Rockwell Automation (NYSE:ROK) has entered into a joint venture (JV) agreement with Schlumberger (NYSE:SLB) , named Sensia. Rockwell Automation will make a $250-million cash payment to Schlumberger at the closing of the deal during the summer of 2019.

Sensia is said to be the first fully integrated provider of domain expertise, measurement solutions and automation to the oil and gas industry. It will offer scalable, cloud and edge-enabled process automation, as well as information and process safety solutions. The JV will drive customer efficiency gains through data-driven intelligent automation.

Oilfield operators strive to maximize their investment value by safely reducing the drilling and production time, optimizing well output and extending well life. Hence, Sensia will be able to connect disparate assets and reduce manual processes with scalable solutions that are integrated into one technology platform. Per the deal, Rockwell Automation’s integrated control and information solutions with Schlumberger’s oil and gas expertise will help customers maximize value of their investments.

Notably, under the terms of agreement, Sensia will operate as an independent entity, with Rockwell’s 53% ownership and Schlumberger’s 47%. Headquartered in Houston, TX, Sensia will serve customers in more than 80 countries and is expected to generate $400 million in annual revenues.

Rockwell Automation maintains strong financial position and support its capital allocation priorities like share repurchases, dividends and acquisitions. The company reaffirmed its share repurchase target at $1 billion for fiscal 2019.

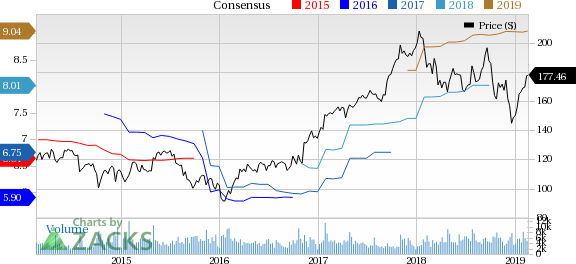

In a year’s time, Rockwell Automation’s shares have declined 3.5% against the industry’s gain of 0.1%.

Rockwell Automation delivered adjusted earnings of $2.21 in first-quarter fiscal 2019, up 13% from the prior-year quarter’s $1.96. Total revenues came in at $1,642 million, up 4% year over year.

In the first quarter of fiscal 2019 earnings call, Rockwell stated that it expects adjusted earnings per share at $8.85-$9.25 for fiscal 2019. It also anticipates organic sales growth of 3.7-6.7% in fiscal 2019. The company continues to witness strong project quoting activity and backlog. Further, industrial production continues to demonstrate strong momentum. However, trade tensions and geopolitical risks remain concerns.

Rockwell Automation, Inc. Price and Consensus

Zacks Rank and Stocks to Consider

Rockwell Automation carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Industrial Products sector are Axon Enterprise, Inc (NASDAQ:AAXN) and Alarm.com Holdings, Inc. (NASDAQ:ALRM) , each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axon has an expected earnings growth rate of 14.5% for 2019. The company’s shares have rallied 98.6% in the past year.

Alarm.com has an expected earnings growth rate of 7.8% for 2019. The stock has climbed 67.7% in the past year.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Schlumberger Limited (SLB): Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Axon Enterprise, Inc (AAXN): Free Stock Analysis Report

Original post