion annually. Currently opioid deterring medications, such as Suboxone, require daily patient compliance. This decreases the patient’s chance of successfully completing the regime. However, Probuphine is a six-month implant that eliminates the possibility of patients terminating treatment on their own.

- The belief that Probuphine will be approved. A study completed in November 2014 was successful in comparing Probuphine to oral treatment, indicating “high potential for the next trial to work.” There is an ongoing pivotal trial as well, and Scott Henry has “high confidence in a positive clinical trial readout.”

- Large revenue potential for Probuphine. The current market for opioid addiction treatments is approximately $1.5 billion per year, but Scott Henry “[expects] this market to grow in coming months [because] prescription limits are increase[ing] for high volume prescribers.” With this information, Henry targets “Probuphine as a ~$250 million peak revenue generator,” noting that this figure may be conservative. Henry assigns a 4% market share to the drug, but notes that other published targets are as high as 20%. This estimate is a “key risk” in the investment.

- Attractive valuation. Scott Henry believes that all the attractive characteristics of Probuphine are not “fully reflected in the current market cap of ~$50 million.” Probuphine has the potential to drive $250 million in revenue, and an estimated 17% of the royalties will go to Titan.

Looking forward, Scott Henry expects Probuphine to receive FDA approval in 2016. The analyst expects that Titan will achieve sustained profitability in 2018.

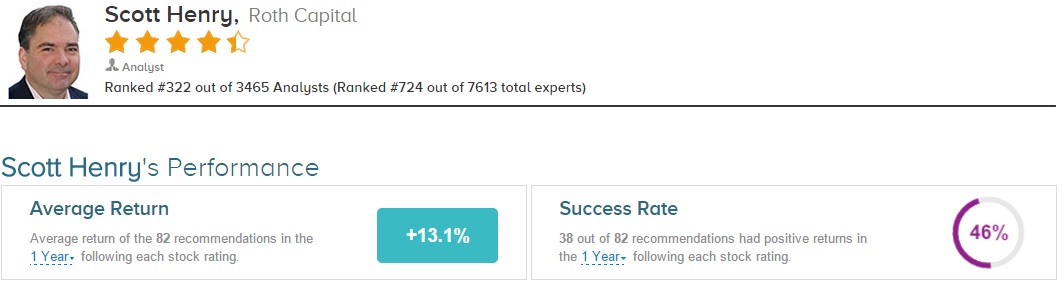

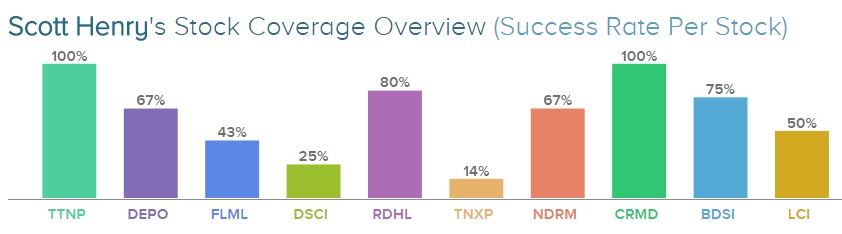

Scott Henry has a hit and miss record rating pharmaceutical companies. Overall, he has a 46% success rate recommending stocks with a +13.1% average return per recommendation. He has rated Redhill (NASDAQ:RDHL) 5 times since July, earning an 80% success rate recommending the stock and a +30.5% average return per RDHL recommendation. Likewise, Henry has rated ANI Pharmaceuticals(NASDAQ:ANIP) 8 times since February 2014, earning an 88% success rate recommending the stock and a 57.4% average return per ANIP recommendation.

However, Henry has not always been on target. He has rated Tonix Pharm (NASDAQ:TNXP) 7 times since October 2013, earning only a 14% success rate recommending the stock and a negative average return of -16.4% per TNXP recommendation.

To see more recommendations by Scott Henry, visit TipRanks today.