Roche Holdings AG (OTC:RHHBY) announced positive results from the phase III study, MURANO.

The study evaluated Venclexta in combination with Rituxan in patients suffering from relapsed or refractory chronic lymphocytic leukemia (CLL). Data showed that the study met its primary endpoint as the results depicted a statistically significant improvement in the time patients lived without their disease progressing or progression-free survival (PFS), when treated with Venclexta plus Rituxan compared to Treanda plus Rituxan.

We note that Roche is developing Venclexta in collaboration with AbbVie, Inc (NYSE:ABBV) . Both the companies are commercializing the drug in the United States while AbbVie will commercialize outside the country.

We remind investors that the FDA approved Venclexta in April 2016 for the treatment of people with CLL, who have received at least one prior therapy, with 17p deletion, as detected by an FDA-approved test. The FDA also granted Breakthrough Therapy Designation to Venclexta in combination with Rituxan for the treatment of relapsed or refractory CLL based on promising results from the phase Ib M13-365 study.

The company is conducting MURANO study to convert the current accelerated approval of Venclexta to a full approval. Data from this study will be presented at an upcoming medical meeting and submitted to global health authorities.

As per estimates, there will be more than 20,000 new cases of CLL diagnosed in the United States in 2017. CLL is the most common type of adult leukemia. Hence, a potential approval for this indication will boost sales potential.

Roche’s hematology portfolio includes approved drugs like MabThera/Rituxan, Gazyva, Tecentriq, and Venclexta along with pipeline candidates, polatuzumab vedotin/RG7596) and a small molecule antagonist of MDM2 (idasanutlin/RG7388).

Last week, the FDA placed a partial clinical hold on a phase Ib and phase I/II b trials evaluating immuno-oncology drug, Tecentriq due to safety issues. A partial hold was put due to emerging safety data from clinical trials evaluating Merck & Co. (NYSE:MRK) Keytruda in combination with Celgene Corp.’s (NASDAQ:CELG) Revlimid and Pomalyst. We note that the FDA had put a hold on several trials in the FUSION program by Celgene.

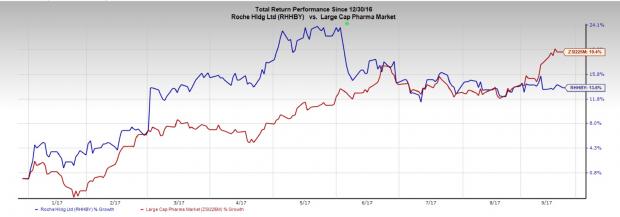

Roche’s stock has gained 13.6% compared with the industry’s gain of 19.4% in the year so far.

Roche has a strong presence in the oncology market. The company dominates the breast cancer space due to the strong demand for its HER2 franchise drugs like Herceptin, Perjeta and Kadcyla. However, sales of Avastin and Tarceva continue to decline. Generic competition for Xeloda continues to hurt sales. Competition from biosimilars looms large on Roche's key drugs like Herceptin, Avastin and Rituxan.

Zacks Rank

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Original post

Zacks Investment Research