High Yield Bonds became a big topic of discussion in the market last summer. With the big fall in oil prices the topic making the rounds was that all the High Yield debt used to finance the shale companies would be heading towards bankruptcy. I suppose that makes sense theoretically, but so far it has not happened.

The lack of bankruptcies has not helped the High Yield market recover though. Certainly it has not been helped by the fact that noted fixed income gurus like Gundlach and Gross and macro masters like Dalio have been very vocal about the economy shifting to (or already in) recession. By the way this has not happened yet either.

This can get all too complex so while I try to follow these stories and make sense of all the data, not just that selected by Gurus, I find it very difficult to actually act upon it. It is much easier to just follow price. And what is the price action saying about High Yield? It may be ready to improve dramatically.

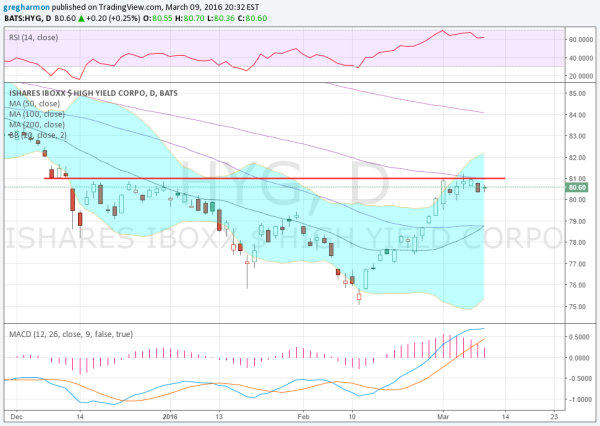

The chart of the iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) above holds the key. There are many bullish points in the chart. Start with the rise in price back to resistance. It has bullish momentum as well, with the RSI in the bullish zone and the MACD positive and rising. The Bollinger Bands® also opened to start this move higher.

But some of these also pose a potential problem for a High Yield recovery. The MACD is starting to level, a slowing of momentum. Of course there is that resistance as well and note that the 100 day SMA is also right there. It can overcome these obstacles with a move over 81, putting the 100 day SMA and the December consolidation highs in its rear view mirror. Keep an eye here as this has only played a backseat to oil prices themselves in 2016 in determining market direction.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.