The old game is Rock-Paper-Scissors in which rock breaks (wins against) scissors, scissors cuts (wins against) paper, paper covers (wins against) rock. The game is balanced with wins, losses, and draws.

The new version is Rock-Paper-Silver and the definitions and rules have changed.

“Rock” represents hard assets and real assets such as gold, wheat, sugar, iron ore and crude oil.

“Paper” represents paper assets such as fiat currencies, sovereign debt paper investments, gold futures paper contracts, interest rate derivative contracts, digital stocks held in a brokerage account, euros, paper gold certificates, yen and many more.

“Silver” represents real silver bars and coins.

Twilight Zone Rules (modern central bank controlled economies):

Paper always wins, rock and silver always lose. Life is good for bankers and politicians. The rich get richer, the poor get poorer and the governments of the world exercise more control.

Real World Rules (where central banks, deficit spending and un-backed paper currencies have become less important after the reset):

Silver wins against rock and paper.

Rock wins against paper.

Paper wins only against other paper but never against Rock or Silver.

Silver is a real asset that has been used as money for several millennia. Those 1000-year old pieces of silver are still valuable. The currencies from hundreds of bankrupt central banks are now worthless paper. Silver won against those pieces of paper and is currently winning against euros, yen, pounds, rubles, and dollars.

The same applies to “Rock” against “Paper.” Paper can be easily devalued or printed into worthlessness. Wheat, sugar and crude oil will remain valuable and are necessary for modern society. Paper futures contracts can distort market prices but ultimately people NEED wheat, sugar and crude oil. They USE paper dollars and euros to obtain what they NEED.

COMMENTARY:

In the Twilight Zone of debt-based fiat currencies promoted by politicians and central bankers for their own gain, they control the paper products. Hence they encourage the paper game of derivatives, sovereign debts, digital bank accounts, fiat currencies that are “printed” to excess, and so forth.

But the paper game is showing signs of stress.

German sovereign debt has “negative yield” out to about 8 years and yields practically zero at 10 years. (Twilight Zone economics…)

Cyprus “bailed-in” two years ago and took depositors money to help the failing banks, after the insiders and politically connected escaped with their assets. Europe, Australia, the UK, Canada and the US have similar regulations that have not YET been used.

Greece – you know the story of “extend and pretend,” where the bankers hope and pray all those debts somehow get paid by the Fairy Godmother of Twilight Zone Economics.

US National debt (just the official debt, not the total liabilities) exceeds $18 Trillion and is climbing rapidly. If it looks like it will never be repaid, reduced, or controlled, and will increase forever, has US National Debt entered the Twilight Zone?

Negative interest rate mortgages are occurring in Europe. Are those mortgages equally crazy or even worse than 102% mortgages to unemployed home buyers in the US in 2006? Remember the NINJA loans to breathing applicants – no income, no job, no assets, aided and abetted by bankers and derivatives. The financial crisis of 2008 was partially caused by such nonsense, and it is happening again.

Mexico issued 100-year bonds.

High-Frequency-Traders in New York and Chicago trade for a whole year (or more) and do not have a single day of net losses. Amazing, or Twilight Zone craziness?

Spain, Italy and others: Their sovereign debt yields are exceptionally low given the risks in their ability to repay their debts. (More Twilight Zone economics.)

There are signs of a liquidity crunch in the global banking system – read this – that could further weaken or crash economic activity.

Fantasizing here … The US House of Representatives voted to reduce US government expenses by 25% in fiscal 2016, agreed to refuse all donations from corporate sponsors, and to donate the budgetary savings to pay French banks who loaned euros to Greece – as a humanitarian gesture.

Fantasizing here … The Fed agreed to remain “patient” until at least the 2020 election before they would either increase or decrease interest rates in the US or revise their flawed models. They noted in their last publication of meeting minutes that “patience” was a virtue and they had chosen to hold tightly to the virtuous path. Repeat – fantasizing …

Why Does Silver Win?

The industrial demand is increasing. It is used in 1000s of applications.

The investment demand is increasing. Read Steve St. Angelo’s analysis. Even if industrial demand is reduced by a global recession, the investment demand is likely to compensate as people reach for anything tangible as a safe store of value.

