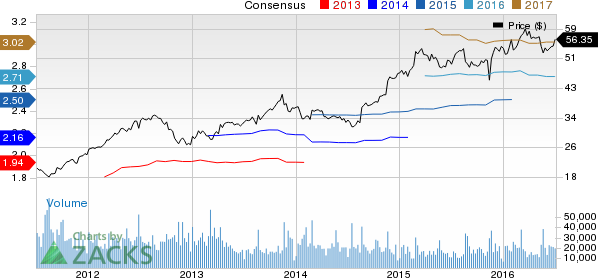

With a solid financial status, ongoing merchandise initiatives and consistent focus on store expansion, Ross Stores Inc. (NASDAQ:ROST) remains confident of performing well this year. It has been gaining from the favorable response of value-focused customers to its extensive collection of brand bargains and efficient cost controls. Shares of the company have surged 13% over the past one year.

Driving Strategies

Ross Stores‘ strategy to keep itself on the growth trajectory involves a continued focus on merchandising organization through investments in workforce, processes and technology. The company continually fine-tunes and upgrades its systems to enhance productivity. Moreover, it constantly organizes its merchant group in order to facilitate steady expansion of market coverage in the vendor community while enhancing relationships with a broad network of existing and new resources. These initiatives help strengthen the company’s buying operations, enabling customers to purchase on-trend merchandise at attractive prices.

Moreover, the company continues to invest in its off-price business model as the competitive bargains it offers help make its stores attractive destinations for customers in all economic scenarios. Additionally, the off-price model with strong value proposition and micro-merchandising drives better product allocation, and helps sustain its top and bottom lines.

Further, the company’s merchandising strategy becomes evident as it remains focused on optimal reduction of inventory at its stores, while making the right assortments available at the right store on time. Lower inventory should aid Ross Stores’ strong merchandise margins and ability to continue capitalizing on in-season inventory buying opportunities in the marketplace to ensure current assortments and better brand content. This, in turn, will boost its sales and gross margins.

The company’s achievement of its store expansion target in the first quarter of fiscal 2016 also makes us confident of its growth potential and ability to successfully attain the goal of taking its store base to 2,500 over the longer term. This indicates that there exists immense store growth potential for the company.

The Overhangs

Despite the aforementioned positives, the volatile macroeconomic environment and competitive retail landscape, along with challenges related to strong comparisons remain concerns for Ross Stores.

Currently, the stock carries a Zacks Rank #3 (Hold).

Stocks that Warrant a Look

Some better-ranked stocks in the same industry include Fred's, Inc. (NASDAQ:FRED) , sporting a Zacks Rank #1 (Strong Buy), Burlington Stores, Inc. (NYSE:BURL) and Wal-Mart Stores Inc. (NYSE:WMT) , both carrying a Zacks Rank #2 (Buy).

WAL-MART STORES (WMT): Free Stock Analysis Report

ROSS STORES (ROST): Free Stock Analysis Report

FREDS INC (FRED): Free Stock Analysis Report

BURLINGTON STRS (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research