Rockwell Automation, Inc. (NYSE:) reported adjusted earnings per share of $1.76 in third-quarter fiscal 2017 (ended Jun 30, 2017), up 14% from $1.55 in the prior-year quarter. Further, earnings outpaced the Zacks Consensus Estimate of $1.64, a positive earnings surprise of 7%. The year-over-year performance was driven by higher sales, lower tax rates, partially offset by higher incentive compensation.

Including one-time items, the company’s earnings came in at $1.67 per share, up 14% from the year-ago quarter figure of $1.46.

Total revenue was $1,599 million in the quarter, up 8.5% year over year and surpassed the Zacks Consensus Estimate of $1,573 million. Organic sales rose 8.2%, acquisitions contributed 1.2% while unfavorable foreign currency translations had an impact of 0.9%. Double-digit increases in Asia Pacific and Latin America contributed to the improvement. Sales in the U.S., Rockwell Automation’s largest market grew 10%, including the contribution from acquisitions. Transportation, food and beverage, as well as semiconductor were reportedly strong.

Operational Update

Cost of sales increased 7.5% year over year to $922 million. Gross profit advanced 10% to $677.7 million from $616.8 million in the year-ago quarter. Selling, general and administrative expenses increased 12% to $386.8 million.

Consolidated segment operating income was $337 million, up 8% from $311 million in the prior-year quarter. Segment operating margin was 21.1% in the quarter, flat from the prior-year quarter on the back of higher sales, partially negated by higher incentive compensation.

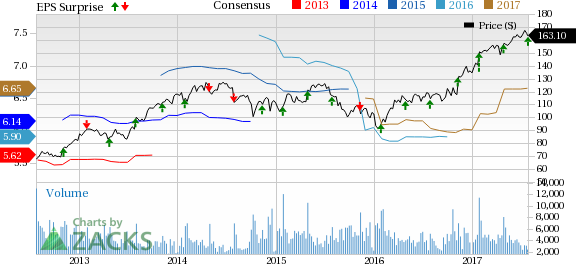

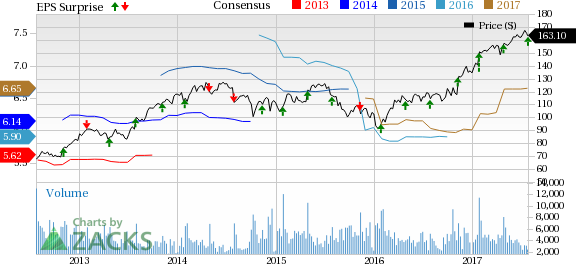

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. Price, Consensus and EPS Surprise | Rockwell Automation, Inc. Quote

Segment Results

Architecture & Software: Net sales rose 10% year over year to $732 million in third-quarter fiscal 2017. Organic sales increased 10.5%, acquisitions contributed 0.3% while currency translations hurt sales by 1%. Segment operating earnings were $204 million, compared with $184 million a year ago. Segment operating margin was 27.9%, compared with 27.6% in the prior-year quarter.

Control Products & Solutions: Net sales rose 7.4% to $867million in the reported quarter. Organic sales increased 6.3%, acquisitions contributed 1.9%, while currency translations dented sales by 0.8%. Segment operating earnings improved 5% to $133 million from $127 million in the year-ago quarter. Segment operating margin was 15.3% compared with 15.7% in the prior-year quarter.

Financials

As of Jun 30, 2017, cash and cash equivalents were $1,549 million, up from $1,526 million as of Sep 30, 2016. As of Jun 30, 2017, total debt was $1,842 million, down from $1,964 million as of Sep 30, 2016.

Cash flow from operations for the nine month period ended Jun 30, 2019 came in at $927 million compared with $675 million in the prior-year comparable period. Return on invested capital was 38.8% as of Jun 30, 2017, increasing from 32.6% as of Jun 30, 2016.

During the reported quarter, Rockwell Automation repurchased 740,000 of its shares for $116 million. As of the quarter end, $643 million was available under the existing share repurchase authorization.

Rockwell Automation's shares have underperformed the industry in the past one year. The company’s share price has surged 42.6%, while the subindustry witnessed a gain of 43.6%.

Guidance

Rockwell Automation stated that the macro environment continues to improve. Backed by strong performance in fiscal 2017 so far, the company hiked adjusted EPS guidance to the range of $6.40 to $6.80 per share from the prior range of $6.45 to $6.75. The company forecasts reported sales growth and organic sales growth to be in the range of 7% and 6%, respectively. Sales are projected to be around $6.3 billion, factoring a smaller headwind from currency.

Per the company, its Connected Enterprise strategy is working well and positions it well for growth in the future. Notably, the pilots have been successful across multiple industries.

Zacks Rank & Other Key Picks

Currently, Rockwell Automation carries a Zacks Rank #2 (Buy).

Other top-ranked stocks worth considering in the same sector are AGCO Corporation (NYSE:) , Terex Corporation (NYSE:) and Apogee Enterprise, Inc. (NASDAQ:) . All the three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 40.39% in the trailing four quarters. Terex generated an outstanding average positive earnings surprise of 122.61% in the past four quarters, while Apogee has an average positive earnings surprise of 3.41% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis ReportRockwell Automation, Inc. (ROK): Free Stock Analysis ReportTerex Corporation (TEX): Free Stock Analysis ReportAGCO Corporation (AGCO): Free Stock Analysis ReportOriginal post