Eighteen months ago, Jim Rogers explained that “everybody is having a wonderful time running the printing presses.” His answer? Protect yourself by owning real assets. In fact, the popular investing guru has publicly denounced equities for years while simultaneously expressing a preference for precious metals and agricultural commodities.

Whenever you listen to Mr. Rogers, you may find yourself agreeing with his assessment of world disorder. On the other hand, PowerShares DB Precious Metals (DBP), PowerShares DB Agriculture (DBA) as well as the Rogers International Commodity Index Total Return (RJI) have failed to provide the kind of results that broad-based U.S. stocks have.

Has Rogers conceded defeat… now that U.S. markets have registered all-time highs? Hardly. In the CNBC interview he gave on Thursday 3/28/2013, he voiced identical concerns to the ones that he made in 2011 and 2012. He said, “I’m certainly not investing in the United States… the whole world is benefiting from all this money being printed, but there are better places than where the all-time high is.”

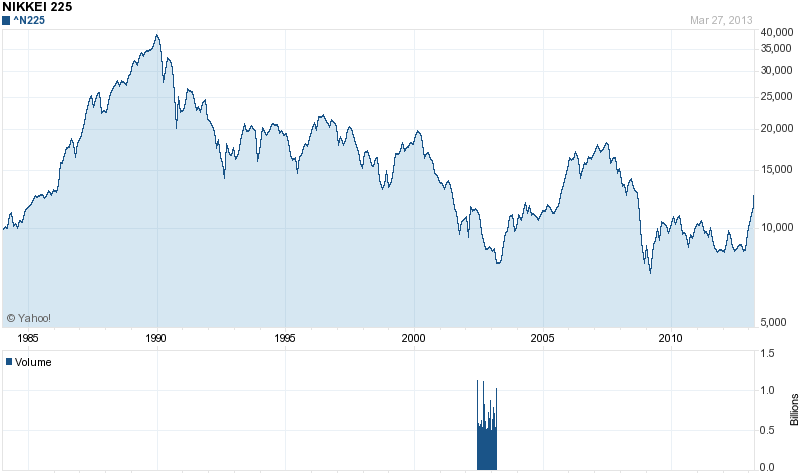

Perhaps ironically, this may be a tacit acknowledgement that money printing has been (can be) beneficial to one’s portfolio. According to Rogers, however, the better places for your stock money include Russia and Japan. Rogers may be reasoning that Japanese stocks are thousands of points below a record peak as well as accounting for currency weakness helping the country’s exports. By the same token, the “anti-Buffett” seems to be dismissing the country’s incredibly weak fiscal and monetary policies.

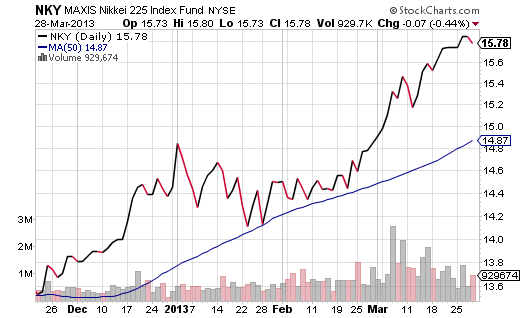

ETF enthusiasts have a fairly wide range of choices to emulate Japanese equities. Last year, I gave a strong nod to Wisdom Japan Hedged Equity (DXJ). The exchange-traded tracker shot higher like cannonball on yen weakness. Today, on a pullback to the 50-day moving average, I might be more inclined to give the MAXIS Nikkei 225 Fund (NKY) a turn at the wheel; rapid yen depreciation is likely to fade in the springtime, making the hedged vehicle (DXJ) a little less palatable.

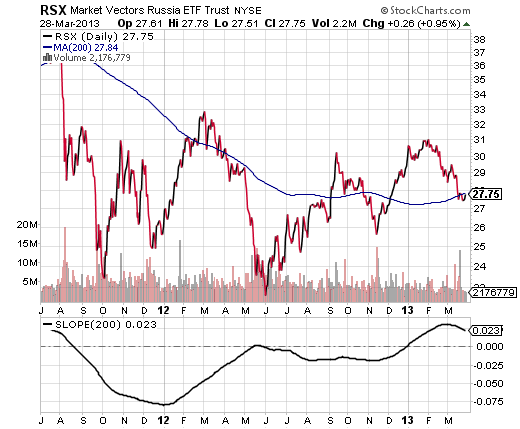

What about opportunities in Russia? Unlike Rogers, I have a bit less faith in the stock market of one of the world’s largest non-OPEC energy producers. In truth, Market Vectors Russia (RSX) has had a very difficult time maintaining a long-term-uptrend (200-day). In fact, whether it is RSX or iShares Russia (ERUS), I’d want to see a definitive bounce higher off the long-term trendline before considering an allocation. (Note: It is worth recognizing, though, that the 200-day slope for RSX recently turned positive.)

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rogers Favors Japan And Russia Over U.S. Stock ETFs

Published 03/28/2013, 06:33 PM

Rogers Favors Japan And Russia Over U.S. Stock ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.