Roche Holdings AG (OTC:RHHBY) announced that the FDA has put a partial clinical hold on a phase Ib and phase I/II b trials evaluating Tecentriq, due to safety issues.

A partial hold was put due to emerging safety data from clinical trials evaluating Merck & Co (NYSE:MRK) Keytruda in combination with Celgene Corporation’s (NASDAQ:CELG) Revlimid and Pomalyst. We note that the FDA had put a hold on several trials in the FUSION program by Celgene.

The FDA is currently evaluating all ongoing blood cancer trials investigating an anti-PD1/PDL1 drug in combination with an immunomodulatory drug in order determine if it is a class-wide (anti-PD1/PDL1) concern in multiple myeloma/blood cancers or a specific concern with certain combinations with immunomodulatory drugs.

The two studies include cohorts evaluating Tecentriq in combination with an immunomodulatory medicine (IMiDs) in relapsed/refractory multiple myeloma and relapsed/refractory follicular lymphoma.

As a result of the partial clinical hold, patients who are currently enroled in these trials and are deriving clinical benefit may continue to receive treatment, but no additional patients will be enroled.

We note that the FDA granted accelerated approval to immuno-oncology drug, Tecentriq in May 2016 for the treatment of patients suffering from locally advanced or metastatic urothelial carcinoma. Initial uptake of the drug has been encouraging. In October 2016, Tecentriq became the first and only anti-PDL1 cancer immunotherapy to be approved by the FDA for the treatment of metastatic NSCLC.

The FDA recently granted accelerated approval to Tecentriq for the treatment of patients suffering from locally advanced or metastatic urothelial carcinoma (mUC) who are not eligible for cisplatin chemotherapy. The drug was previously approved for patients suffering from locally advanced or mUC who have disease progression during or following any platinum-containing chemotherapy, or within 12 months of receiving chemotherapy before surgery (neoadjuvant) or after surgery (adjuvant).

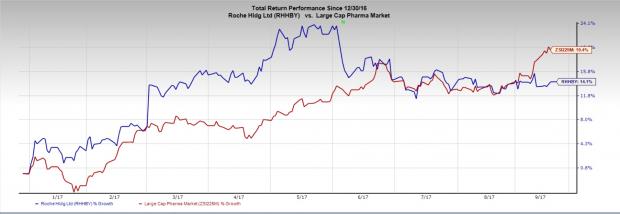

The news comes as a disappointment as label expansion of the drug will boost sales. Roche’s stock has gained 14.1% against the industry’s gain of 19.4% in the year so far.

Earlier, the FDA also put a partial clinical hold on Bristol-Myers Squibb Company’s (NYSE:BMY) three clinical trials — CA209602 (CheckMate-602), CA209039 (CheckMate-039) and CA204142 for the same reason. The trials are investigating Opdivo-based combinations in patients with relapsed or refractory multiple myeloma.

Zacks Rank

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020. The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.Download the new report now>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Original post

Zacks Investment Research