Steve Romick On Sears Canada Play Amid Retail Woes

Since its inception in June 1993, Steve Romick’s FPA Crescent Fund has returned 10.4% annualized Vs 7.0% for the MSCI World (NYSE:URTH), which makes the fund one of the best-performing value funds out there.

However, while FPA’s record of investing is highly impressive, recently, Romick and team have been more concerned about the current “weapon of mass destruction” that is threatening markets.

The weapon in question is ETFs, the growth of which is being driven by investors’ insatiable appetite for passive rather than active funds. The rising demand for passive investments is not itself the most pressing problem. The real problem the duo points out is that “as the number of corporate listings continues to dwindle, more and more ETFs are brought to the marketplace. This leads to more ETFs (financial vehicles), some of which use leverage, chasing fewer and fewer actual companies.” This means the rush toward passive could be generating another bubble as financial vehicles use “leverage to purchase a shrinking pool of real assets.”

Luckily, for fans of value investing, Romick stopped ETF bashing at last month’s London Value Investor Conference to talk about one interesting trade FPA has recently put on.

Betting On Retail's Demise With Sears Canada Loan

As we’ve noted several times, the US retail industry is in a death spiral as years of over-expansion come back to haunt the sector as it struggles to fight off competition from the likes of Amazon.com (NASDAQ:AMZN).

The one bright spot for the retail industry is real estate. Most large retailers own a significant portfolio of commercial property, which helps provide flexibility throughout market cycles and improves profitability as there is no requirement to pay rent to a third party. As retailers enter survival mode, many companies have been restructuring their real estate portfolios in an attempt to unlock value (and cash). The prime example of this trend is Seritage Growth Properties (NYSE:SRG), which was spun off from Sears (NASDAQ:SHLD) and has attracted the likes of Warren Buffett due to its growth potential and unique real estate portfolio.

Steve Romick also likes Sears’ property, in fact, he likes it so much that his fund has provided a loan to Sears Canada to help the cash-strapped business keep the lights on. Even though Sears is teetering on the brink of bankruptcy, Romick is confident that he has invested his money at a deep enough discount to intrinsic value with a wide enough margin of safety. The loan has been secured by inventory, receivables and real estate with Romick and his team estimating that company liquidation value is around 1.7 times the amount of the loan. No matter what happens to the struggling retailer, Steve Romick is expecting an internal rate of return of 11% from his lending.

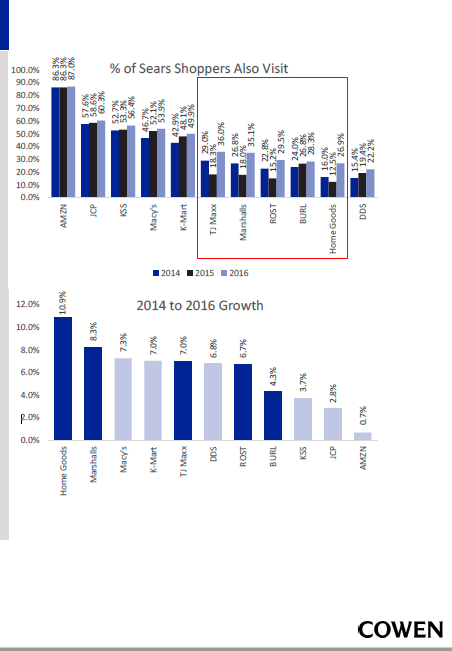

On the other hand, in a new note to clients, Oliver Chen of Cowen thinks JC Penney (NYSE:JCP) could be a winner from Sears' demise.

Chen notes:

We anticipate to see JCP pick up share as the retailer has aggressively been expanding its home department by adding appliance show rooms and is conducting service tests. JCP has previously noted its best performing stores are located in malls shared with Sears.