“A person who never made a mistake never tried anything new.” Albert Einstein

Another strong day as we move into the end of the week and a long weekend.

US markets are closed Monday so holding over the long weekend seems a little on the risky side but that will depend on the action tomorrow.

I still have my full 10% weightings each in SPDR S&P 500 (NYSE:SPY), NASDAQ:AMZN, NASDAQ:ACIA NASDAQ:TSLA, NASDAQ:GOOGL, NASDAQ:FB, NASDAQ:GILD, and NASDAQ:NFLX but I imagine I’ll be reducing to 5% weightings at some point Friday and perhaps locking in all gains.

Time will tell but the action on this bounce has been great so far.

I also bought a little 5% weighting in AG later in the day today.

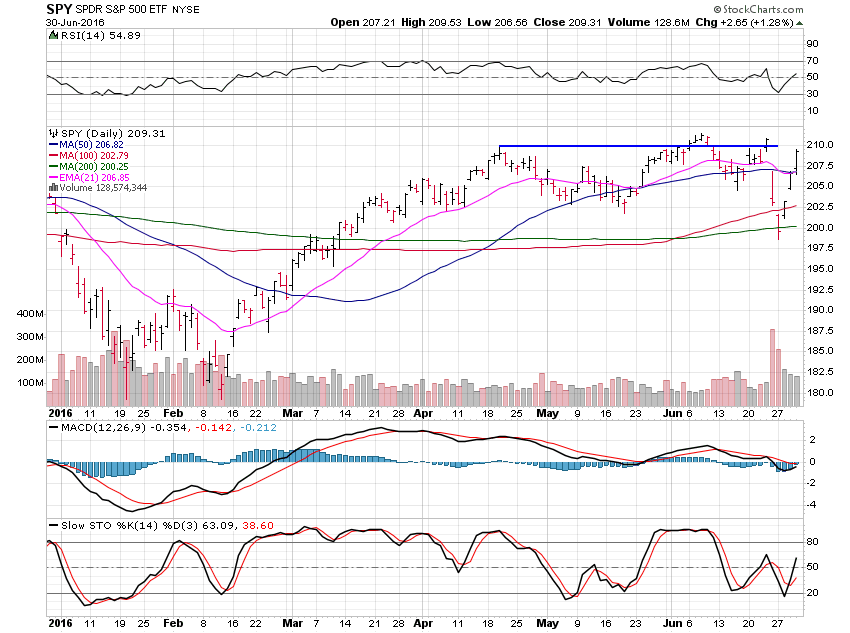

Great stuff from SPY as it approaches the 210 resistance area.

I’d love to hold longer but this is just a swing trade unless we blast above 210 on heavy volume.

I’ve got 10% into SPY at 202 and I’m looking at 208.60 or so for stops now.