I would encourage you to go back and study every bull market in history. Do you know what you'll find? Sectors rotating. And this bull market is no different. In the back half of 2022, almost everything was working. In fact, very few stocks were not working. And then we got sector rotation. The laggards from the back half of 2022 became the new leaders during the first half of 2023. The Nasdaq had its best first six months to a year in history.

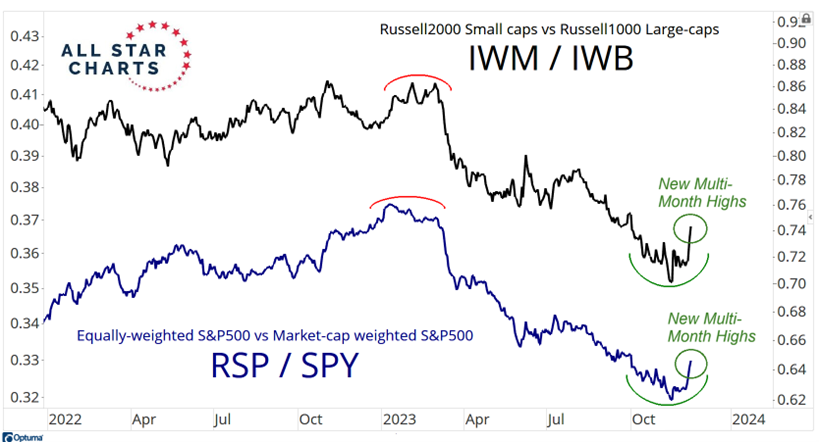

Then this Spring, you got rotation again, back into many of those former leaders from 2022. And that's exactly what's happening here once again. You can see the new multi-month highs in the ratios between Small-caps and Large-caps, as well as in the Equally-weighted vs Market-cap weighted S&P 500.

These downtrends throughout most of 2023 are NOT evidence of weak breadth. They were NOT risk-on / risk-off indicators. It's simply a representation of sector rotation. So as these ratios break out to new multi-month highs, you can see in this chart below how the major indexes are back near former all-time highs.

I bet that while the Nasdaq and S&P500 try to figure themselves out up here near resistance, sector rotation should remain dominant. I would not be surprised to see a similar situation as the back half of last year where most stocks and sectors did well, but the indexes were held back due to their composition. In other words, what drove the outperformance of these indexes for much of 2023, is what held them back in late 2022, and what could slow them down once again.

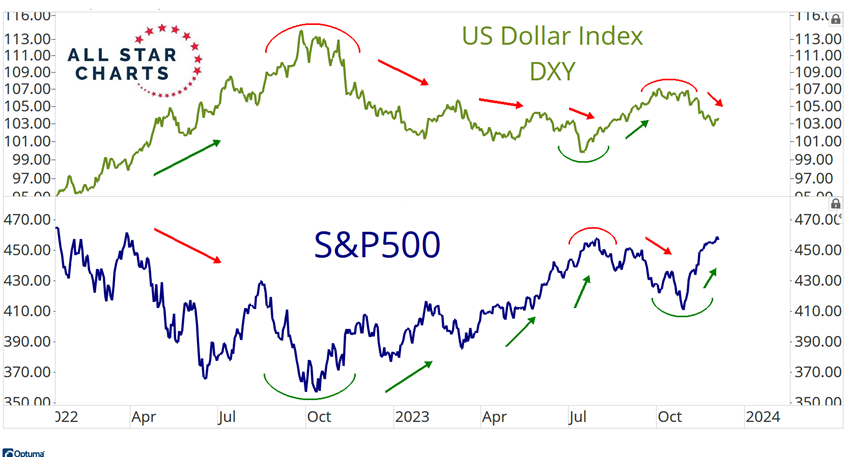

The catalyst is the US Dollar. It always was. Dollar up = S&P500 down. Dollar down = S&P500 up.

Do you think this is a coincidence? The day the Dollar bottomed in July was the day the new highs list peaked on the NYSE. Coincidence? The day the Dollar peaked in early October was the day the new lows list peaked on the NYSE. Coincidence? It's all about the Dollar. It always was.

Contrary to popular belief, the US Treasury Bond Market is NOT the haven that it once was. And there's no evidence AT ALL that it will be again any time soon. Stocks and Bonds are trading together. The safe haven is the US Dollar. It continues to prove that it is the only real safe haven. I suspect that it's going to take investors a long time to adapt because as we know, investors hate doing basic math.

Around here we like to count. And if you're willing to count, you'll quickly see how the bond market is NOT a safe haven. I bet that it's going to take the worst investors the longest amount of time to finally figure this out. There's a lot of money to be made here because of the mispositioning from lazy investors not willing to do the actual work. To be clear, I'm not calling anyone out or picking on any group. I'm just presenting the current opportunity for those who are paying attention.