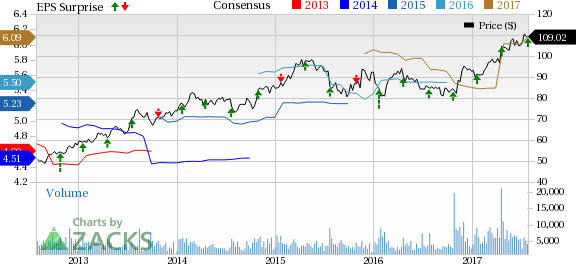

Rockwell Collins Inc. (NYSE:COL) reported financial results for third-quarter fiscal 2017 (ended Jun 30, 2017). The company’s adjusted earnings per share of $1.64 surpassed the Zacks Consensus Estimate of $1.58 by 3.8%. Reported earnings also grew 0.6% from $1.63 per share a year ago.

Revenues

In the reported quarter, Rockwell Collins’ total sales was $2,094 million, beating the Zacks Consensus Estimate of $2,026 million by 3.4%. Revenues also grew 57% year over year driven by higher sales at Interior Systems, Commercial Systems, Government Systems and Information Management Services.

Operational Highlights

Total segment operating income during the quarter was $386 million, up 36.9% from $282 million in the year-ago quarter.

Rockwell Collins’ total research and development investment (including the increase in pre-production engineering costs) was $303 million, up 24.2%. The figure represented 14.5% of total quarterly sales compared with 18.3% in the year-ago period.

Interest expense during the quarter was $77 million compared with $16 million in the year-ago quarter.

Segment Performance

Commercial Systems: In the quarter under review, segmental sales of $658 million were up 7.5% year over year primarily owing to higher original equipment and aftermarket sales.

Operating earnings for the quarter were $144 million compared with $141 in the year-ago quarter. However, operating margin contracted 110 bps to 21.9%.

Government Systems: The segment reported sales of $558 million, up 0.5% on the back of higher communication and navigation revenues.

Operating earnings for the quarter were $123 million, up 7% from $115 million in the year-ago period. Operating margin also expanded 130 bps to 22%, primarily driven by higher sales volume and favorable sales mix.

Information Management Services: Segment sales were $183 million, up from $167 million in the year-ago period backed by growth in aviation related revenues.

Operating earnings for the quarter were $39 million, up from $26 million in the year-ago period. Operating margin was also 21.3% compared with 15.6% a year ago. The increase was primarily owing to higher sales volume.

Financial Condition

As of Jun 30, Rockwell Collins’ cash and cash equivalents were $578 million compared with $340 million as of Sep 30, 2016.

Long-term debt (net) was $7,268 million as of Jun 30 up from $1,374 million as of Sep 30, 2016.

Cash used for operating activities in the first nine months of fiscal 2017 was $416 million, compared with $223 million a year ago.

Fiscal 2017 Guidance

Adjusted earnings per share are still expected in the range of $5.95–$6.15.

The company expects its fiscal 2017 revenue to be about $6.8 billion compared with its prior guidance in the range of $6.7–$6.8 billion.

Total segment operating margin is reaffirmed to be in the band of 19%–20%.

The company still expects free cash flow in the range of $650−$750 million. Its R&D expenditure guidance is projected to be about $1.1 billion compared with the prior $1.05−$1.15 billion band.

The full-year tax rate is reiterated to be in the range of 27%–28%.

Zacks Rank

Rockwell Collins currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

AAR Corp. (NYSE:AIR) reported fourth-quarter fiscal 2017 earnings of 44 cents per share, which surpassed the Zacks Consensus Estimate of 43 cents. Earnings were up 29.4% from the year-ago figure of 34 cents.

Triumph Group Inc.’s (NYSE:TGI) adjusted earnings from continuing operations in first-quarter fiscal 2018 (ended Jun 30) came in at 24 cents per share, missing the Zacks Consensus Estimate of 87 cents by 72.4%. Reported earnings also declined 76.9% from $1.04 per share a year ago.

Raytheon Company (NYSE:RTN) reported second-quarter 2017 adjusted earnings from continuing operations of $1.98 per share, beating the Zacks Consensus Estimate of $1.74 by 13.8%. The figure also improved 5.3% from $1.88 in the year-ago quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

Triumph Group, Inc. (TGI): Free Stock Analysis Report

AAR Corp. (AIR): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post