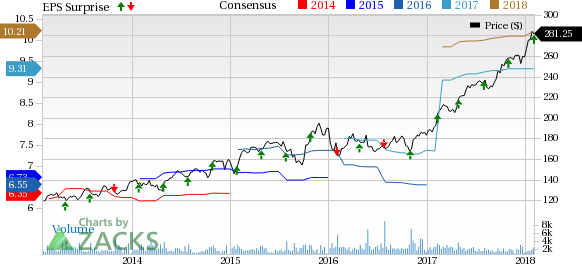

Roper Technologies, Inc. (NYSE:ROP) reported fourth-quarter 2017 adjusted earnings of $2.70 per share, which beat the Zacks Consensus Estimate of $2.61 and increased 23% on a year-over-year basis.

Adjusted revenues of $1.23 billion improved 21% year over year. Organic revenues were up 5%, while acquisitions contributed 15% of the top-line growth.

Net Orders grew 20.3% from the year-ago quarter to $1.30 billion.

Roper Technologies stated that its asset light business model and acquisitions continued to boost performance, especially ConstructConnect and Deltek.

Quarter Details

Medical & Scientific Imaging revenues increased 4.5% year over year to $367.1 million. RF Technology revenues surged 45.5% from the year-ago quarter to $491.4 million.

Industrial Technology revenues increased 16% year over year to almost $207 million. Also, revenues from Energy Systems & Controls grew 12.5% year over year to $160.4 million.

Adjusted gross margin increased 30 basis points (bps) to 62.6%.

Segment wise, Medical & Scientific Imaging, Industrial Technology and Energy Systems & Controls gross margins contracted 170 bps, 110 bps and 200 bps, respectively. However, RF Technology gross margin expanded 510 bps in the quarter.

Adjusted EBITDA was $441 million, up 21% year over year. Adjusted EBITDA margin expanded 20 bps to 35.7%.

Guidance

For first-quarter 2018, Roper Technologies expects adjusted earnings between $2.44 and $2.50 per share. For 2018, the company expects adjusted earnings between $10.88 and $11.20.

Conclusion

Roper Technologies holds a dominant position in most of the markets where it operates. The company has an optimum mix of highly-engineered and niche-oriented products, which help it gain market share. We are optimistic about the company’s strategic expansion strategy, primarily through accretive acquisitions.

Zacks Rank & Other Stocks to Consider

Roper Technologies carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader technology sector are Micron Technology (NASDAQ:MU) , Lam Research (NASDAQ:LRCX) and The Trade Desk (NASDAQ:TTD) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Micron, Lam Research and The Trade Desk is projected at 10%, 14.9% and 25%, respectively.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research