Roche Holding (SIX:ROG) AG (OTC:RHHBY) announced that it has completed the submission of a supplemental Biologics License Application (sBLA) to the FDA to expand the label of its breast cancer drug Kadcyla. The company is seeking FDA approval for Kadcyla for adjuvant (after surgery) treatment of patients with HER2-positive early breast cancer (eBC) with residual disease after neoadjuvant (before surgery) treatment.

Kadcyla, an antibody-drug conjugate, is approved as monotherapy in second-line setting for treating metastatic breast cancer in patients who have received treatment with Herceptin or/and taxane.

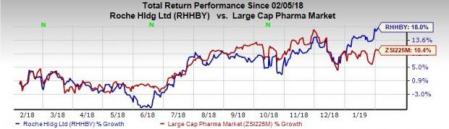

Shares of Roche have gained 18% so far this year, compared with the industry’s growth of 10.4%.

The application was supported by the results of the phase III study which showed that Kadcyla significantly reduced the risk of disease recurrence by 50% as adjuvant therapy in phase III KATHERINE study compared to its other breast cancer drug, Herceptin. The late-stage KATHERINE study compared Kadcyla to Herceptin for risk of disease recurrence or death in HER2-positive eBC patients with residual disease following a neoadjuvant (before surgery) therapy.

The FDA is reviewing the application under the Real-Time Oncology Review and Assessment Aid pilot programs, which aim to explore a more efficient review process to ensure the availability of safe and effective treatments for patients as early as possible.

Kadcyla was granted Breakthrough Therapy Designation for this indication. The Breakthrough Therapy designation is granted to speed up the development and review of drugs that target serious or life-threatening conditions.

Roche has a strong presence in the oncology market. In particular, the company dominates the breast cancer space with strong demand for its HER2 franchise drugs. The HER2 franchise includes Herceptin, Perjeta and Kadcyla. Sales of the HER2 franchise grew 7% in 2018.

We remind investors that in November 2018, the FDA accepted Roche’s supplemental sBLA for the label expansion of immuno-oncology drug Tecentriq.

The agency also granted Priority Review to Tecentriq plus chemotherapy (Abraxane) for the initial (first-line) treatment of unresectable locally advanced or metastatic triple-negative breast cancer (TNBC) in patients whose disease expresses the PD-L1 protein, as determined by PD-L1 biomarker testing.

Approval of new drugs and a potential label expansion of existing drugs bode well for Roche as its legacy drugs like Avastin, Herceptin and MabThera are facing competition from biosimilars. Novartis (NYSE:NVS) has already launched its biosimilar version of Rituxan/ MabThera in Europe. Amgen (NASDAQ:AMGN) too has got its biosimilar of Avastin.

Zacks Rank & Stock to Consider

Roche currently carries a Zacks Rank #3 (Hold).

A better-ranked stock from the same space worth considering is Eli Lilly and Co. (NYSE:LLY) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lilly’s earnings per share estimates have increased from $5.49 to $5.58 for 2018 and from $5.79 to $5.87 for 2019 in the past 90 days. The company delivered a positive earnings surprise in all the trailing four quarters, with average of 10.03%.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

Roche Holding AG (RHHBY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research