A better than expected US Non-Farm Payrolls figure boosted the USD against its main currency rivals to close out last week's trading session. In yet another sign that the economic recovery is moving forward, the US added 227K jobs in February. The news led to significant dollar gains against the euro, Japanese yen and Swiss franc. This week, traders will want to focus on a batch of data out of the US, including retail sales figures on Tuesday and a speech from Fed Chairman Bernanke on Wednesday. Positive data could lead to additional dollar gains.

Economic News

USD - Non-Farm Report Leads to Major USD Gains

Positive US employment data gave the USD a boost to close out last week's trading session. The Non-Farm Payrolls figure came in at 227K, above the forecasted level of 209K. As a result, the USD/JPY shot up close to 90 pips to close out the week at 82.45. Against the euro, the combination of the positive US data and ongoing concerns regarding euro-zone debt caused the common-currency to slide on Friday. The EUR/USD dropped some 150 pips to close out the week at 1.3120.

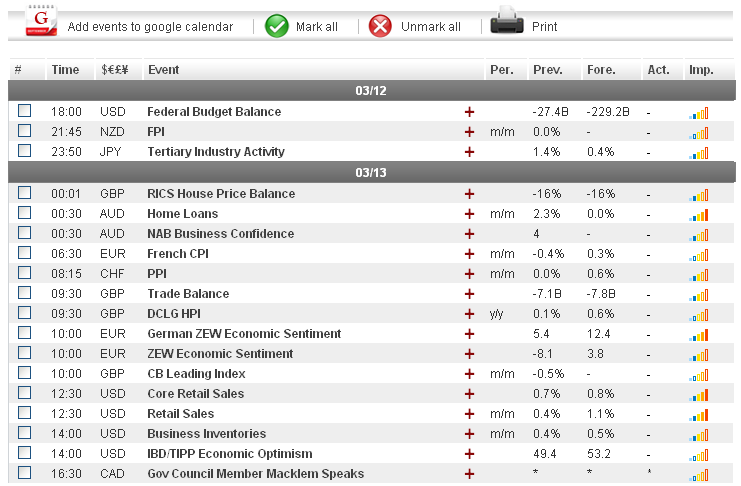

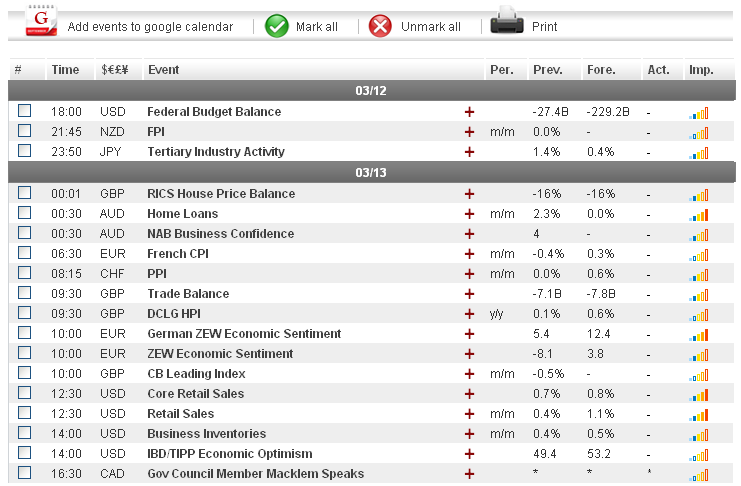

Taking a look at the next several days, dollar traders will want to focus on Tuesday's US Retail Sales and Core Retail Sales figures, as well as a speech from the Fed Chairman on Wednesday. Later in the week, the weekly Unemployment Claims and CPI figures may generate some market volatility. Positive data may help the dollar extend its gains against the yen.

Turning to today, a lack of significant US news means that any announcements out of the euro-zone may dictate risk appetite in the marketplace. Despite a successful bond swap last Thursday, investors are still worried about Greece's long term prospects for economic stability. In addition, concerns regarding the Spanish and Portuguese economies have the potential to weigh down on the euro in the near future. Unless positive euro-zone news is announced, the EUR/USD may continue to slide.

EUR - Greece Continues to Weigh Down on Euro

A successful Greek bond swap last Thursday did little to help the euro against its main currency rivals during Friday's trading session. Greece needed to complete the bond swap in order to qualify for a badly needed bailout package. While the news means that Greece will likely receive its bailout and avoid a potentially disastrous default later this month, it appears that the countries problems are far from over. High unemployment combined with the likely affects of tough austerity measures means that Greece's prospects for economic growth are bleak. As a result, the EUR/USD tumbled some 150 pips on Friday, while the EUR/AUD dropped close to 90 to close out the week at 1.2403.

