As blockchain week in New York winds down, we're seeing several articles like this one...

What the writers of these articles fail to realize is the underlying principle behind the so-called "consensus effect" and what it's all about.

This is not "pump" and it was never about speculation or crypto trader exuberance. The theory championed by Tom Lee and others is about the construction of infrastructure.

During the event, we witnessed a flurry of exciting product launches, new partnerships, groundbreaking initiations, and investment commitments. These are the type of things that tend to have a large impact on market prices, but not instantly.

In the last three years, we have seen that Bitcoin stayed flat for weeks after the Consensus conference and then took off about a month later. This graphic does a rather good job of displaying the delayed fuse...

Our CEO and co-founder of eToro Yoni Assia took the center stage several times during the conference and this morning wrote us a powerful letter. Here is small excerpt...

Rome wasn't built in a day.

Today's Highlights

Rome Rebuilt

Chinese Stocks Boost

The Bitcoin Chart

Please note: All data, figures & graphs are valid as of May 18th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

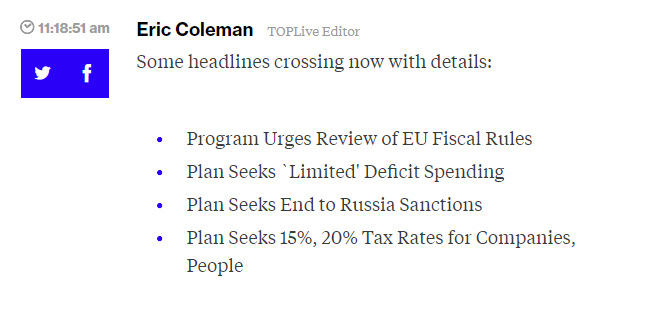

In the last hour, Italy's Five Star Movement has announced that they've finalized a contract with the League, and will vote on it shortly. It looks like the nation will finally have a working government, possibly as soon as this weekend.

The good news is that it seems they will not be asking the EU to write off their €250 billion debt. The idea was gaining traction within the country, but as we saw with Greece not too long ago, it would be very difficult to get any European leaders to simply erase a mountain of debt.

Some of the highlights of the deal do include..

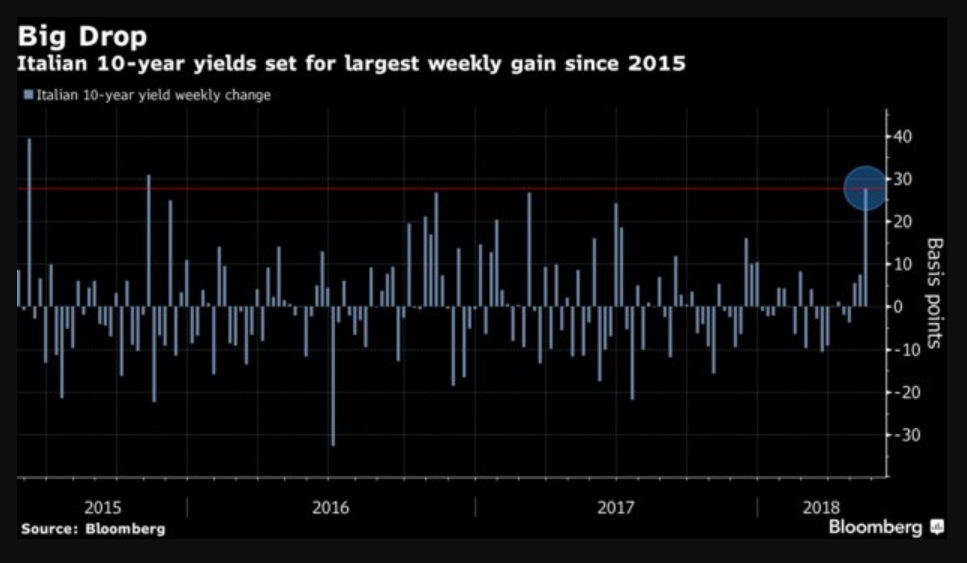

A quick glimpse at Italian bond yields shows that investors aren't exactly thrilled with the new plan.

Putting it in perspective, we can see that the new updates are far more impactful than the recent election...

eToro's top Italian analyst writes...

The main issue is: how do they think they will get the necessary financial coverage for those reforms? (Citizenship Income, Pension

Fornero’s Law, Flat Tax)Do they really think that Brussels will allow them to create new spending initiatives (immigration for example) without batting an eyelid?

It does not seem like the new coalition will have the necessary strength to get the weight in a Europe to affect any real change.-Gabriel Debach eToro, Italian Market Analyst

No Worries

If the international markets are concerned about any of this, it sure isn't showing up in asset prices today. Stocks are mostly flat around the world, with the exception of the China 50, which is flying...

This could be due to a softer outlook for the US-China trade negotiations, or possibly just because the index is currently 15% from the top.

Either way, it's the only real mover today other than crypto.

