Rockwell Automation Inc. (NYSE:ROK) , a leading global provider of industrial automation power, control, and information solutions scaled a 52-week high of $165.39 yesterday, closing at $164.06. This was backed by increased investment, acquisitions and focus on long-term goals.

Rockwell Automation has a healthy year-to-date return of 23.3% and a solid one-year return of 43.1%. The company displays long-term earnings growth rate of 10.63%, making us confident of its innate strength.

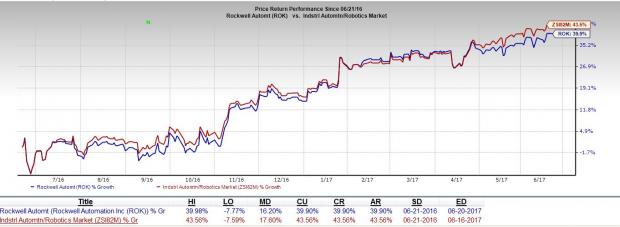

Despite crafting a 52-week high, the price of the company has underperformed the Zacks Categorized Industrial Automation/Robotics sector over the last 12 months. The current rate of return for the industry is 43.5%, while that of Rockwell Automation is 39.9%.

The stock has a market cap of $21.1 billion. Average volume of shares traded over the last three months was approximately 951K. Over the last 60 days, the Zacks Consensus Estimate for Rockwell Automation moved up 5.7% to $6.64 for 2017. We note that the company has beaten the Zacks Consensus Estimate in each of the trailing four quarters, the average positive earnings surprise being 9.89%.

Growth Catalysts

Rockwell Automation’s new Connected Enterprise (CE) integrated supply chain management system will prove conducive to growth. The company is increasing the number of industries, applications and geographies, as well as improving its investments to expand the value of CE. With average profitability well above the corporate average, CE sales will be an integral part of Rockwell’s incremental growth and boost margins over the next few years.

Notably, the company acquired Automation Control Products in Sep 2016 to help customers enhance global competitiveness through CE. Further, the MagneMotion acquisition adds to its portfolio of innovative motion control solutions for consumer and transportation verticals. Finally, MAVERICK Technologies buyout has boosted expertise in chemical, consumer, life sciences, along with oil and gas industry applications.

In addition, Rockwell Automation continues to target long-term revenue growth of 6–8%. The company also maintains its objective of delivering double-digit EPS growth, return on invested capital (ROIC) of more than 20% over the long term, and cash flow of around 100% of adjusted income. These long-term goals will be supported by Rockwell Automation’s strategy of diversifying its sales streams by expanding products portfolio, solutions and services, and global presence.

The company is also aimed at achieving growth rates in excess of the automation market, by expanding its served market, strengthening competitive differentiation, and serving a wider range of industries and applications. Rockwell Automation’s objectives also include market share growth by gaining customers, capturing a larger share of existing customer spending, as well as improving quality and customer experience.

Zacks Rank & Other Key Picks

Rockwell Automation currently carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the same sector are iRobot Corporation (NASDAQ:IRBT) , Altra Industrial Motion Corp. (NASDAQ:AIMC) and Parker-Hannifin Corporation (NYSE:PH) . All three stocks boast a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

iRobot Corporation has an average positive earnings surprise of 61.72% for the trailing four quarters. Altra Industrial Motion generated an average positive earnings surprise of 15.93% over the past four quarters, while Parker-Hannifin has an average positive earnings surprise of 14.94% for the last four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research