Turning to this week, the euro may see some relief when the German ZEW Economic Sentiment figure is released on Tuesday. As the euro-zone's biggest economy, German data tends to have a significant impact on the common-currency. A positive reading may encourage investor risk taking and help the euro recover some of its recent losses. That being said, traders will also want to pay attention to any announcements regarding the current state of the Greek economy. Negative news could cause the euro to extend its losses.

JPY - US Employment Data Sends Yen to 11-Month Low vs. USD

The yen closed out last week by dropping to an 11-month low against the USD, following the release of a better than expected US Non-Farm Payrolls figure. The USD/JPY was last trading at 82.45, its highest level since April of 2011. Against most of its other main currency rivals, the yen was relatively unchanged on Friday. Negative Japanese economic data has caused investors to question the yen's safe-haven status as of late, and has kept the currency low against the euro, British pound and Swiss franc.

Turning to this week, yen traders will want to focus on Tuesday's Bank of Japan (BOJ) Monetary Policy Statement. While the BOJ is not expected to adjust Japanese interest rates, the statement could give investors a better idea of the current state of the Japanese economy. A positive statement could help the yen against its higher yielding currency rivals, like the euro and AUD. In addition, traders will also want to note the results of a batch of US data set to be released throughout the week. Any positive US news could cause the yen to extend its recent losses vs. the greenback.

Crude Oil - Crude Oil Hits $108 Following US Non-Farms Data

Crude oil hit its highest level in a week on Friday, following the release of a positive US employment figure. Positive US data typically leads to an increase in demand among American consumers, and can result in higher oil prices. Crude reached as high as $108.17 a barrel on Friday, before staging a slight downward reversal to close out the week at $107.40.

Turning to this week, a batch of US data is forecasted to generate some volatility in the price of oil. Positive indicators out of the US could convince investors that demand will continue to go up, which may lead to another spike in prices. Additionally, traders will want to monitor the ongoing conflict between Iran and the West. Any escalation in the conflict may cause the price of oil to rise.

Technical News

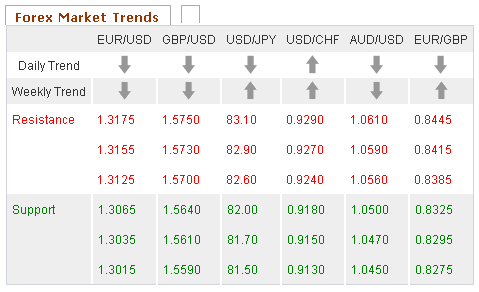

EUR/USD

The Relative Strength Index on the daily chart has dropped into oversold territory, indicating that upward movement could occur in the near future. That being said, most other long-term indicators place the pair in neutral territory. Taking a wait and see approach for the pair may be a wise choice.

GBP/USD

While the Williams Percent Range on the daily chart has entered the oversold zone, which means that upward movement could occur, most other technical indicators are inconclusive at this time. Traders will want to keep an eye on indicators like the Slow Stochastic and Bollinger Bands on the daily and weekly charts, as a more defined trend may present itself in the near future.

USD/JPY

Following the spike the pair saw to close out last week's session, technical indicators now show that downward movement could occur in the coming days. The Slow Stochastic on the daily chart has formed a bearish cross, while the Relative Strength Index on the weekly chart has entered overbought territory. Going short may be the wise choice for this pair.

USD/CHF

The Bollinger Bands on the weekly chart have begun to narrow, indicating that a price shift could occur in the coming days. The Relative Strength Index on the daily chart, which has crossed into overbought territory, shows that this shift could be downward. Traders may want to go short in their positions.

The Wild Card

EUR/CAD

A bullish cross on the 8-hour chart's Slow Stochastic indicates that upward movement could occur in the near future. This theory is supported by the daily chart's Relative Strength Index, which has dropped into oversold territory. Forex traders may want to go long in their positions.

Economic News

USD - Non-Farm Report Leads to Major USD Gains

Positive US employment data gave the USD a boost to close out last week's trading session. The Non-Farm Payrolls figure came in at 227K, above the forecasted level of 209K. As a result, the USD/JPY shot up close to 90 pips to close out the week at 82.45. Against the euro, the combination of the positive US data and ongoing concerns regarding euro-zone debt caused the common-currency to slide on Friday. The EUR/USD dropped some 150 pips to close out the week at 1.3120.

Taking a look at the next several days, dollar traders will want to focus on Tuesday's US Retail Sales and Core Retail Sales figures, as well as a speech from the Fed Chairman on Wednesday. Later in the week, the weekly Unemployment Claims and CPI figures may generate some market volatility. Positive data may help the dollar extend its gains against the yen.