Crypto Drop

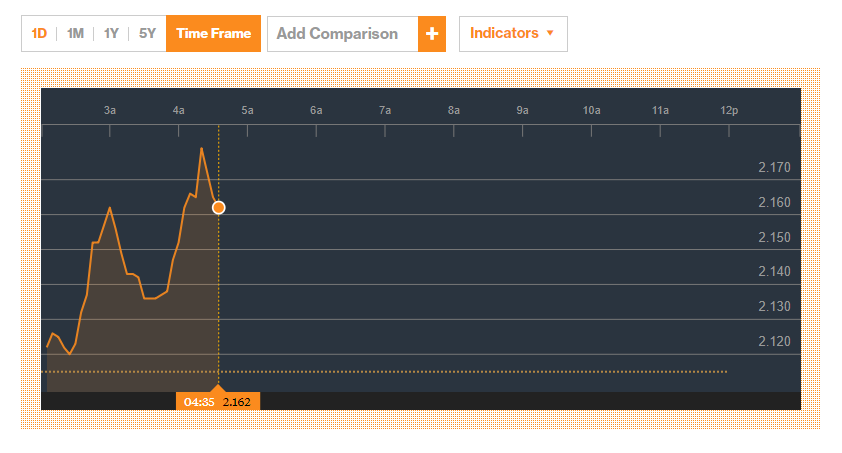

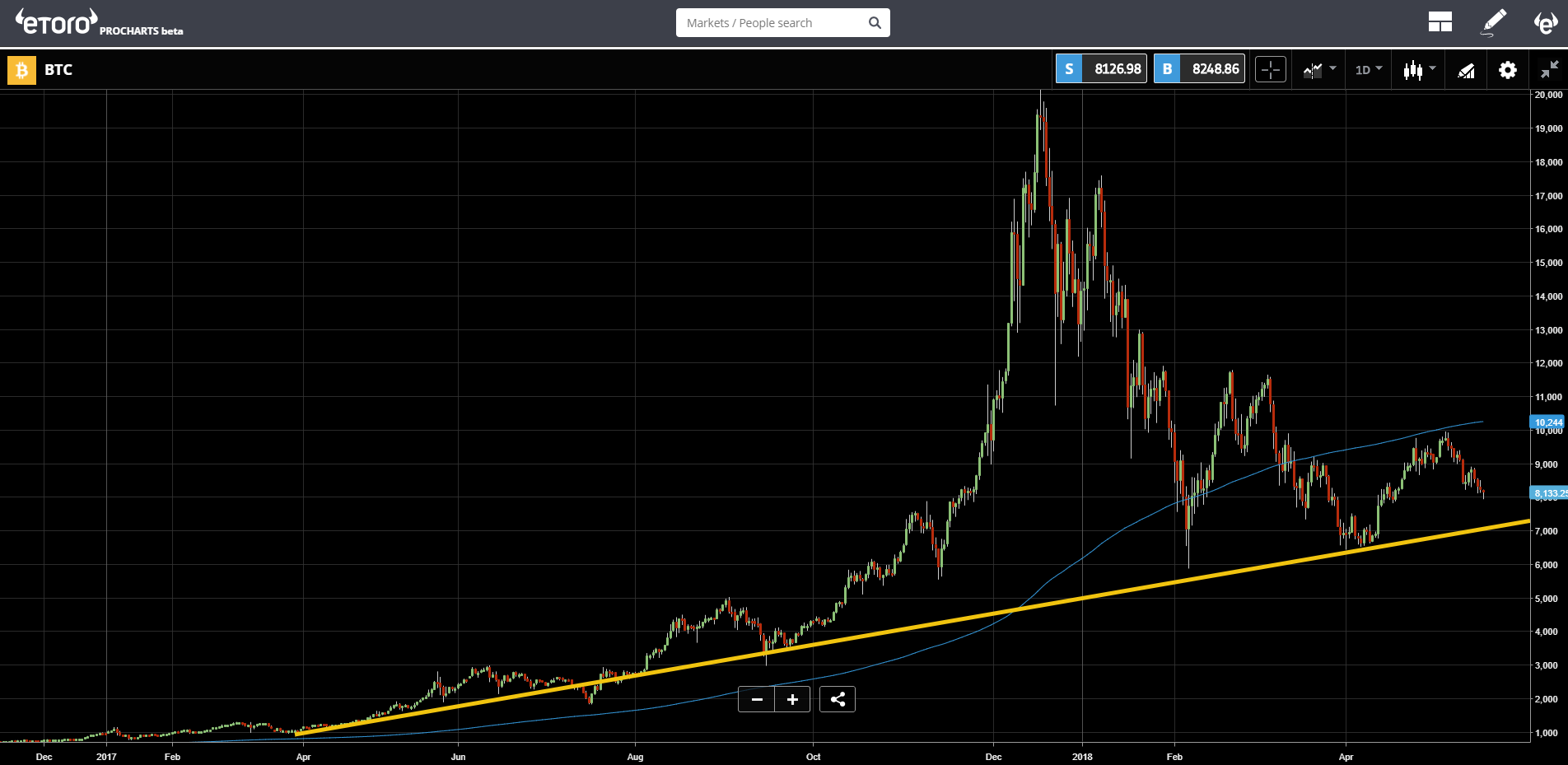

Digital assets went through a mild sell-off last night. Bitcoin fell through support at $8,250 and is now barely holding $8k.

The good news is that the alleged Upbit scandal that smacked EOS and the rest of the crypto markets seems to be resolved now.

Bad news always travels faster than good news. Though there was a sell-off when this news hit, the resolution doesn't seem to be having an opposite effect.

Nothing affects sentiment like price, and as the price drops it is important to put things into perspective. This graph shows the long-term trend line that's been a foundation of support for the market in the last few months.

Judging by this, it is a distinct possibility that we'll be testing this line again circa $7,100. The blue line (200DMA) and the round level of $10k will certainly be a hard walnut to crack, but if we do somehow get on top of it... Let's have an amazing weekend!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.