Paper assets will be increasingly distrusted as we fall further into the financial Twilight Zone. Silver and gold will be priced far higher to reflect the devalued fiat currencies and the destroyed trust in fiat currencies.

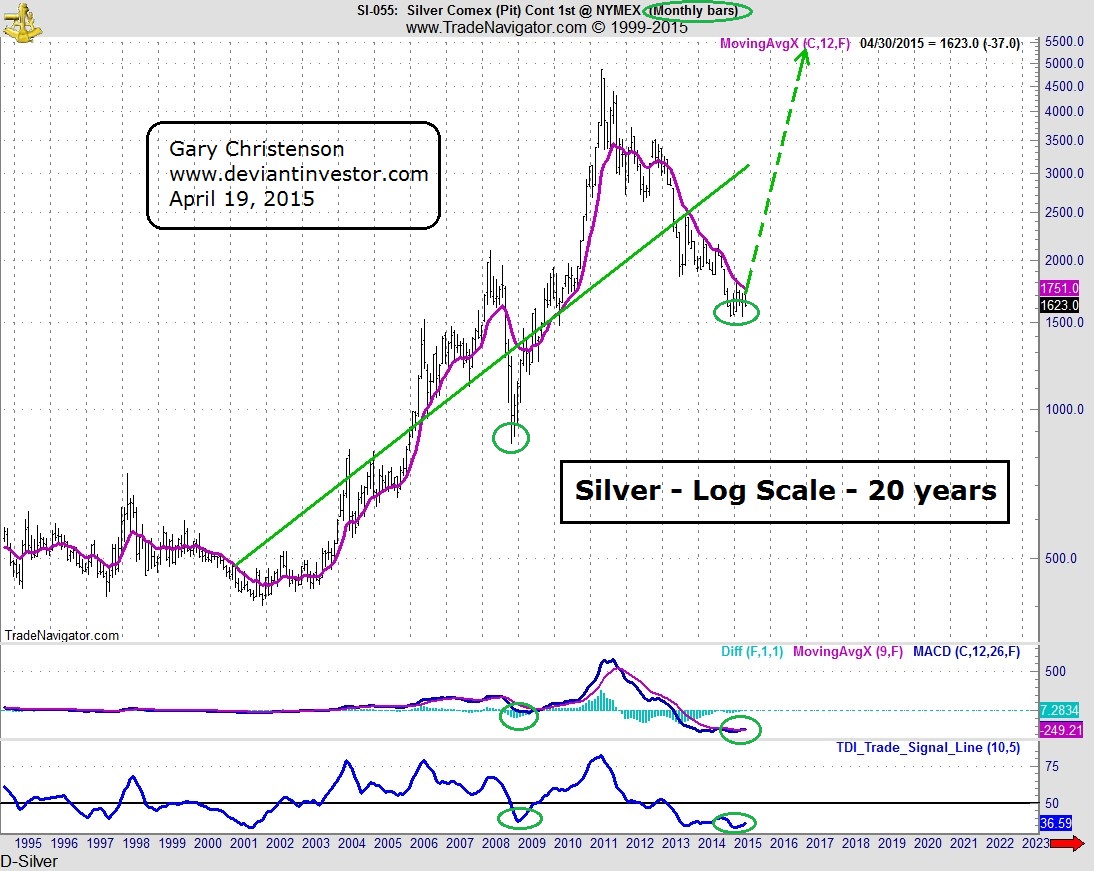

Consider the following graph of silver – log scale over 20 years.

Note the years from 1995 – 2001 when paper assets were in demand, investment demand for silver was tiny, and the US government was selling its hoard of accumulated silver.

Note the years subsequent to 2001 when military expenses substantially increased, stocks had crashed, and the last of the US silver had been sold. Prices increased.

Note the dramatic rise from late 2008 to April 2011. Silver increased from under $9 to over $48 – too far and too fast.

Note the dramatic correction from April 2011 over the past four years. I have drawn a green line that approximates the center of the trend where highs and lows are balanced. The trend line price for 2015 is about $30.

I expect that prices will rally far higher and substantially exceed $30 and probably $50 by 2016 or 2017. Of course I have no proof, but as the world falls deeper into Twilight Zone craziness, war escalates, debt inevitably increases, and political stability deteriorates, the investment demand for silver will rise as confidence in fiat currencies declines. Much higher silver prices are all but guaranteed within several years.