Roku Inc (NASDAQ:ROKU) has a lot going for it - with the exception of an onslaught of wannabe competitors.

It beat third-quarter estimates at its earnings call, reported an increase in hours of content streamed, an increase in active accounts, more average revenue per user, and its got some great alternative data that we'll get to soon. Roku even purchased Dataxu in October for a cool $150 million (they do ad tech stuff).

But all anyone can talk about is the Q3 loss, which is a real shame.

Roku announced the results, analysts tracked by Zacks Investment Research were looking at an EPS of -$0.28 and they only lost $0.22 per share. Amazon (NASDAQ:AMZN) technically doesn't make a profit and no one bats an eye at them, so the narrative for Roku shouldn't be stock market yoga babble, it should be on its alternative data.

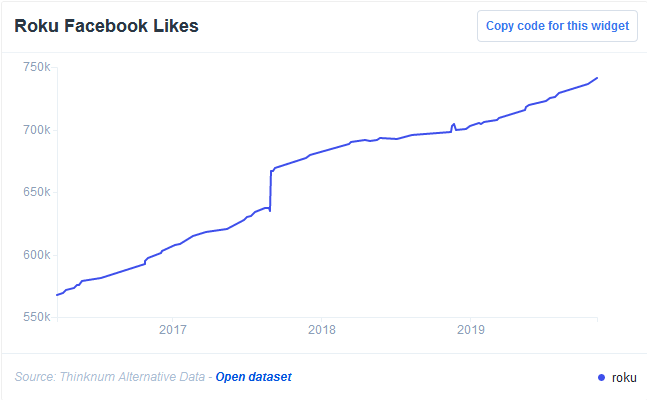

So all the doom and gloom really should be shrugged off, after looking at the above chart. The stock is up overall, the number of employees listed on LinkedIn (NYSE:LNKD) is up, as well. Those two things are correlated, and it seems as though what steers the ship, and what really matters to us, is that customers are happy and are watching more TV and spending more money.

In 2020 Roku will hit a million likes on Facebook (NASDAQ:FB), for sure, it's only a matter of time.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.