Roche Holdings (OTC:RHHBY) announced that the European Commission (EC) has granted marketing authorization for multiple sclerosis (MS) drug Ocrevus.

The drug is approved for patients suffering from active relapsing forms of multiple sclerosis defined by clinical or imaging features and for patients with early primary progressive multiple sclerosis in terms of disease duration and level of disability, and with imaging features characteristic of inflammatory activity.

The approval was based on data from three pivotal phase III studies from the ORCHESTRA trial program which met the primary and nearly all the key secondary endpoints. The drug also demonstrated a favorable benefit-risk profile demonstrated in three large Phase III studies with a diverse patient population, including those early in the disease.

We remind investors that the drug was also approved in the United States in March 2017 for both relapsing and primary progressive forms of multiple sclerosis.

The approval boosts Roche’s neuroscience portfolio. Roche has more than a dozen pipeline candidates in the neuroscience portfolio for diseases that include multiple sclerosis, Alzheimer’s disease, spinal muscular atrophy, Parkinson’s disease and autism.

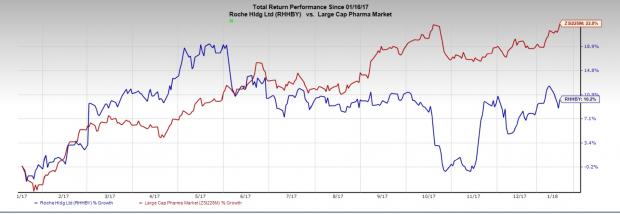

Roche’s stock has rallied 10.2% in the past one year compared with industry's gain of 22.8%.

MS market has immense potential in Europe. The disease affects approximately 700,000 people in Europe, of which around 96,000 have the highly disabling primary progressive form.

However, the competition is stiff in MS space.

In August 2017, the European Commission Merck (NYSE:MRK) approved KGaA ‘s MKGAF Mavenclad for the treatment of MS. In the United States, Biogen Inc. (NASDAQ:BIIB) has a strong position in the MS market backed by a wide range of products including Avonex, Tysabri, Tecfidera & Plegridy.

Meanwhile, Roche has a strong presence in the oncology market. The company dominates the breast cancer space with strong demand for its HER2 franchise drugs like Herceptin, Perjeta and Kadcyla. We are also impressed by the company's efforts to develop its portfolio beyond oncology into immunology. New drug launches, such as Tecentriq, Cotellic and Alecensa boosted sales and is expected to continue to do so in the upcoming quarters.

Zacks Rank & Key Pick

Roche carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Exelixis, Inc. (NASDAQ:EXEL) with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelixis’ earnings per share estimates have moved up from 72 cents to 73 cents for 2018 over the last 60 days. The company delivered a positive earnings surprise in the last four quarters, with an average beat of 572.92%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research