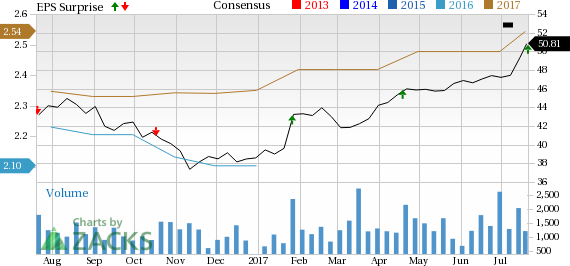

Rogers Communications Inc. (NYSE:RCI) , the largest integrated telecom operator in Canada, reported mixed financial results for the second quarter of 2017, wherein the bottom line surpassed the Zacks Consensus Estimate and the top line missed the same.

Rogers Communications continues to remain the first wireless operator in Canada to offer Internet of Things (IoT) as a service to business enterprises. End-to-End Incident Management, Farm & Food Monitoring and Level Monitoring are the three IoT services that the wireless carrier currently offers.The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Net Income

Quarterly net income was approximately $394.53 million compared with $292.74 million in the year-ago quarter. Adjusted earnings per share of 74 cents were above the Zacks Consensus Estimate of 71 cents. The bottom line grew 19.35% year over year.

Revenue

Quarterly total revenue came in at around $2,670 million, down 0.39% year over year and below the Zacks Consensus Estimate of $2,762.8 million.

Operating Metrics

Adjusted operating profit was $1,047.63 million compared with $1,000.82 million in the year-ago quarter. Quarterly adjusted operating profit margin was 39.3% versus 39.0% from the year-ago quarter.

Cash Flow

During the reported quarter, Rogers Communications generated $611.49 million of cash from operations compared with $832.90 million at the end of Jun 2016. Free cash flow was $465.12 million compared with $367.79 million in the year-ago quarter.

Liquidity

In quarter under review, change in the cash and cash equivalents on Rogers Communications’ balance amounted $18.58 million. Total outstanding long-term debt was approximately $11,454.83 million compared with $11,807.76 million at the end of Dec 2016.

Wireless Segment

Quarterly total revenue came in at around $1,521.66 million, up 6% year over year. Service revenues totaled $1,430.28 million, up 8% from the year-ago quarter. Equipment sales were $91.39 million, down 14% year over year.

Quarterly adjusted operating profit for the segment was $686.53 million, up 9% year over year. Adjusted operating profit margin was 48.0% compared with 47.3% in the year-earlier quarter.

Quarterly blended ARPU (average revenue per user) was $62.13, compared with $60.18 in the year-ago quarter. As of Jun 30, the prepaid subscriber base totaled 1.689 million, with a gain of 77,000 subscribers from the year-ago quarter. Monthly churn rate was 3.96% compared with 3.57% in the prior-year quarter.

As of Jun 30, Rogers Communications’ postpaid wireless subscriber base totaled 8.710 million. In the second quarter, the company added 93,000 postpaid wireless subscribers. Quarterly postpaid ARPA (average revenue per account) was around $124.31 compared with $116.06 in the year-ago quarter. The monthly churn rate was 1.05% versus 1.14% in the prior-year quarter.

Cable Segment

Quarterly total revenue came in at $646.41 million, flat year over year. Service revenues totaled $645.67 million, flat year over year. Internet revenues were $298.69 million, up 7% year over year. Television (Video) revenues were $280.11 million, down 4% year over year. Telephony revenues totaled $66.87 million, down 9% year over year. Equipment sales were $1.51 million, flat year over year.

Quarterly adjusted operating profit for the segment was $318 million, up 3% year over year. Adjusted operating margin was 49.2% compared with 47.7% in the year-ago quarter.

As of Jun 30, the high-speed Internet subscriber count was 2.186 million. Rogers Communications added 11,000 high-speed Internet customers in the quarter. Video subscriber base totaled 1.771 million, after a loss of 25,000 users. Telephony subscriber count was 1.098 million. The company lost 2,000 telephony subscribers in the reported quarter.

Media Segment

Quarterly total revenue came in at $473.29 million, up 4% year over year. Quarterly operating expenses rose 9% year over year to $426.48 million. Adjusted operating profit margin came in at 9.9% versus 14.6% with the year-ago quarter.

Business Solutions Segment

Quarterly total revenue came in at $71.33 million, down 1% year over year. Of the total, next-generation revenues were $58.69 million, up 1%. Legacy revenues were $11.14 million, down 12%. Service revenues were $69.84 million, down 1%. Equipment revenues were $1.49 million, flat year over year. Quarterly adjusted operating profit was $23.78 million, up 3% year over year. Adjusted operating margin was 33.3% compared with 32.0% in the year-ago quarter.

Rogers Communications continues to face tough competition from market incumbents like TELUS Corp. (NYSE:TU) and BCE Inc. (TO:BCE) and other small regional cable TV operators in the wireless market of Canada. Moreover, Shaw Communications Inc.’s (NYSE:SJR) entry into the market with the WIND Mobile acquisition has intensified competition.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

TELUS Corporation (TU): Free Stock Analysis Report

BCE, Inc. (BCE): Free Stock Analysis Report

Shaw Communications Inc. (SJR): Free Stock Analysis Report

Rogers Communication, Inc. (RCI): Free Stock Analysis Report

Original post

Zacks Investment Research