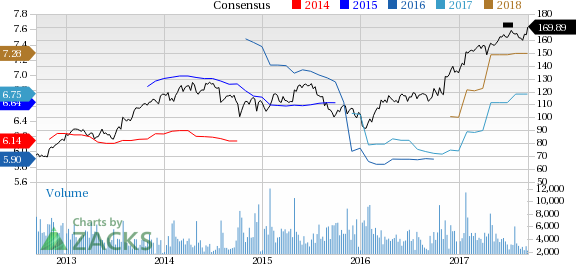

Rockwell Automation Inc. (NYSE:ROK) scaled a new 52-week high of $170.45 during the trading session on Sep 13, before eventually closing a tad lower at $169.89. The company has a healthy year-to-date return of 26% and a solid one-year return of 47%.

Rockwell Automation has a market cap of $21.8 billion. Average volume of shares traded over the last three months is approximately 667K. We note that the company has beaten the Zacks Consensus Estimate in each of the trailing four quarters, the average positive earnings surprise being 10%.

The stock has surged 47.1% over the past year, outperforming 46% growth recorded by the industry. This Zacks Rank #3 (Hold) stock has the potential for further price appreciation with long-term earnings growth expectation of 11.1%.

Growth Drivers

Rockwell Automation reported relatively healthy third-quarter fiscal 2017 results, with 14% year-over-year growth in adjusted earnings driven by elevated sales, lower tax rates, partially offset by higher incentive compensation. Revenues also improved 8.5% year over year in the reported quarter.

Backed by strong performance in fiscal 2017, so far, and an improving macro environment, Rockwell Automation hiked its adjusted earnings per share guidance for fiscal 2017. The company expects transportation and consumer verticals and heavy industries to grow in low-single digits.

Rockwell Automation has been successfully executing its initiatives to focus on increasing the number of industries, applications and geographies, as well as improving its investments. Further, the company has made inroads with its pilot program, working with customers in a wide range of applications, including remote-asset monitoring and predictive analytics.

Rockwell Automation’s strategy of diversifying its sales streams by expanding its products portfolio, solutions and services, and global presence will drive growth. The company also aims to achieve growth rates in excess of the automation market by broadening its served market, strengthening competitive differentiation, and serving a wider range of industries and applications.

Stocks to Consider

Better-ranked stocks in the same sector are AGCO Corporation (NYSE:AGCO) , Terex Corporation (NYSE:TEX) and Caterpillar Inc. (NYSE:CAT) . All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an expected long-term earnings growth rate of 13.5%.

Terex has an expected long-term earnings growth rate of 19.7%.

Caterpillar has an expected long-term earnings growth rate of 9.5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post