Rolls-Royce’s IMS highlighted trading is in line and continues to deliver growth and margin enhancement to drive future cash flows. With contracts won across the group and forecast cash flow (excluding M&A) set to be around break-even, we feel that H1 concerns about whether working capital outflows would reverse should prove unfounded. With Trent XWB (A350) and Trent 1000 (B787) both proving their worth in the market and in development, the future for large civil engines is assured, underpinning our long-term growth thesis. Decisions still remain, including the long-term approach to mid-size aircraft and how to create value from the sub-scale Energy division. However, we feel these provide further value opportunities over our medium-case fair value of 1,438p/share.

IMS shows H1 strength continued

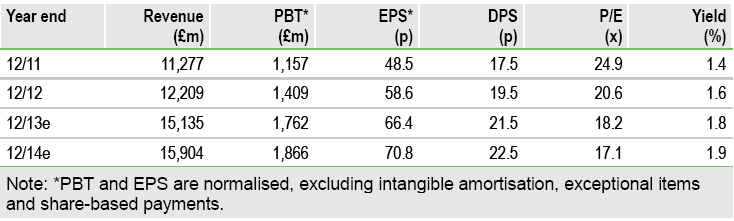

The IMS highlighted that the strong H1 has continued throughout the third quarter. As a result, we are nudging up our full year EPS forecasts by 2% for both 2013 and 2014. The IMS confirmed that modest revenue growth will drive good underlying profit growth, supported by contracts won across the group, a reversal of the H1 working capital build and an in line performance from Tognum. Rolls also continued its portfolio refining with the sale of its share in the RTM322 helicopter engine programme to Turbomeca for €293m.

Cash outflow reversal shows actions working

Important in our view is the confirmation that the group will achieve a broadly break-even cash flow position for the year, excluding the impact of M&A activity. Given the significant outflow at H1 of £400m, something replicated across the industry in H1, the reversal demonstrates actions undertaken by the group to focus on the four Cs (customer, concentration, cash and cost) are working. While half-on-half variations may well occur due to timing, we continue to believe that Rolls has the potential to improve long-term cash generation.

Valuation: Driving value from operations

We maintain the thesis described in our May 2013 Outlook note. The IMS supports our view that the previous investment in R&D has supported the build-up of the order book to £69bn with the opportunity to deliver improved growth, margin expansion and cash generation. While the JV with Pratt & Whitney in mid-size aircraft engines has not proceeded and questions still remain surrounding Energy, we feel these provide further value opportunities above our medium-case fair value of 1,438p/share, updated to reflect our revised forecasts.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rolls-Royce Holdings

IMS highlights opportunities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.