Rockwell Automation Inc. (NYSE:ROK) delivered adjusted earnings of $2.21 in first-quarter fiscal 2019 (ended Dec 31, 2018), up 13% from the prior-year quarter figure of $1.96. The bottom line also surpassed the Zacks Consensus Estimate of $1.98. Higher sales and lower share count led to improved results in the quarter. However, the bottom line was weighed down by higher investment spending.

Rockwell Automation, Inc. (ROK): Get Free Report

Cintas Corporation (CTAS): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Get Free Report

Enersys (ENS): Get Free Report

Original post

Zacks Investment Research

Including one-time items, the company reported earnings of 66 cents per share against loss per share of $1.84 suffered in the year-ago quarter.

Total revenues came in at $1,642 million, up 4% year over year, surpassing the Zacks Consensus Estimate of $1,630 million. Organic sales rose 5.7% but foreign currency translations had a negative impact of 2.2%.

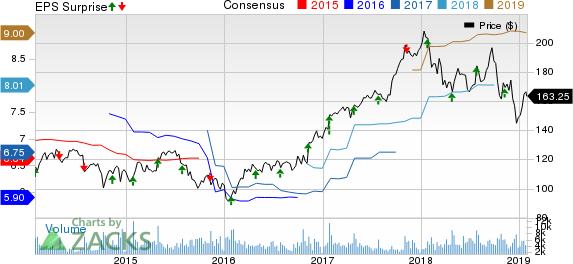

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Cost of sales increased 2% year over year to $904 million. Gross profit increased 6% to $739 million from $700 million reported in the year-ago quarter. Selling, general and administrative expenses remained flat year over year at $387 million.

Consolidated segment operating income totaled $375 million, up 5% from $355 million recorded in the prior-year quarter. Segment operating margin was 22.8% in the fiscal first quarter, up 40 basis points from the year-earlier quarter aided by higher sales which was partially offset by higher investment spending.

Segment Results

Architecture & Software: Net sales rose 2% year over year to $753 million in the first quarter. While organic sales were up 4.6%, currency translation had a negative impact of 2.2%. Segment operating earnings came in at $237 million compared with $224 million recorded in the prior-year quarter. Segment operating margin was 31.5% compared with 30.5% witnessed in the year-ago quarter.

Control Products & Solutions: Net sales climbed 4.5% year over year to $889 million in the reported quarter. Organic sales increased 6.6% while currency translation reduced sales by 2.1%. Segment operating earnings increased 5% to $138 million from $131 million in the year-ago quarter. Segment operating margin came in at 15.5% compared with 15.4% recorded in the prior-year quarter.

Financials

As of Dec 31, 2018, cash and cash equivalents totaled $632 million, up from $619 million as of Sep 30, 2018. As of Dec 31, 2018, total debt was $1,867 million, up from $1,231 million as of Sep 30, 2018.

Cash flow from operations in the first quarter of fiscal 2019 was $212 million compared with $213 million in the prior-year quarter. Return on invested capital was 39.2% as of Dec 31, 2018 compared with 40.8% as of Dec 31, 2017.

During the reported quarter, Rockwell Automation repurchased 1.8 million shares for $293 million. As of the quarter end, $815.6 million was available under the existing share-repurchase authorization.

Guidance

For fiscal 2019, Rockwell Automation maintained adjusted EPS guidance at $8.85-$9.25. It anticipates organic sales to grow 3.7-6.7%. The company continues to witness strong project quoting activity and strong backlog. Further, industrial production continues to demonstrate strong momentum. However, trade tensions and geopolitical risks remain concerns.

Share Price Performance

In a year’s time, Rockwell Automation’s shares have declined 16.7% compared with the industry’s decline of 17.4%.

Zacks Rank & Stocks to Consider

Rockwell Automation carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the sector include Alarm.com Holdings, Inc. (NASDAQ:ALRM) , Cintas Corporation (NASDAQ:CTAS) and Enersys (NYSE:ENS) . While Alarm.com Holdings sports a Zacks Rank #1 (Strong Buy), Cintas and Enersys carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alarm.com has a long-term earnings growth rate of 17%. The stock has appreciated 65% over the past year.

Cintas has a long-term earnings growth rate of 12%. The company’s shares have gained around 12% over the past year.

Enersys has a long-term earnings growth rate of 10%. Its shares have gained 16% over the past year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Rockwell Automation, Inc. (ROK): Get Free Report

Cintas Corporation (CTAS): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Get Free Report

Enersys (ENS): Get Free Report

Original post

Zacks Investment Research