Roper Technologies, Inc. (NYSE:) is slated to report third-quarter 2017 results on Oct 30 before the opening bell.

Notably, the company has beaten the Zack Consensus Estimate in each of the trailing four quarters, delivering an average positive surprise of 2.61%.

Last quarter, the company reported earnings of $2.24 per share that beat the Zacks Consensus Estimate of $2.22 per share.However, despite a 21.8% jump year over year, revenues of $1.135 billion missed the consensus mark of $1.156 billion.

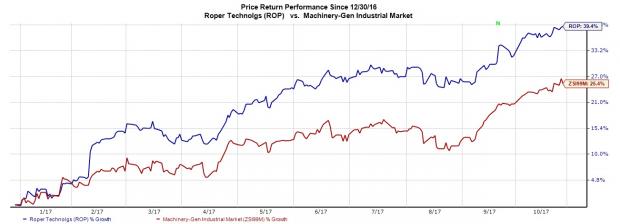

Notably, the stock has gained 39.4% year to date, outperforming the industry’s 25.3% rally.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

We remain positive about Roper Technologies’ strategic expansion strategy primarily through accretive acquisitions. Successful integration of the acquisitions has contributed meaningfully to the top line and margins. Its acquisition ofConstructConnect and Deltekwill continue to boost its performance especially in the software and network businesses.

Roper Technologies, Inc. Price and EPS Surprise

Roper Technologies, Inc. Price and EPS Surprise | Roper Technologies, Inc. Quote

We also continue to believe that Roper Technologies’ distinctive asset-light business model will boost forthcoming financial results. Further, Roper Technologies holds a dominant position in the niche markets where it operates. The company has an optimum mix of highly engineered, oriented products, which give it bargaining power and boost its market share.

However, sluggish global macroeconomic conditions and stiffening competition remain overhangs.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or #3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided.

Roper has a Zacks Rank #2 (Buy) and an Earnings ESP of +0.13% and that indicates a likely positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks that, as per our model, have the right combination of elements to post an earnings beat this quarter:

Applied Materials (NASDAQ:) with an Earnings ESP of +0.37% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kemet Corporation (NYSE:) with an Earnings ESP of +7.46% and a Zacks Rank #1.

NVIDIA Corporation (NASDAQ:) with an Earnings ESP of +0.53% and a Zacks Rank #1.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>