Turning to today, a lack of significant US news means that any announcements out of the euro-zone may dictate risk appetite in the marketplace. Despite a successful bond swap last Thursday, investors are still worried about Greece's long term prospects for economic stability. In addition, concerns regarding the Spanish and Portuguese economies have the potential to weigh down on the euro in the near future. Unless positive euro-zone news is announced, the EUR/USD may continue to slide.

EUR - Greece Continues to Weigh Down on Euro

A successful Greek bond swap last Thursday did little to help the euro against its main currency rivals during Friday's trading session. Greece needed to complete the bond swap in order to qualify for a badly needed bailout package. While the news means that Greece will likely receive its bailout and avoid a potentially disastrous default later this month, it appears that the countries problems are far from over. High unemployment combined with the likely affects of tough austerity measures means that Greece's prospects for economic growth are bleak. As a result, the EUR/USD tumbled some 150 pips on Friday, while the EUR/AUD dropped close to 90 to close out the week at 1.2403.

Turning to this week, the euro may see some relief when the German ZEW Economic Sentiment figure is released on Tuesday. As the euro-zone's biggest economy, German data tends to have a significant impact on the common-currency. A positive reading may encourage investor risk taking and help the euro recover some of its recent losses. That being said, traders will also want to pay attention to any announcements regarding the current state of the Greek economy. Negative news could cause the euro to extend its losses.

JPY - US Employment Data Sends Yen to 11-Month Low vs. USD

The yen closed out last week by dropping to an 11-month low against the USD, following the release of a better than expected US Non-Farm Payrolls figure. The USD/JPY was last trading at 82.45, its highest level since April of 2011. Against most of its other main currency rivals, the yen was relatively unchanged on Friday. Negative Japanese economic data has caused investors to question the yen's safe-haven status as of late, and has kept the currency low against the euro, British pound and Swiss franc.

Turning to this week, yen traders will want to focus on Tuesday's Bank of Japan (BOJ) Monetary Policy Statement. While the BOJ is not expected to adjust Japanese interest rates, the statement could give investors a better idea of the current state of the Japanese economy. A positive statement could help the yen against its higher yielding currency rivals, like the euro and AUD. In addition, traders will also want to note the results of a batch of US data set to be released throughout the week. Any positive US news could cause the yen to extend its recent losses vs. the greenback.

Crude Oil - Crude Oil Hits $108 Following US Non-Farms Data

Crude oil hit its highest level in a week on Friday, following the release of a positive US employment figure. Positive US data typically leads to an increase in demand among American consumers, and can result in higher oil prices. Crude reached as high as $108.17 a barrel on Friday, before staging a slight downward reversal to close out the week at $107.40.

Turning to this week, a batch of US data is forecasted to generate some volatility in the price of oil. Positive indicators out of the US could convince investors that demand will continue to go up, which may lead to another spike in prices. Additionally, traders will want to monitor the ongoing conflict between Iran and the West. Any escalation in the conflict may cause the price of oil to rise.

Technical News

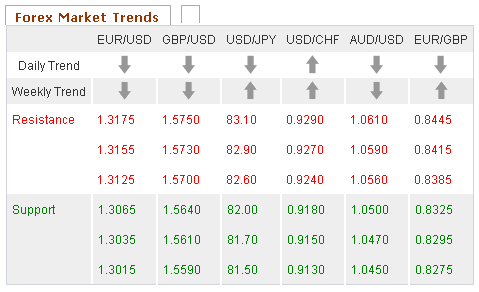

EUR/USD

The Relative Strength Index on the daily chart has dropped into oversold territory, indicating that upward movement could occur in the near future. That being said, most other long-term indicators place the pair in neutral territory. Taking a wait and see approach for the pair may be a wise choice.

GBP/USD

While the Williams Percent Range on the daily chart has entered the oversold zone, which means that upward movement could occur, most other technical indicators are inconclusive at this time. Traders will want to keep an eye on indicators like the Slow Stochastic and Bollinger Bands on the daily and weekly charts, as a more defined trend may present itself in the near future.

USD/JPY

Following the spike the pair saw to close out last week's session, technical indicators now show that downward movement could occur in the coming days. The Slow Stochastic on the daily chart has formed a bearish cross, while the Relative Strength Index on the weekly chart has entered overbought territory. Going short may be the wise choice for this pair.

USD/CHF

The Bollinger Bands on the weekly chart have begun to narrow, indicating that a price shift could occur in the coming days. The Relative Strength Index on the daily chart, which has crossed into overbought territory, shows that this shift could be downward. Traders may want to go short in their positions.

The Wild Card

EUR/CAD

A bullish cross on the 8-hour chart's Slow Stochastic indicates that upward movement could occur in the near future. This theory is supported by the daily chart's Relative Strength Index, which has dropped into oversold territory. Forex traders may want to go long in their positions.